Cryptocurrency Prices by Coinlib

Will the Fed restart momentum?

- ETH’s shortage shifts

- Banks advising on BTC

- The merchants’ positioning resets

Market solid

BTC: Is stability rising?

On the weekly chart, Bitcoin is consolidating round $90,000, buying and selling near the decrease Bollinger Band, a volatility indicator that also displays a cautious, bearish backdrop. The RSI momentum gauge is edging towards oversold territory, and the MACD histogram, which tracks pattern power, stays firmly unfavorable. Even so, the Stochastic oscillator, a shorter-term momentum device, has begun to show increased from oversold ranges. If this upward crossover holds, it could be the primary signal that draw back momentum is beginning to ease.

On the every day timeframe, circumstances seem extra impartial and rangebound, with value hovering close to the center Bollinger Band. Each the RSI and Stochastic stay directionless, whereas the MACD histogram stays optimistic, suggesting the underlying pattern might nonetheless supply help ought to consumers try to re-engage.

Help: First at $89,000, then the $85,000-$84,000 space. The weekly 100-period SMA, a long-term pattern indicator, reinforces this zone as dynamic help.

Resistance: Preliminary resistance is available in at $91,000-$92,000, with a stronger barrier close to $94,000.

Outlook: Whereas the weekly image nonetheless leans bearish, early enhancements in short-term momentum by way of the Stochastic introduce the opportunity of a gradual stabilization section. A sustained transfer by means of the close by resistance bands would validate that shift, whereas a break under help would maintain the corrective construction intact.

The massive thought

The speed minimize that might shift the market’s momentum

Bitcoin spent the previous week between confidence and warning, reclaiming the $90,000s as quantitative tightening formally ended, briefly slipping into the high-$80,000s after which snapping again once more. Regardless of the back-and-forth, it retains gravitating towards the identical degree. And now, heading into Wednesday, an actual tailwind could lastly emerge.

This week’s Federal Reserve determination could possibly be essentially the most consequential in months. Markets are pricing a near-90% chance of a 25 bps cut, and whereas nothing is assured, the macro backdrop more and more factors in a single route. If the Fed follows the info, Wednesday could mark the second Bitcoin regains a supportive coverage setting — and step one towards a renewed climb.

Inflation cools down: The long-delayed core PCE studying arrived softer at 0.2% MoM and a pair of.8% YoY, preserving the disinflation pattern the Fed has been ready for. Shopper sentiment improved for the primary time in months, with inflation expectations drifting towards pre-pandemic norms. For policymakers, that mixture reduces the chance of easing too quickly.

The labor market softens: Personal payrolls are shedding momentum, and the ADP report posted a surprise job decline. Weekly jobless claims hit a three-year low, but persevering with claims stay elevated – an indication the headline numbers could quickly mirror the underlying slowdown. The Chicago Fed’s estimate of 4.4% unemployment provides to the image of a market that's now not overheating.

Enterprise exercise slows down: Manufacturing has now contracted for 9 consecutive months, with the ISM index staying under 50. Providers exercise stays regular however subdued, with employment cooling and enter costs nonetheless elevated. Traditionally, this kind of mixed-but-slowing setting pushes the Fed towards recalibration somewhat than restraint.

Why the minimize issues: A single fee transfer doesn’t remodel Bitcoin, however the turning level of a cycle usually does. A minimize would weaken the greenback’s momentum, ease actual yields, and ship a sign that financial circumstances are shifting from restrictive to impartial. Bitcoin’s repeated resilience across the $90,000 zone suggests the market is already positioning for this transition.

And additional down on this publication, our have a look at balanced, near-neutral funding charges reveals how quietly this anticipation is constructing. With leverage mild and positioning cautious, the market is ready somewhat than chasing – circumstances that may speed up rapidly if the macro winds change.

If the Fed not solely cuts however frames it as the beginning of a gradual reset, Bitcoin might lastly regain the macro alignment it has lacked. The trail to 6 figures by no means begins with fireworks – it begins with the primary coverage shift. And that second could arrive on Wednesday.

