Cryptocurrency Prices by Coinlib

Why the $98 trillion liquidity actuality trumps the noise?

Market Forged

BTC: Consolidation close to key ranges

On the weekly chart, the value of Bitcoin not too long ago dipped towards the two-hundred-period easy shifting common earlier than rebounding and is now consolidating across the $69,000 stage, which can operate as near-term assist. Broader situations stay skewed to the draw back. Momentum indicators proceed to replicate bearish strain, with each RSI and Stochastic in oversold territory and the MACD histogram deeply damaging, indicating that draw back momentum has not but totally reset.

The each day chart presents a extra balanced image. Worth motion has stabilized over latest periods, whereas each RSI and Stochastic have moved again above oversold ranges, in keeping with easing bearish momentum. Though the MACD histogram stays beneath zero, its gradual convergence towards the impartial line means that draw back strain could also be weakening somewhat than accelerating.

The Large Concept

Market noise vs. the $98 trillion liquidity actuality

There may be by no means a single cause why the market strikes. Whereas headlines love a singular ‘why,' the reality is all the time discovered within the intersection of a number of, usually conflicting, drivers.

Take Bitcoin’s latest drawdown. It displays a repricing of near-term liquidity expectations following Kevin Warsh’s nomination as Fed Chair, alongside broader volatility in technology-linked danger belongings, somewhat than a deterioration in underlying fundamentals.

This volatility is additional coloured by the market’s historic four-year rhythm, which frequently sees traders recalibrate their positions as we method the math-driven pivots of the halving cycles.

Nonetheless, beneath short-term market noise, the worldwide liquidity backdrop stays constructive. Combination M2 throughout main economies stands close to all-time highs at roughly $98.6 trillion, indicating that system-wide liquidity stays ample even because the tempo of enlargement moderates.

Importantly, whereas Warsh’s nomination has launched some near-term uncertainty as markets interpret his stance as structurally hawkish, his appointment additionally removes a key coverage unknown. Warsh brings institutional credibility by way of crisis-era Fed expertise and a powerful dedication to central financial institution independence, whereas any near-term coverage impression is more likely to be restricted by the committee-driven nature of FOMC choices.

Exterior the U.S., world liquidity dynamics stay broadly supportive. In China, the PBOC maintains a coverage bias towards lodging amid subdued inflation and weak home demand. In Europe, final week’s softer eurozone inflation print and a stronger euro depart room for potential ECB insurance coverage cuts. Within the UK, faster-than-expected disinflation has elevated the chance of a March fee lower. Japan might show to be much less of a residual danger than markets presently assume. Bettering fiscal fundamentals, predominantly home JGB possession, and a gradual method to coverage normalisation scale back the chance of disorderly tightening.

Total, latest crypto volatility has been amplified by market construction results and a leverage reset in derivatives markets. Bitcoin open curiosity has fallen by greater than 50% from October’s all-time highs, with a fair bigger reset throughout altcoins. With a lot of the damaging information already priced in and world liquidity remaining supportive, markets seem higher positioned, pending a clearer macro catalyst.

The takeaway is easy: do not mistake a tactical recalibration for a structural breakdown. Whereas the headlines deal with the friction of latest nominations and the historic four-year cycle, the plumbing of the worldwide monetary system tells a distinct story.

Blue chips

Community exercise & ETFs lead restoration

Altcoins declined 8–10% alongside Bitcoin, however community fundamentals stay comparatively resilient. Ethereum exercise continues to increase, with each day transactions reaching a report ~2.8 million in early February. Trade-held ETH has fallen to ~12% of provide whereas staked ETH approaches 37 million, reinforcing lowered near-term promote strain and Ethereum’s continued dominance throughout DeFi, RWAs, and stablecoins.

XRP has additionally diverged from worth weak spot, with Ripple not too long ago securing a full EU EMI license and rising RLUSD stablecoin provide to ~$1.5 billion, alongside rising on-chain volumes.

