Cryptocurrency Prices by Coinlib

Right here’s how the Fed may increase Bitcoin

On this patch of your weekly Dispatch:

- ETH dominates stablecoins

- An important inflation report

- Textbook BTC dip-buying

Market forged

BTC: Technical leans bullish towards resistance

Bitcoin’s technical image leans cautiously bullish, although a transparent pattern has but to determine itself. On the weekly chart, the Relative Energy Index (RSI) and Stochastic oscillator, each measures of momentum, stay in impartial territory, suggesting neither overbought nor oversold circumstances. The Shifting Common Convergence Divergence (MACD)histogram is hovering slightly below zero, reflecting subdued however stabilizing momentum, whereas the Common Directional Index (ADX) is edging towards 25, a threshold that sometimes alerts whether or not a powerful pattern is creating.

The every day chart, in the meantime, gives a firmer tone: RSI is climbing, the MACD histogram is decisively constructive, and Stochastic has entered the overbought zone—typically related to sturdy momentum fairly than an computerized reversal. Nonetheless, the low ADX studying implies that conviction behind the transfer is restricted for now.

Worth-wise, instant resistance lies at $116,000, with a breakout doubtlessly opening a path towards $120,000, whereas assist is holding on the 50-day exponential shifting common (EMA) close to $113,500, strengthened by the $110,000–112,000 zone.

The Large concept

The Fed’s fee cuts: Will historical past repeat for Bitcoin?

The Setup: In our final Dispatch, we explored potential catalysts for a market-wide bull run. Right now, we slender the lens to Bitcoin itself — and the way the September 17 Fed fee reduce may form its path because the main digital asset.

Markets have virtually priced the result already: a 25 bps reduce carries 94% odds by way of CME FedWatch, with prediction markets shut behind at 88%. The transfer itself isn’t a shock. The true story is the context: the S&P 500, Bitcoin, and gold all hovering close to all-time highs whereas core inflation stays above 3.1% and labor market revisions quietly erased round 911,000 jobs. The Fed is easing into power — at the same time as early indicators of pressure emerge. Analysts at BofA count on this week’s cut to be adopted by a pause till December, warning that sticky inflation above 3% will make any easing cycle “no stroll within the park.” In contrast, our personal neighborhood suggests back-to-back cuts in September and October — a extra aggressive path that might mark a notable divergence from the cautious analyst consensus.

Crypto’s playbook: For Bitcoin, Fed pivots are inclined to amplify the macro backdrop. In 2019’s mid-cycle “insurance coverage” cuts, BTC rallied from ~$7,000 to $12,000 as liquidity seeped again into markets. In 2020’s panic cuts, crypto fell with equities earlier than staging a good stronger rebound as soon as confidence returned. Right now seems extra like 2019: a soft-landing try the place Bitcoin leads, Ethereum follows, and high quality alts path — solely with sharper swings.

Market positioning: Merchants have eased up on hedging for a drop. Demand for draw back safety in choices has cooled, hinting at decreased concern. If Powell sticks to the anticipated 25 bps reduce, the probably final result is a measured grind larger. A 50 bps shock may set off a sharper rally throughout Bitcoin, Ethereum, and even gold. Nonetheless, Powell’s tone and the Fed’s dot plot will steer near-term reactions greater than the reduce itself.

The massive(ger) concept: Historical past leans bullish: within the three months following fee cuts, Bitcoin has risen about 62% of the time, with common positive factors of 16.5%. Longer-term, fashions mapping Bitcoin to gold’s trajectory see targets near $700,000 by 2035. The Fed’s pivot could not ship instantaneous fireworks, however it tilts the taking part in area in Bitcoin’s favor. For now, the bias factors upward — but the trail is layered with complexities, from sticky inflation to fragile labor dynamics. In that rigidity lies Bitcoin’s edge: it thrives not on certainty, however on the cracks within the previous framework.

Ethereum

ETH’s strongest cycle?