Ethereum

ETH’s supply-and-demand recreation

Ethereum is quietly shifting into one in all its strongest provide dynamics so far. Alternate balances have dropped to simply 8.8% of whole provide – the lowest level since Ethereum’s launch, after falling 43% since July as staking, restaking, L2 exercise, DAT accumulation, and long-term custody proceed absorbing provide. With greater than a ten% acquire previously 10 days and ETH holding above $3,000, the backdrop more and more resembles the early phases of a provide squeeze.

Technical momentum: ETH continues to consolidate round $3,050, however the ETH/BTC pair has turned upward, and quantity indicators similar to OBV present underlying shopping for power whilst value meets resistance.

Fusaka rolled out: Ethereum’s Fusaka improve efficiently went dwell final week, unlocking main data-capacity enhancements and decrease prices for L2s. For individuals who missed it, we’ve damaged down the improve’s impression in our latest blog post.

TradFi traits

Are banks giving Bitcoin the thumbs-up?

Financial institution of America is opening a brand new chapter in conventional finance, formally recommending that wealth purchasers allocate crypto of their portfolios. The financial institution will even start analysis protection on a choose group of spot Bitcoin ETFs, reflecting a broader strategic shift towards incorporating regulated digital-asset merchandise into mainstream portfolio development.

The transfer reverses BoA’s earlier coverage that prevented greater than 15,000 advisers from recommending crypto until purchasers particularly requested it. Now, the financial institution falls into line with friends similar to Morgan Stanley, BlackRock, and Constancy, reinforcing a rising consensus round modest, professionally guided crypto publicity.

And whereas Bitcoin stays about 10% under final yr’s ranges after its pullback from the $126,000 highs, long-term conviction from main establishments, together with JPMorgan and Normal Chartered, indicators that positioning for the subsequent cycle is already underway.

Macroeconomic roundup

Countdown to the Fed’s determination of the yr

A packed mid-December calendar brings a cluster of information and central-bank choices that can form expectations heading into Tuesday’s pivotal FOMC assembly. With markets closely pricing a U.S. fee minimize and Bitcoin holding above $90,000, the macro setup leans quietly supportive and the anticipation is constructing throughout danger belongings. This week’s releases will decide whether or not that momentum carries into year-end or stalls in entrance of the Fed.

FOMC Assertion & Fed Price Choice (Tuesday): The primary occasion. Markets assign an 87% likelihood of a 25 bps minimize. Ahead steerage will decide whether or not easing expectations prolong into 2026.

FOMC Press Convention (Tuesday): Powell’s tone will matter as a lot because the transfer. Any shift in confidence about inflation or labor might sway danger sentiment sharply.

Preliminary Jobless Claims (Wednesday): A clear measure of labor momentum. Rising claims strengthen the case for additional easing; decrease claims argue for endurance.

U.Okay. GDP October (Thursday): A snapshot of whether or not the U.Okay. economic system is stabilizing into year-end.

German CPI November (Thursday): One other step in Europe’s disinflation path, including to the broader image of worldwide easing cycles rising.