Regardless of final week’s consolidation, spot Bitcoin ETFs recorded $371 million in web inflows on February 6, with no outflows throughout any product. Altcoins stay extremely correlated with Bitcoin, however ETF flows present early indicators of differentiation. XRP spot ETFs noticed $39 million in weekly inflows, led by XRPZ, whereas SOL ETFs posted web weekly outflows regardless of a modest rebound on February 6. These patterns are in keeping with gradual capital concentration in belongings with clearer institutional positioning.

TradFi tendencies

Macro information shapes near-term market sentiment

Markets enter a data-heavy week with delayed U.S. labour releases in focus, after stronger-than-expected PMI readings final week contrasted with delicate sentiment and declining job openings. The January U.S. employment report has been postponed once more because of the authorities shutdown, complicating near-term evaluation of labour market situations following the weakest yr for U.S. job development since 2020.

U.S. inflation information additionally stay underneath scrutiny after latest CPI prints had been questioned because of shutdown-related information gaps. The BLS carried ahead lacking shelter costs underneath its commonplace procedures; given shelter’s roughly one-third weight within the CPI basket, this methodological alternative might have understated reported lease inflation and dampened latest CPI readings.

Collectively, delayed labour market information and lingering questions round inflation measurement elevate the stakes for upcoming macro releases. Till readability improves, markets are more likely to stay delicate to incremental indicators on the financial coverage outlook.

Macroeconomic roundup

U.S. jobs and inflation information in focus

U.S. Retail Gross sales (Tue)

December retail gross sales will gauge shopper resilience into year-end, informing the steadiness between soft-landing and draw back development dangers.

U.S. Nonfarm Payrolls & Labour Market Information (Wed): The rescheduled jobs report will check whether or not labour market cooling is constant with no sharp slowdown, with direct implications for Fed coverage expectations, USD pricing, and danger sentiment.

China Inflation & Exercise Information (Wed): Subdued CPI and damaging PPI readings are anticipated to bolster China’s disinflationary backdrop and assist expectations of continued coverage lodging.

U.S. CPI Inflation (Fri): Inflation stays the first constraint on Fed easing. Markets will deal with whether or not shelter inflation re-accelerates after prior information gaps, given its outsized contribution to core CPI. The discharge is more likely to drive near-term strikes in charges and danger belongings.

For a fuller breakdown of this week’s macro occasions and timings, see our full macro calendar on X.

