Cryptocurrency Prices by Coinlib

A Week of Waves Forward

On this patch of your weekly Dispatch:

- Volatility incoming

- Crypto validated

- Fed’s November reduce

Market solid

Bitcoin continues to function inside a bullish development channel on the every day chart, with a help degree established round $66,500. Ought to this help maintain, analysts anticipate one other check of the all-time excessive of $73,200, which is considered as a essential resistance degree for sustaining bullish momentum. The worth is at present positioned close to the center band (20-period SMA) of the Bollinger Bands indicator, suggesting potential stabilization and the doable conclusion of the current development correction. Whereas most shifting averages point out a robust purchase sign, oscillators stay impartial. With the upcoming U.S. elections and anticipated charge cuts, elevated volatility and buying and selling volumes are anticipated.

The massive concept

Crypto – right here to remain

If you happen to observe our updates often, you are doubtless enthusiastic about the way forward for crypto, like us. All of us wish to know the way essentially the most revolutionary asset class progresses. Whereas it’s almost unattainable to ship concrete projections, typically it’s the large image – or the ‘Massive Concept' – that gives reassurance. For these in search of validation, it hardly will get higher than acknowledgment from the chief monetary officer of a U.S. state, like Florida’s Jimmy Patronis.

Lately, Patronis directed the State Board of Administration to spend money on Bitcoin as a hedge towards foreign money inflation and a safeguard towards central financial institution digital currencies. “Crypto is not going anywhere,” he stated. “It isn't going to contract – it should proceed increasing – and I feel we would be silly if we're not ready to harness the alternatives there.” He additionally warned that ignoring the rise of crypto could be a mistake: “If you happen to’re not taking note of it, you’re making a mistake.”

