Cryptocurrency Prices by Coinlib

the world’s seventh largest asset

On this patch of your weekly Dispatch:

- BTC’s newest ATH

- Ethereum ETFs catch up

- The Fed pauses cuts

Market solid

The golden cross and a $100,000 tease

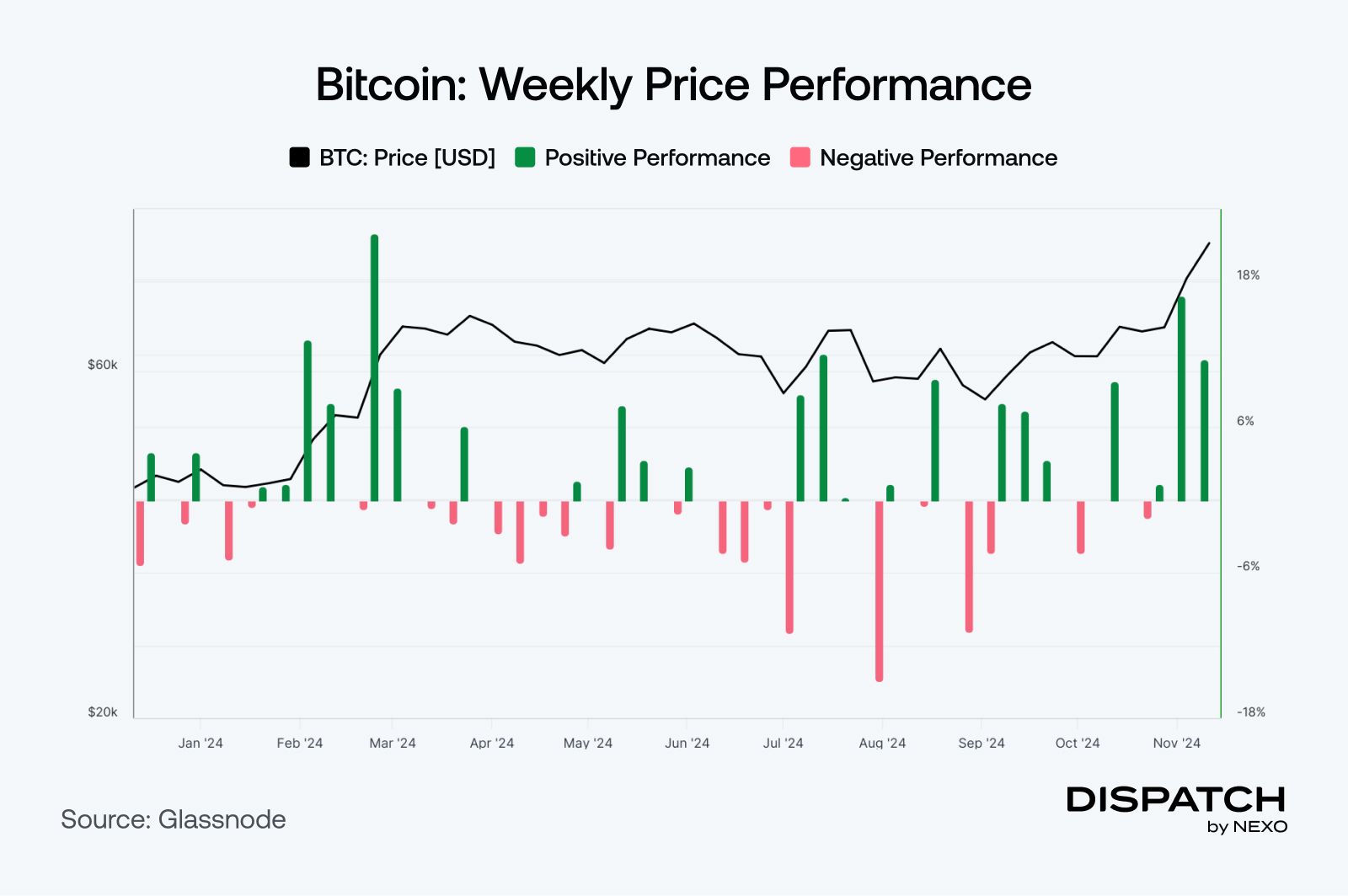

Bitcoin has smashed via $93,367 for a brand new all-time excessive, turning into the seventh-largest asset globally. It surpassed conventional shares like Visa, JPMorgan Chase, Tesla, Meta Platforms, oil big Saudi Aramco and silver with a market capitalization nearing $1.8 trillion. Its dominance within the crypto market now sits at a formidable 61%.

However beneath the achievements lie the technicals. At the moment consolidating across the $90K mark, Bitcoin is inching nearer to the psychological $100,000 milestone, with robust technical momentum. Oscillators sign optimism and a strong uptrend above the 70 stage, however the market can also be approaching the overbought zone, hinting at attainable short-term corrections.

Nonetheless, a key technical indicator presents a bullish outlook. The golden cross – the 50-day transferring common crossing above the 200-day transferring common – is a traditional sign of sustained upward momentum. Final time this occurred, Bitcoin doubled in worth. Final week on CNBC, Nexo’s co-founder boldly predicted $100,000 BTC very soon. If historical past and a golden cross are any indicators, that “very quickly” would possibly simply dwell as much as its identify.

The massive thought

Blue skies for crypto?

