Cryptocurrency Prices by Coinlib

What reignites the comeback transfer?

On this patch of your weekly Dispatch:

- The Fed’s December reduce odds

- BTC’s demand facet

- Asia’s crypto advance

Market forged

Bitcoin: The help zone take a look at

On the weekly chart, Bitcoin has slipped under the decrease Bollinger Band—a volatility gauge that measures how far value has moved from its common—underscoring the present bearish tone. Momentum indicators align with this view: the Stochastic oscillator stays deep in oversold territory, the MACD histogram is damaging and nonetheless declining, and the RSI is nearing 30, all pointing to stretched draw back situations. On the day by day chart, the 50-day easy transferring common has moved under the 200-day, a sign that sometimes displays waning short-term momentum however usually lags behind precise value motion.

Every day oscillators inform an analogous story, with each RSI and Stochastic deeply oversold and the MACD holding under zero. Fast help lies round $91,000–$90,000, with stronger footing close to $85,000–$84,000, whereas resistance stands at $96,000 and the psychological $100,000 stage.

The massive thought

BTC, ETH, SOL and XRP: Restoration beneath the floor

Dispatch places the crypto majors again in focus. Not for his or her volatility, however for what they every carry and finally – what might see them rise once more. The October derivatives correction, the U.S. authorities shutdown, and a macro unwind left markets bruised however not damaged. Beneath the floor, adoption, institutional engagement, and sovereign curiosity maintain advancing. With cleaner positioning and coverage turning favorable, Bitcoin, Ethereum, XRP, and Solana are getting into a section the place fundamentals matter greater than leverage. The comeback story is much less about chasing highs and extra about watching crypto’s pillars quietly re-anchor the subsequent cycle.

Bitcoin: After weeks that peeled off its year-to-date good points, Bitcoin’s slide to $94,000 seems extra like recalibration. The 43-day U.S. shutdown and tariff tensions harm sentiment, however adoption momentum is undamaged. In Washington, essentially the most pro-crypto administration on document has backed new ETFs, clearer regulation, and a surge in company treasury demand. Analysis agency Bernstein argues the pullback stems from cycle psychology.

Many traders anticipated a fourth-quarter weak point, with the standard post-peak sample, however this time the market seems basically stronger. Round 340,000 BTC, price $38 billion, has been distributed by long-term holders prior to now six months, but most of it has been absorbed by ETF inflows and company treasuries, which collectively have added roughly $34 billion in demand. Institutional possession of Bitcoin ETFs has climbed to twenty-eight%, up from 20% final 12 months, underscoring what Bernstein calls “larger high quality and constant possession.” Elsewhere, the Czech Nationwide Financial institution’s $1 million pilot, primarily Bitcoin, with stablecoins and tokenized deposits, marks step one by a European central financial institution towards integrating digital property into reserves. It’s a small however symbolic leap from commentary to experimentation. In the meantime, on-chain information reveals whale promoting typical of late-cycle profit-taking, not capitulation. With leverage flushed, ETF flows regular, and macro coverage softening, Bitcoin’s subsequent rally is probably going quieter however extra sturdy.

Ethereum: Ethereum’s consolidation could also be organising the beginning of its personal cycle. Tom Lee of BitMine says ETH is “embarking on the identical path” that noticed Bitcoin multiply a hundredfold since 2017. Like early Bitcoin, ETH’s progress is uneven – down about 35% from its August excessive of $4,946, however conviction could also be constructing. Roughly 17 million ETH flowed into long-term wallets this 12 months, elevating their whole to 27 million from 10 million in January. At round $3,100, ETH trades close to the fee foundation of those holders, a stage that has traditionally marked sturdy accumulation zones. The subsequent Fusaka improve guarantees actual good points in pace and usefulness, whereas Ethereum’s dominance in stablecoins and tokenized property retains it central to digital finance. If exercise and institutional inflows rebound, the groundwork for a sustained restoration – and maybe a protracted supercycle, will already be in place.

