Cryptocurrency Prices by Coinlib

Dispatch #220: Vacation spot moon for Bitcoin?

On this patch of your weekly Dispatch:

- The largest candle but

- Solana’s star act

- Ethereum’s unknowns

Market forged

Bitcoin’s subsequent believable transfer?

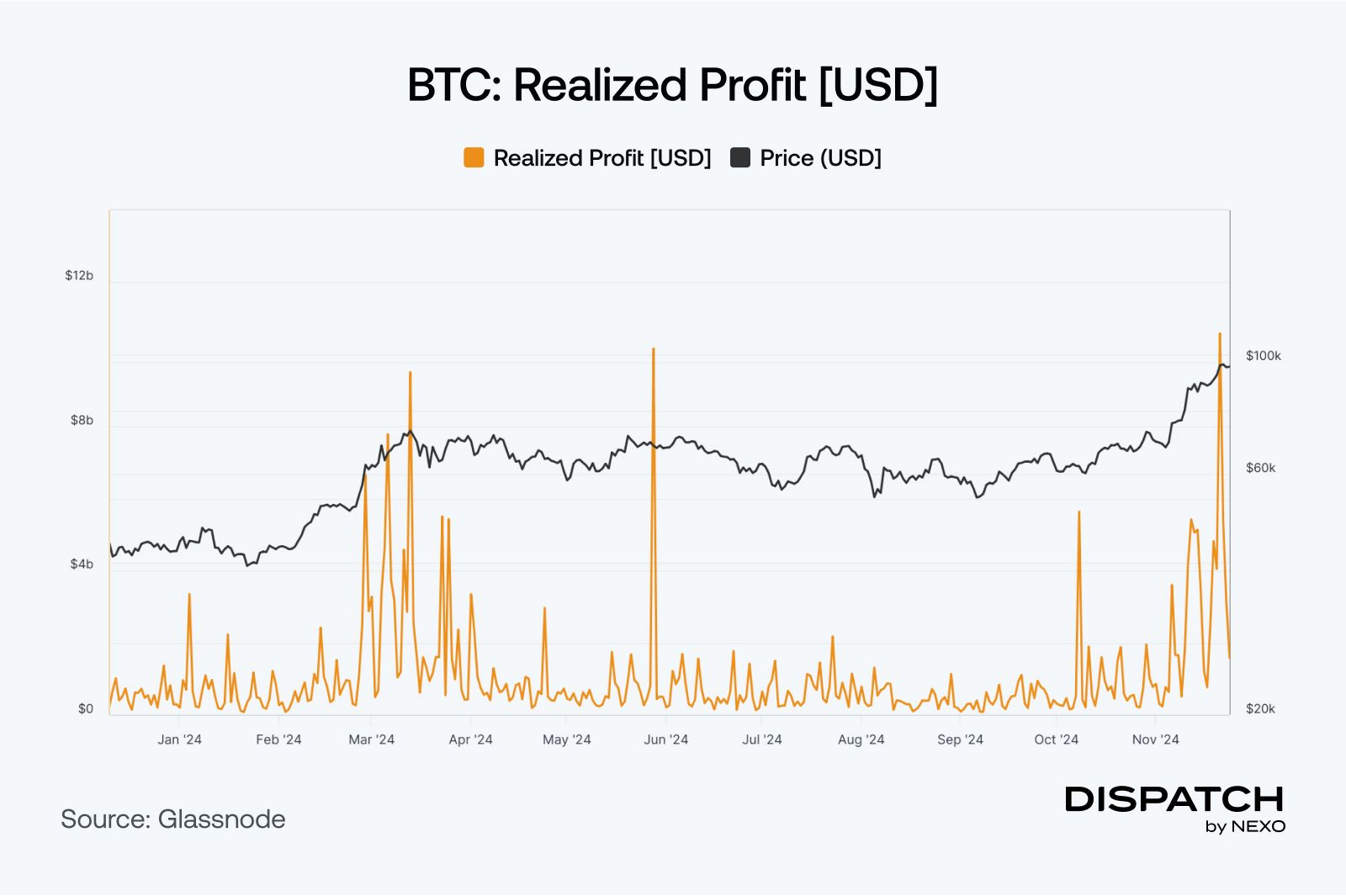

Bitcoin’s momentum stays sturdy, spurred by a $5.4 billion shopping for spree as MicroStrategy added 55,000 BTC to its holdings. Oscillators stay firmly within the overbought zone regardless of latest liquidity shifts towards altcoins. In November, Bitcoin made historical past with its largest-ever month-to-month candle, a 40.8% value surge, whereas 24-hour buying and selling volumes hit highs of $70–$80 billion, propelling it nearer to the long-anticipated $100,000 milestone.. It was all predicted by Nexo Co-Founder Antoni Trenchev. The $100,000 mark is predicted to behave as important resistance, however historic tendencies recommend the rally may not finish there. From its final backside, BTC has already gained 6x, and if previous bullish cycles repeat, a transfer towards $150K–$200K is a query of when not if.