Ethereum is again above $4,600 after a 7% weekly rise, and CryptoQuant says it might be coming into its strongest cycle yet — right here’s why. Greater than $3.7 billion in ETH is queued for staking, the busiest validator entry line in two years, whereas Ethereum’s stablecoin provide has surged to a file $166 billion, cementing its position as DeFi’s settlement layer. The ETH/BTC ratio sits at 0.039, nonetheless effectively beneath its 2017 peak of 0.14, however that underperformance leaves room for Ethereum to catch up if its structural demand retains accelerating. With staking, stablecoins, and ETFs all converging, the trail towards $5,000 seems more and more grounded in fundamentals — and a flip within the ETH/BTC ratio might be the catalyst that unlocks the subsequent section of the cycle.

TradFi Traits

$7.5T on the sidelines – will crypto rise?

U.S. cash market funds have hit a record $7.5 trillion, underscoring simply how a lot capital is sitting idle. With the Fed poised to chop charges, the protected yields that drew money into these funds are set to shrink, pushing traders to hunt out larger returns.

That shift doesn’t must be dramatic — even a modest rotation of this “dry powder” into danger belongings may add critical gasoline to rallies in tech shares and Bitcoin. As historical past reveals, when protected havens lose their shine, liquidity tends to move towards development. With monetary circumstances about to ease, markets could quickly learn how rapidly this money mountain strikes.

Scorching in crypto

Solana’s treasury increase

Solana is up a wholesome 10% on the week — and there’s good cause for it, with indicators that extra might be coming. Galaxy Digital has gone on a Solana shopping for spree, snapping up over 6.5 million SOL price $1.55 billion in simply 5 days, together with a single-day haul of $306 million. The purchases, linked to a brand new crypto treasury initiative with Multicoin Capital and Leap Crypto, spotlight a pattern of corporations positioning Solana as a balance-sheet asset.

Treasury corporations are rapidly turning into a Solana story of their very own. Ahead Industries has pivoted to constructing one of many largest company SOL holdings, whereas others have raised billions for a similar technique. In the meantime, Solana’s fundamentals are strengthening too: complete worth locked on its DeFi ecosystem has hit a file $12 billion, second solely to Ethereum. With company treasuries and on-chain liquidity each surging, Solana’s rally may be warming up.

The week’s most fascinating information story

A brand new ATH for BTC in 2025?