Ripple’s XRP: XRP’s long-awaited return to mainstream finance is underway. The primary U.S. spot XRP ETF, buying and selling as XRPC, places it alongside Bitcoin, Ethereum, and Solana as a part of the ETF period’s core group. It’s a landmark second for Ripple, as soon as outlined by regulatory battle however now buoyed by shifting coverage winds. Institutional demand is rising quick: new treasury platforms plan to boost over a billion {dollars} in XRP-backed merchandise, and derivatives positioning stays bullish. Ripple’s increasing funds community provides actual utility to the narrative. But near-term information present a market caught between conviction and warning: short-term holders are actively shopping for the dip, however long-term traders have elevated promoting to maintain momentum muted. Technically, XRP wants a decisive transfer above $2.38 to regain a bullish construction, whereas dropping $2.06 would invalidate it. If ETF inflows hold and cross-border volumes rise, XRP’s subsequent chapter could possibly be outlined by adoption, not litigation.

Solana: Solana stays the community establishments can’t ignore. At the same time as SOL fell to about $140 – its lowest since June because the asset has logged 14 straight days of ETF inflows, including $12 million final week and lifting cumulative totals previous $370 million. That consistency, regardless of wider market redemptions, highlights deepening institutional confidence in Solana’s function because the quickest, user-ready blockchain. Reliability has improved, throughput stays unmatched, and improvement in funds, gaming, and DePIN retains increasing. The ETF bid is strengthening liquidity and setting a strong base for restoration. If the community maintains stability by high-traffic durations and continues scaling its real-world ecosystem, this correction might show a mid-cycle reset earlier than renewed momentum – a chance for traders positioning for the subsequent adoption wave.

Collectively, the Massive 4 in crypto stand in a consolidation. Leverage has been flushed, infrastructure is advancing, and adoption from central banks to corporates is shifting from resistance to readiness. If that development holds, this correction might mark not the tip of the cycle, however the starting of its subsequent, extra mature section.

Macroeconomic roundup

Is the December reduce nonetheless on the map?

Investor confidence in a December Federal Reserve fee reduce has eroded sharply, with 46% of traders now anticipating a transfer – down from 67% per week in the past, CME information reveals. The shift comes as markets digest October’s 25 bps reduce, which was absolutely priced in and didn't raise danger property, together with crypto. Fed Chair Jerome Powell has since burdened that “coverage will not be on a preset course,” signaling a extra cautious, data-driven stance as inflation stays sticky and the labor market sturdy.

The fading odds mirror a broader recalibration: traders who as soon as anticipated a number of cuts in 2025 at the moment are bracing for a slower, extra measured easing cycle. With liquidity staying tight and danger urge for food subdued, each equities and digital property might stay below strain till the subsequent studying. Till the Fed alerts a clearer path towards sustained fee reduction, the risk-on momentum merchants have been ready for will probably keep on maintain.

TradFi developments

Asia: The place tokenization and regulation transfer

Asia’s main monetary facilities are accelerating their digital-asset agendas. In Hong Kong, the Financial Authority has launched the pilot section of Venture Ensemble, transferring from sandbox testing to real-value tokenized transactions. Working by 2026, this system will take a look at tokenized money-market funds and real-time liquidity administration, with plans to broaden towards 24/7 interbank settlement in tokenized central financial institution cash. HKMA chief Eddie Yue referred to as the launch “the place innovation meets implementation,” as each Hong Kong and Singapore advance interoperability in tokenized finance.

In Japan, the Monetary Providers Company plans to reclassify 105 cryptocurrencies, together with Bitcoin and Ether, as monetary merchandise below securities regulation whereas chopping the highest tax fee on crypto revenue from 55% to twenty% to align with inventory investments. The reforms, anticipated to take impact by 2026, mark Japan’s shift towards a Web3-ready monetary framework with clearer guidelines, stronger oversight, and extra aggressive taxation to draw international capital.