The week's most attention-grabbing information story

Stablecoin exercise factors to resilient underlying liquidity

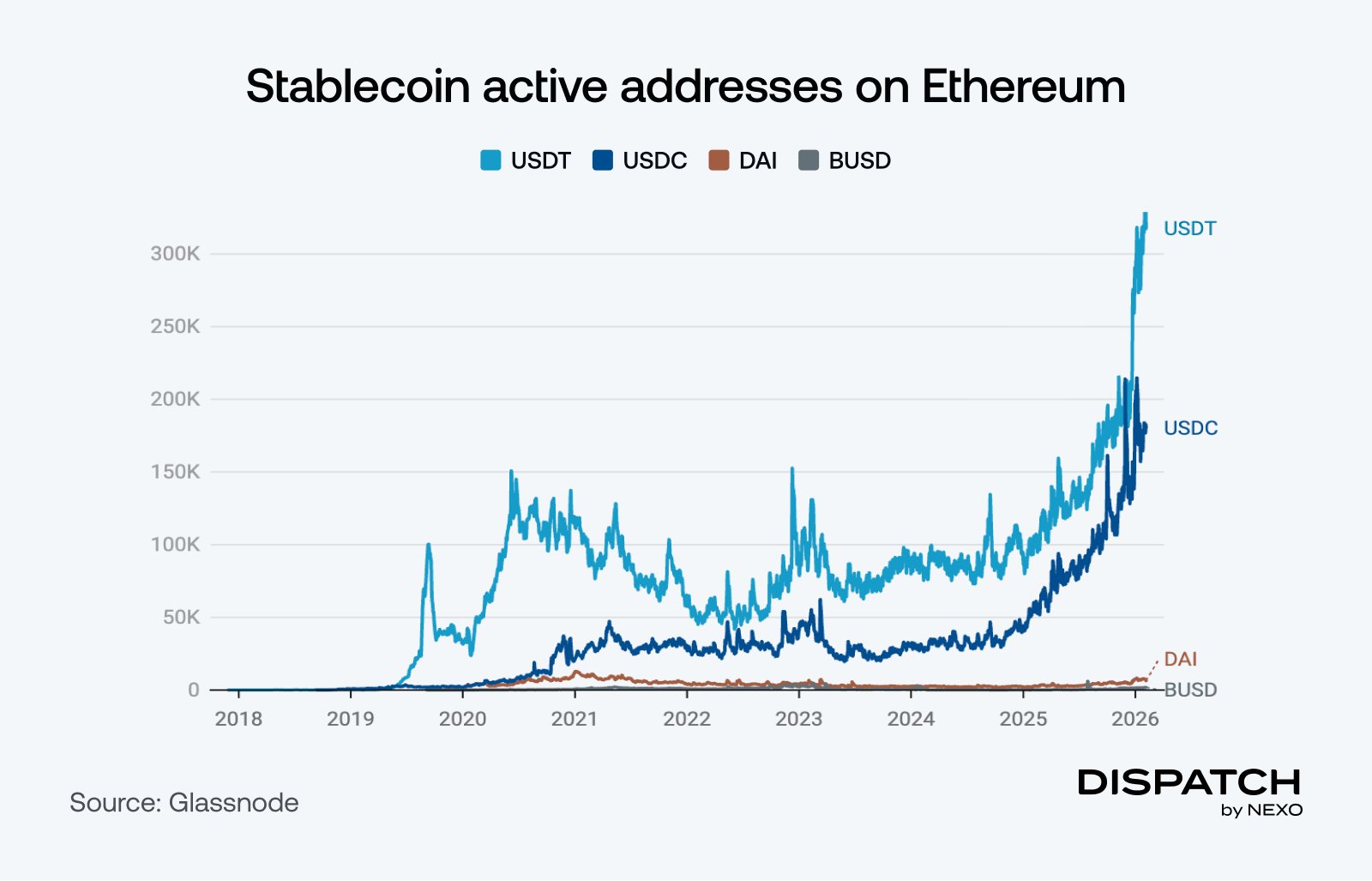

On-chain exercise throughout main stablecoins stays resilient, indicating that the crypto ecosystem’s core liquidity and settlement layer continues to operate regardless of softer danger sentiment. Every day lively handle information for USDT, USDC, BUSD, and DAI level to sustained engagement somewhat than broad-based contraction.

Per this, mixture stablecoin provide throughout the 5 largest issuers is down solely ~2% yr thus far, holding close to $261 billion. This decline seems pushed by the lagged impression of the broader crypto market cap drawdown somewhat than materials capital outflows.

The numbers

The week’s most attention-grabbing numbers

1.5 – Bitcoin to gold volatility ratio has fallen to report lows, making Bitcoin extra enticing on a relative foundation, in line with JP Morgan.

$21.4 billion – BTC perpetual futures open curiosity in early February, greater than halved from October highs, indicating a large leverage reset.

170,000 – Web improve in ETH held by treasury corporations because the begin of the yr.

408,000 contracts – The Common Every day Worth (ADV) of CME crypto futures and choices traded in January ($10.8 billion notional), highlighting continued institutional engagement.

$2,000 – Normal Chartered’s end-2030 worth goal for Solana, reflecting long-term conviction in its shift towards funds and micropayments regardless of a extra cautious near-term outlook.

What the group is discussing

Crypto ETF investors show strong holding conviction.

XRP Ledger sees sustained whale activity.

Crypto VC funding doubled in 2025.

Dispatch is a weekly publication by Nexo, designed to help you navigate and take action in the evolving world of digital assets. To share your Dispatch suggestions and comments, email us at [email protected].