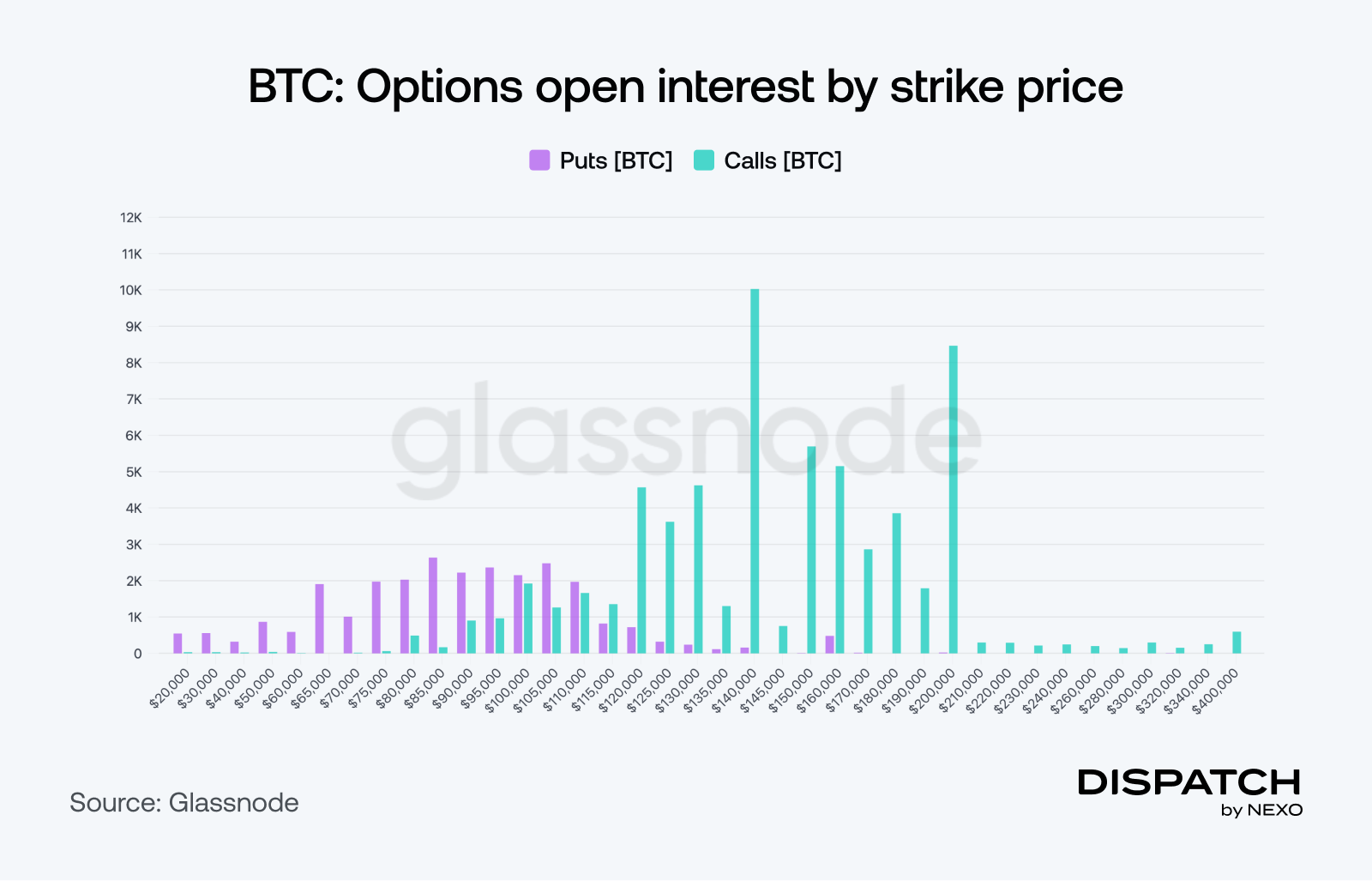

Bitcoin’s choices market has matured right into a central area for danger administration — and it’s now flashing the place merchants see the subsequent huge transfer. Open curiosity is at file highs, with calls dominating over places, pointing to a market tilted bullish whereas nonetheless hedged towards draw back. Implied volatility has trended decrease, reflecting deeper liquidity and steadier worth motion than in previous cycles. Put collectively, choices merchants are signaling confidence that Bitcoin will maintain larger floor — with year-end 2025 positioning clustering across the $140,000 mark because the most definitely vacation spot.

The numbers

The week’s most fascinating numbers

- $38.6 billion — Altcoin open curiosity, surging towards Bitcoin’s $40 billion, an indication of leveraged bets constructing forward of the Fed.

- 12 million — Day by day Ethereum smart-contract calls hit an all-time excessive, marking the heaviest on-chain exercise ever recorded.

- 1,000,000,000,000,000,000,000 — Bitcoin’s hashrate crossed one zetahash per second, a milestone that makes the community essentially the most safe computing system on earth.

- 12.3% — Establishments now management 2,595,000 of Bitcoin’s 21,000,000 complete provide, a structural shift tightening the asset’s float.

- $10.7 billion — BitMine’s complete crypto holdings, anchored by 2.15M ETH, making it the biggest company Ethereum treasury.

Scorching subjects

BTC ETFs’ back on track.

$114,000 seems to be the make-or-break level.

BTC’s getting more popular by the year.

N.B.: Next week’s Dispatch will be sent on Wednesday, September 24, instead of Tuesday.

Dispatch is a weekly publication by Nexo, designed to help you navigate and take action in the evolving world of digital assets. To share your Dispatch suggestions and comments, email us at [email protected].