Cryptocurrency Prices by Coinlib

Dispatch #268: Bitcoin’s largest market movers

On this patch of your weekly Dispatch:

- The most important macro week in 2025

- Stablecoin dominance

- Bitcoin year-end predictions

Market solid

Searching for the macro path?

Bitcoin has been recovering over the previous few days, climbing from round $108,000 to an early-week excessive close to $116,000 on Monday. On the weekly chart, the asset is consolidating across the center Bollinger Band, reflecting stability between patrons and sellers. The ADX stays beneath 20, signaling a weak pattern, although a transfer above 25 would affirm stronger directional momentum. Each the RSI and Stochastic Oscillator keep impartial, whereas the MACD histogram lingers barely beneath zero, displaying restricted upside strain.

On the day by day chart, sentiment seems firmer. The ADX is nearing 25, the Stochastic has entered the overbought zone with out reversal indicators, and the MACD has turned constructive after a bullish crossover. The RSI stays mid-range, suggesting regular however cautious momentum. With the Fed’s charge resolution approaching on Wednesday, volatility may improve as merchants reassess danger publicity.

Help is seen at $112,000 and $108,000, whereas resistance lies at $115,000, now performing as former assist, and $117,000.

The Bollinger Bands measure volatility, the ADX gauges pattern power, the RSI and Stochastic spotlight overbought or oversold circumstances, and the MACD tracks momentum shifts by way of shifting common crossovers.