After Bitcoin’s spectacular good points, many marvel if an altcoin season is subsequent. The whole crypto market cap surged from $2.8 trillion to over $3 trillion in only one week—may this be a sign?

Bernstein Research is optimistic, advising buyers to “purchase all the pieces you possibly can” as institutional curiosity grows and value traits stay bullish. They predict Bitcoin may attain $200,000 as adoption continues.

Sygnum’s annual survey exhibits 57% of establishments plan to extend digital asset publicity, with Layer-1 blockchains and DeFi as key funding focuses. A positive U.S. regulatory surroundings is predicted to spice up crypto's enchantment amongst asset managers and personal buyers.

K33 Research highlights the continued power of the altcoin market, noting the three million memecoins and 1 million Ethereum-based tokens launched this yr.

Tl;dr: With Bitcoin nearing $100,000 and a optimistic political local weather, altcoins are poised for development.

Ethereum

ETH slips under trendline

Ether (ETH) just lately misplaced a key help stage in opposition to Bitcoin (BTC), breaking under an upward trendline that had marked value lows since 2016. The trendline has traditionally signaled main recoveries, however its breach, together with the ETH/BTC pair dropping 15% and growing buying and selling volumes, level to promoting strain. As compared, Solana (SOL) has been outperforming ETH, with its value surging over 925% in opposition to it since December 2022.

Solana

A SOL ATH in sight?

In accordance with the “This fall 2024 Crypto Funding Supervisor Survey” by MV International, most enterprise capital and hedge funds anticipate Solana (SOL) to succeed in at the least $600 on this bull cycle, with practically a 3rd of respondents predicting it is going to exceed that stage. About 23% foresee SOL's all-time excessive being inside this vary, whereas others anticipate the asset to commerce between $150 and $300 within the second half of 2025.

The survey, which interviewed 76 main liquid funds and enterprise allocators, revealed a powerful consensus that Solana will outperform Bitcoin (BTC) and Ethereum (ETH) on this cycle.

TradFi traits

BlackRock expands to a number of blockchains

BlackRock’s USD Institutional Digital Liquidity Fund (BUIDL) has expanded to function on the Aptos, Arbitrum, Avalanche, Optimism, and Polygon blockchains, broadening entry to tokenized property. Backed by BNY Mellon, the fund invests in US Treasuries and liquid property, providing options like on-chain yield and real-time transfers. This multi-chain enlargement enhances alternatives for DAOs and digital asset companies.

Goldman Sachs spins out a blockchain platform

Goldman Sachs is spinning off its blockchain-based platform, GS DAP, right into a standalone entity inside the subsequent 12–18 months to modernize buying and selling and settlement for institutional purchasers. The platform will facilitate transactions involving conventional property like bonds and money, whereas increasing into personal digital markets and exploring tokenization tasks. Goldman’s $600M investments in Bitcoin ETFs and blockchain-backed merchandise underscore its strategic dedication to digital property, as institutional curiosity continues to soar.

Macroeconomic roundup

The Fed: No rush for charge cuts

Federal Reserve Chair Jerome Powell tempered market optimism on Thursday, stating there isn't a hurry to decrease charges.” Talking at a Dallas convention, Powell emphasised the Fed's potential to strategy charge selections cautiously because of the present financial power. His remarks dampened expectations for a December charge minimize, with odds dropping from 83% to 62%, according to CME FedWatch. Bitcoin slipped 3.2% to $88,000 following the speech, whereas conventional markets additionally dipped, with the Nasdaq closing 0.75% decrease.

Scorching in crypto

XRP’s three-year excessive

Ripple (XRP) futures open curiosity surged to a report $2B in worth over the weekend, coinciding with the most recent value leap. The rally pushed XRP above $1.20, marking an 87% weekly acquire and its highest value in three years. Analysts word that the rise in each open curiosity and value displays robust market participation, indicative of bullish momentum.

Merchants stay barely skewed towards brief positions, with 51% betting in opposition to additional good points. Nevertheless, the sharp rise in open curiosity suggests new cash coming into the market, additional amplifying the token's upward trajectory.

The week’s most attention-grabbing knowledge story

ETH’s path to restoration?

Ethereum spot ETFs have recorded their highest weekly volumes since their August launch, with over $1.63 billion in buying and selling final week—a 44% enhance from the prior week. This spike follows a interval of stagnation, the place volumes averaged simply $168 million per day from August to October. The current surge mirrors the buying and selling sample seen with Bitcoin ETFs, which skilled a quiet interval earlier than a dramatic enhance in volumes, adopted by a 35% rise in Bitcoin’s value. Following final week's spike, Ethereum noticed a 25% value enhance, marking its largest weekly acquire in six months.

The numbers

High 5 stats of the week

- 331,200 – MicroStrategy's Bitcoin holdings.

- $1.67 billion: Final week's inflows to BlackRock's iShares Bitcoin Belief (IBIT).

- 1.07 million – The quantity of BTC held at US-traded spot Bitcoin ETFs.

- $700 million – The quantity the state of Pennsylvania may spend money on Bitcoin.

- $180,000 – VanEck’s Matthew Sigel’s BTC value prediction for the subsequent yr.

Scorching subjects

Who doesn’t love Bitcoin exploration?!

Is it all about trading?

How major is that?

Dispatch is a weekly publication by Nexo, designed to help you navigate and take action in the evolving world of digital assets. To share your Dispatch suggestions and comments, email us at [email protected].