The week’s most attention-grabbing information story

Time for demand-side motion

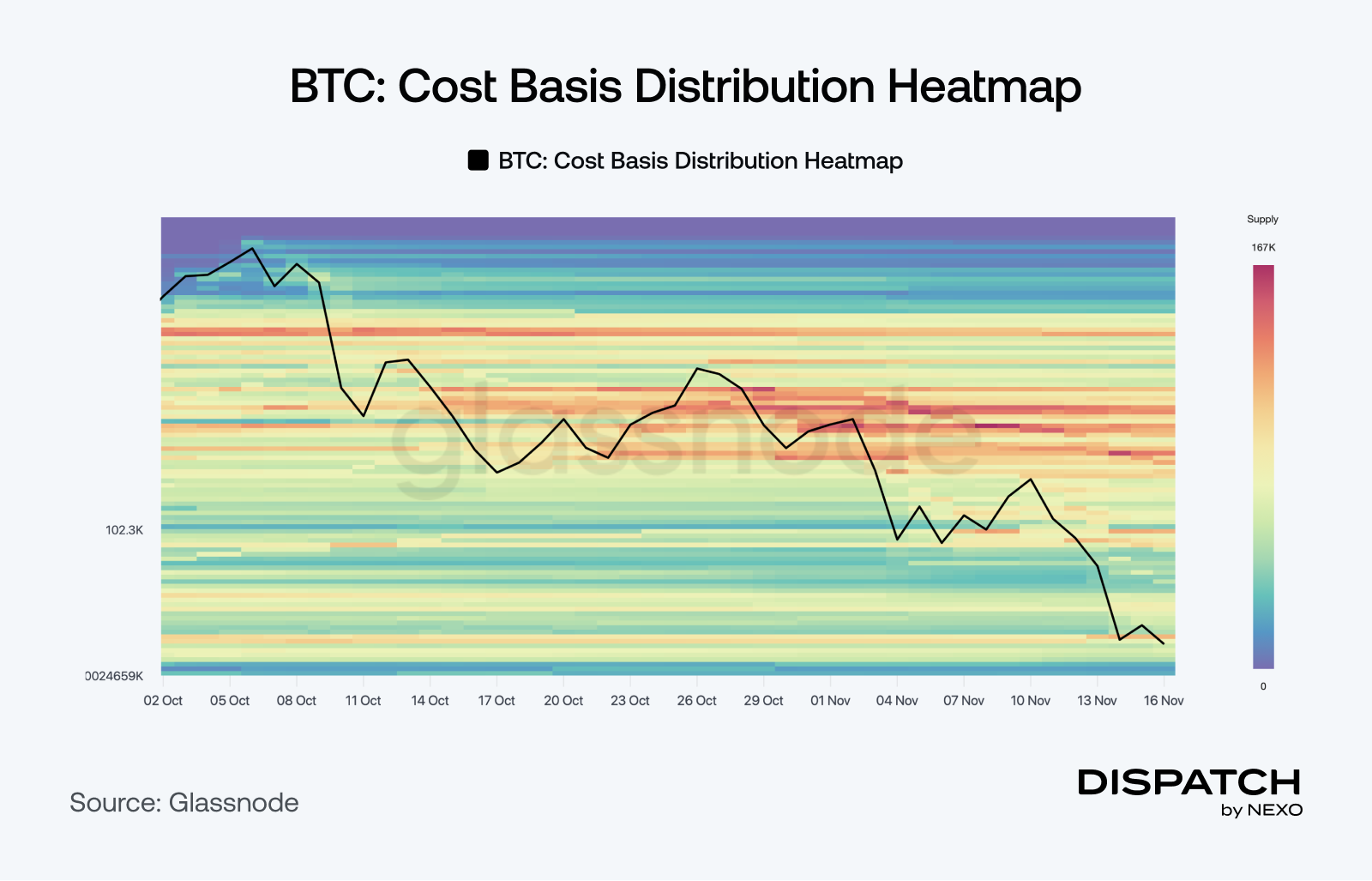

The Value Foundation Distribution Heatmap highlights a notable buildup of realized provide just under $100,000, each forward of and after the rebound to $106,000. The intensifying exercise on this zone factors to renewed accumulation, as consumers take up capitulation flows and set up a firmer base. This stability of vendor exhaustion and contemporary demand is giving the market room for a measured short-term restoration, even within a broader cautious structure.

Nonetheless, a thick provide cluster between $106,000 and $118,000 continues to behave as resistance, with many holders utilizing that vary to exit close to breakeven. Overcoming it can require stronger inflows and sustained conviction to soak up remaining distribution and restore upward momentum.

The numbers

The week’s most attention-grabbing numbers

- $25,000 — Peak worth of a $10,000 wager on BlackRock’s Bitcoin ETF for a 150% acquire in below two years.

- 257% — Harvard’s bounce in Bitcoin ETF holdings, making IBIT its high declared funding.

- 89% — XRP’s yearly surge, the one main crypto nonetheless within the inexperienced.

- $58 million — First-day quantity for Canary’s XRP ETF, the most important ETF debut of 2025.

Sizzling subject

A balanced perspective from Bloomberg.

Is this SOL’s ticket to recovery?

The 4-year cycle makes room for liquidity channels?

Dispatch is a weekly publication by Nexo, designed to help you navigate and take action in the evolving world of digital assets. To share your Dispatch suggestions and comments, email us at [email protected].