The massive concept

The three elementary drivers for BTC

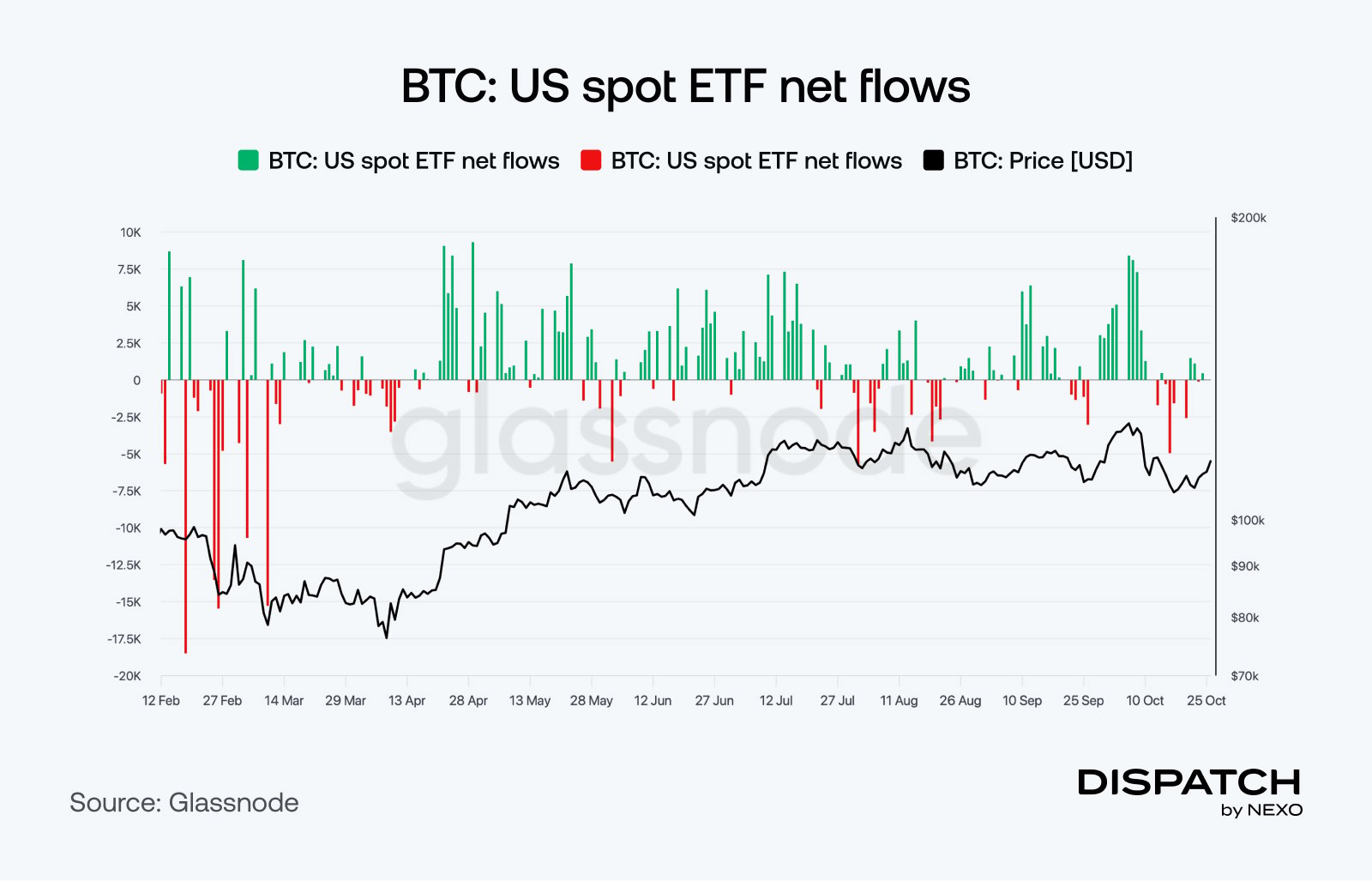

At Dispatch, we love monitoring the smaller alerts — cooling inflation, regular ETF flows, and delicate on-chain shifts. We notably like it when these threads converge into one thing larger, like this week, for instance.

Bitcoin now sits on the intersection of a number of forces that might outline its subsequent chapter: the Fed’s coverage pivot, renewed progress in U.S.–China commerce, institutional flows by way of ETFs, and the state of on-chain accumulation.

The setup is constructive however whether or not it turns into the muse for a breakout or one other spherical of consolidation will rely on how these 4 developments beneath evolve. Let’s unpack them one after the other.

Financial insurance policies: the turning tide: The most recent inflation studying of three.0% Y/Y has strengthened expectations for one more Fed charge lower by December, extending the easing cycle into early 2026. This shift towards cheaper capital ought to step by step restore liquidity to danger property. If the Fed maintains its course and world yields drift decrease, Bitcoin may reassert its function as a liquidity proxy — the primary asset class to answer easing. The trail received’t be linear; volatility will possible rise earlier than capital returns in power. The underside line? Sustained charge cuts may remodel this hesitant market into one outlined by momentum.

ETFs: the institutional barometer: Spot Bitcoin ETFs have offered the market with a ground, however not but a spark. BlackRock’s IBIT stays the principle engine of inflows, whereas others lag. Participation should broaden for the following leg of this cycle to type. A pickup in ETF inflows within the subsequent few months would affirm a real re-risking setting — one that might propel Bitcoin towards new all-time highs. Conversely, if ETF flows stagnate, Bitcoin may stay range-bound, mirroring a broader market nonetheless ready for a catalyst.

Geopolitics: will commerce discover a truce?: U.S. and Chinese language officers have reached a preliminary framework geared toward easing tariffs and restoring commerce cooperation forward of the upcoming Xi–Trump assembly in South Korea. The tone marks a shift from confrontation to collaboration. A sturdy U.S.–China commerce thaw may ease strain on world progress and provide chains, restoring confidence and supporting cross-border liquidity. That situation would reinforce Bitcoin’s macro attraction as a worldwide danger asset. If talks falter, nonetheless, renewed friction may reignite danger aversion and stall crypto’s restoration.

Accumulation: the market’s heartbeat: Mid-tier “dolphins” (100–1,000 BTC) now management roughly 26% of provide, quietly stacking whereas the gang hesitates. When accumulation returns in power, that’s the market’s inform. If these mid-sized gamers preserve including and long-term holders keep anchored, Bitcoin’s rhythm may shift from pause to push. Falling charges, thawing commerce tensions, and regular ETF demand all hum within the background — separate markers that might quickly sync right into a breakout. When conviction, liquidity, and fundamentals lastly transfer in tune, the actual bull run begins.