Bitcoin

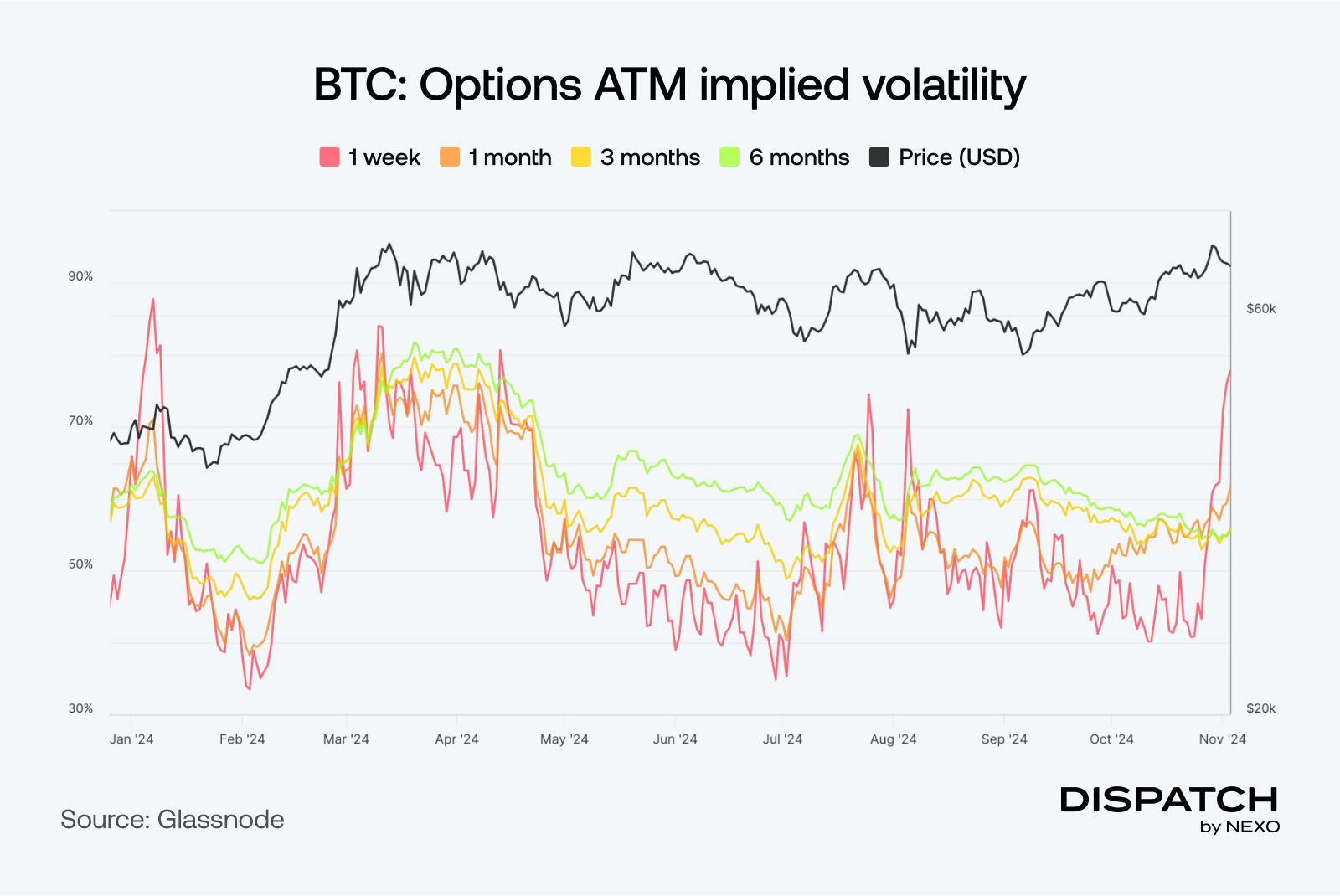

Because the U.S. election approaches, Bitcoin is experiencing a surge in volatility that has merchants on excessive alert. The 30-day volatility gauge for Bitcoin has reached its highest degree since August, with media reviews suggesting potential value actions of round 8% in both path following the vote – considerably greater than the everyday 2% swings. This uncertainty is compounded by shifting political dynamics, significantly regarding former President Donald Trump, whose prediction market odds have dropped amid tightening race outcomes towards Vice President Kamala Harris. Merchants brace for speedy fluctuations as exterior components affect Bitcoin's value motion and the broader crypto market.

Ethereum

Analysts at 21Shares argue that Ethereum is at a pivotal second akin to Amazon's emergence within the Nineties, when its potential was largely ignored. Because the launch of spot Ether ETFs in July, inflows have been modest in comparison with these of Bitcoin ETFs. 21Shares researchers suggest that bigger investments in Ethereum will materialize as its use instances turn into clearer.

At the moment, Ethereum boasts a market capitalization of $320 billion, solely 6.25% of Amazon's valuation. Nonetheless, it considerably outpaces Amazon's early workforce with over 200,000 lively builders right now, in comparison with Amazon’s 7,600 in its early life. Regardless of dealing with competitors from different platforms, analysts stay optimistic that Ethereum's various functions might lead it to rework the digital panorama very like Amazon did for e-commerce.

TradFi traits

With BlackRock solidly embracing the rising development of tokenization, it was solely a matter of time earlier than different main monetary establishments adopted go well with. Now, UBS has launched its first tokenized fund, “uMINT”, on the Ethereum blockchain, persevering with the development of conventional monetary giants embracing blockchain expertise. This fund brings institutional-grade money administration to a decentralized platform, utilizing cash market devices inside a risk-managed framework. The launch is a part of UBS's broader “UBS Tokenize” initiative, which has already seen the financial institution challenge digital bonds and execute cross-border transactions utilizing blockchain.

Macroeconomic roundup

The U.S. Federal Reserve's rate of interest determination is due this Thursday, and ING analysts anticipate that the Fed will implement a 25 foundation level reduce on November 7, whatever the final result of the U.S. presidential election. The Fed is shifting its focus from inflation considerations to a cooling job market, permitting for continued charge cuts to succeed in a extra impartial coverage degree. After a 50 foundation level reduce in September, ING expects the Fed to chop charges once more in December, totaling 100 foundation factors for the yr.

The week’s most attention-grabbing information story

On the finish of October, Bitcoin surged previous $72,000, its highest degree since June, coinciding with a report spike in Bitcoin futures open curiosity (OI). This means heightened market exercise from merchants and traders. Whereas elevated OI can result in elevated volatility, funding charges within the futures market stay beneath March peaks, suggesting that the market is cautiously optimistic slightly than overheated.

The numbers

$901 million in crypto funding inflows have been recorded final week, marking one of many best-performing weeks.

$7.7 billion is Tether's year-to-date internet revenue, supported by sturdy gold holdings and extra reserves.

$2.68 billion is the entire worth of crypto property set to be unlocked in November.

12,000 jobs have been added within the U.S. nonfarm payrolls, a major miss in comparison with the anticipated 106,000.

- $42 billion is MicroStrategy's deliberate capital increase by 2027 to increase its Bitcoin holdings.

Sizzling subject

Some refreshing food for thought…

Is this free Bitcoin mining then?

Bernstein have it figured out.

Dispatch is a weekly publication by Nexo, designed to help you navigate and take action in the evolving world of digital assets. Discover insights and opportunities shaping crypto's role in driving the next generation of wealth. To share your Dispatch suggestions and comments, email us at [email protected].