The week’s most attention-grabbing information story

Funding charges: A real sign for markets

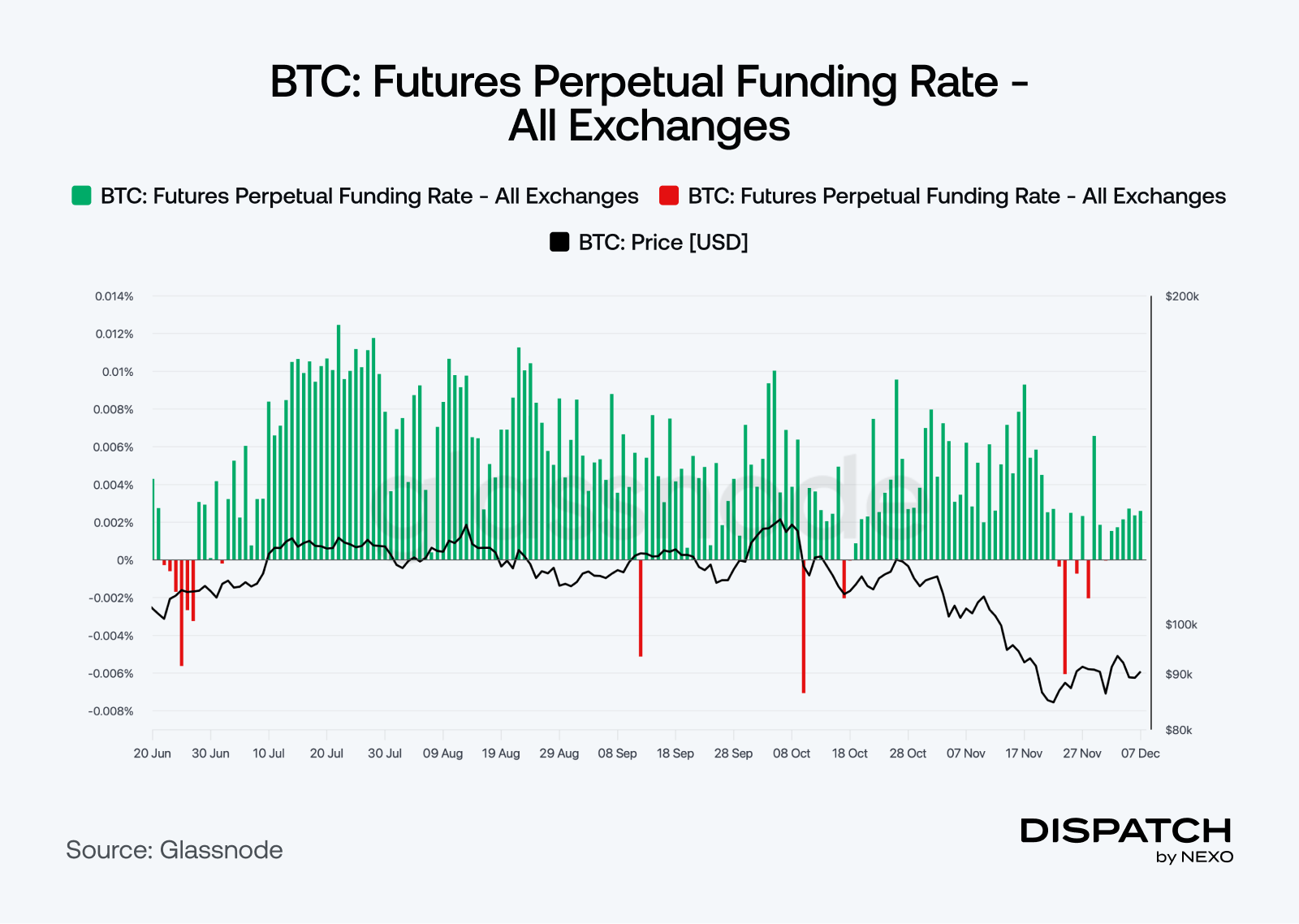

Funding charges, the funds between lengthy and quick perpetual merchants, supply a fast learn on market positioning. Lately, they’ve moved again towards impartial as falling open curiosity unwinds the substantial lengthy positioning from earlier within the rally. Transient dips under zero have been gentle, suggesting merchants aren’t shifting aggressively quick regardless of the pullback. This reset leaves the market extra balanced and fewer weak to draw back shocks, making a more healthy setup if demand begins to get better.

The numbers

The week’s most attention-grabbing numbers

$716 million — One other week of robust web inflows into world crypto funds, signaling a transparent flip in sentiment.

$3.7 trillion — Potential measurement of the stablecoin market by 2030, highlighting how digital {dollars} have gotten a significant drive in world liquidity.

$150 million — New ETH added to BitMine’s treasury this week, reinforcing long-term accumulation because the agency pushes towards 5% of whole provide.

$8.69 billion — Recent month-to-month realized-cap inflows into Bitcoin, displaying regular conviction returning whilst spot exercise cools.

$898 million — Inflows into XRP spot ETFs since launch, cementing them as one of many breakout winners of this ETF cycle.

Scorching subject

Inside info from BlackRock’s CEO?

Are these whales onto something?

Did someone say altcoin season?

Dispatch is a weekly publication by Nexo, designed to help you navigate and take action in the evolving world of digital assets. To share your Dispatch suggestions and comments, email us at [email protected].