Scorching in crypto

Stablecoins proceed their surge

Stablecoins stole the highlight this 12 months. A brand new TRM Labs report exhibits their transaction quantity jumped 83% year-on-year, topping $4 trillion and now making up 30% of all crypto exercise.

That surge isn’t simply taking place on-chain — it’s hitting the checkout counter. In response to Nexo’s 2024 Card Report, 65% of all debit transactions made with the Nexo Card final 12 months had been settled in stablecoins, overlaying the whole lot from groceries and journey to day by day spending.

The market stays U.S.-dollar dominant and tightly held — Tether (USDT) and Circle (USDC) management 93% of the sector — however adoption is accelerating quick, particularly throughout South Asia, the place India leads world crypto uptake.

TradFi developments

Right here is how the Fed warms to crypto

The Fed simply made its most crypto-friendly transfer but. Governor Christopher Waller mentioned the central financial institution is coming into “a brand new period” the place crypto is now not on the fringes of finance.

Talking on the Funds Innovation Convention, Waller unveiled plans for a “skinny grasp account” — a prototype that might let fintechs and stablecoin issuers entry Fed fee rails straight, bypassing middleman banks.

It’s a pointy pivot from the Fed’s previous warning. With discuss of tokenization and stablecoins now by itself agenda, the Fed is signaling that digital property have gotten a part of the monetary core, not its periphery.

Macroeconomic roundup

Is that this the largest macro week in 2025?

Bitcoin’s macro sensitivity is again in focus as merchants brace for a data-heavy week. With the FOMC charge resolution, Powell’s press convention, jobless claims, and PCE inflation on deck — all in opposition to a month-long U.S. authorities shutdown — each launch may sway liquidity and sentiment.

FOMC Determination (Wed): Markets value a 96.7% likelihood of a 25-bps lower to 4.00%. A confirmed transfer would anchor easing bets and raise danger property; a shock maintain may hit crypto’s momentum.

Powell Speaks (Wed): His tone will form 2026 rate-cut expectations. Hints that QT is ending and extra cuts are coming would weaken the greenback and favor Bitcoin.

Jobless Claims (Thu): Federal filings have spiked because the shutdown. The next print would reinforce a cooling labor pattern and stronger liquidity hopes — a light tailwind for BTC.

PCE Inflation (Fri): Nonetheless the Fed’s gauge to look at. A softer learn would validate CPI aid and cement dovish momentum; sticky knowledge may delay deeper cuts.

Macro is messy, however it’s nonetheless driving the market. For now, Bitcoin stays its barometer.

The week’s most fascinating knowledge story

Bitcoin’s barometer turns inexperienced

Bitcoin ETFs are again on the offensive, with weekly inflows climbing to $445 million as institutional demand strengthens forward of the Fed’s October 29 charge resolution. With a 97% likelihood of a 25-bps lower, danger urge for food is enhancing and Bitcoin is holding close to $115,000. The mix of easing coverage and renewed ETF accumulation suggests a possible increased low forming — a setup that might pave the best way towards the $125,000 vary if inflows proceed into November.

The numbers

The week’s most fascinating numbers

$100,000 — Normal Chartered says Bitcoin could by no means fall beneath six figures once more as U.S.–China relations and ETF inflows anchor its new value ground.

51 — The Worry & Greed Index returned to impartial for the primary time in two weeks as Bitcoin climbed to $115K.

$7 billion — Round 62,000 BTC moved out of long-term wallets since mid-October, loosening provide as whales quietly gathered.

$921 million — Web inflows into world crypto funding merchandise final week, led by U.S. Bitcoin ETFs — a pointy rebound from prior outflows.

$46 trillion — The worth of on-chain funds settled through stablecoins over the previous 12 months, now 2.3% of worldwide fee flows.

Scorching matter

When have we not been optimistic?

Will this turn into a strong signal for SOL?

Who’s arguing?

Dispatch is a weekly publication by Nexo, designed to help you navigate and take action in the evolving world of digital assets. To share your Dispatch suggestions and comments, email us at [email protected].