Whereas long-term sentiment stays bullish, short-term corrections may happen, with key help across the $90K–$92K zone. With Bitcoin posting record-breaking beneficial properties, merchants stay optimistic about its trajectory.

The massive thought

Crypto’s mainstream ambitions

If cash talks, then crypto is screaming. Digital asset funding merchandise simply smashed weekly influx data with a staggering $3.13 billion, catapulting year-to-date totals to $37 billion. For perspective, that’s greater than 100 occasions what U.S. Gold ETFs managed of their first yr. Bitcoin stole the present with $3 billion in inflows, proving as soon as once more it’s the star of the digital revolution. In the meantime, Solana outshone Ethereum final week, pulling in $16 million in comparison with Ethereum’s modest $2.8 million. The worldwide urge for food is uneven, although. Whereas the U.S. added $3.2 billion, Germany, Sweden, and Switzerland cashed out, citing profit-taking alternatives. Elsewhere, bullish inflows got here from Australia, Canada, and Hong Kong, exhibiting that crypto fever respects no borders.

Is that this simply one other hype cycle? Hardly. With altcoins becoming a member of the inflows, it’s clear crypto is now not area of interest, it’s knocking on the door of mainstream finance. Want on-chain proof? The stablecoin market has reached a brand new document with a $190.4 billion market cap. Ethena’s $ENA currently registers the very best development.

When future historians write about monetary evolution, will 2024 be the yr they mark as crypto’s breakout second? At Nexo, we're doing our half with the launch of Personal USD Accounts, providing seamless, direct USD financial institution transfers in shoppers’ names, alongside EUR and GBP choices.

Ethereum

Capital rotation or inflation?

Ethereum‘s rally to $3,500 is difficult to disregard, however there’s extra to this value spike than meets the attention. Optimistic funding charges and rising leverage present merchants are betting on additional beneficial properties, whereas on-chain exercise has surged 85% in November, signaling rising market confidence.

However there’s a catch. Ethereum’s inflation charge has hit 0.35% (decrease than Bitcoin’s), with over 350,000 ETH added to produce since March. With decreased payment burns and staked Ether at historical highs, there's added stress on the worth, making this surge a possible setup for each breakout and volatility.

Solana

SOL, congrats on the all-time excessive!

Solana (SOL) has hit a brand new all-time excessive above $260, up 386% over the previous yr. Its market cap has additionally jumped by 50% to just about $120 billion right now. This surge is fueled by sturdy DEX exercise, with Solana’s month-to-month commerce quantity topping $109 billion—practically double Ethereum's—pushed by low charges and the memecoin growth, according to media reports. Hypothesis round Solana ETFs can also be heating up, with Bitwise and VanEck submitting plans to launch funds. Analysts predict it may attain $500-$700 by 2025 if ETFs achieve approval.

TradFi tendencies

Rediscovering Bitcoin-backed loans

Cantor Fitzgerald, a key banking associate of Tether which holds most of Tether’s $134 billion of reserves, primarily in US Treasury payments, has reportedly acquired a 5% stake within the stablecoin issuer for $600 million. The deal may imply Tether will obtain extra help as Cantor Fitzgerald’s CEO Howard Lutnick was chosen as United States President-elect Donald Trump’s secretary of commerce however it'll additionally imply extra public scrutiny. Lutnick has publicly emphasised the essential function {that a} US dollar-backed stablecoin can play for folks in high-inflation nations, together with Argentina, Turkey, and Venezuela.

Macroeconomic roundup

Sizing the economic system

The highlight is again on inflation and rates of interest as markets put together for a holiday-shortened week. Key occasions embrace:

- PCE Inflation Information (Wednesday): Economists anticipate a modest rise of 0.2% MoM and a pair of.3% YoY, with core inflation forecasted at 0.3% MoM and a pair of.8% YoY. A warmer-than-expected print may dim hopes for a December charge minimize.

- FOMC Assembly Minutes (Wednesday): Buyers will analyze the Fed’s dedication to easing charges amid sticky inflation. Present market odds for a December minimize sit at 60%, down from 70% a month in the past.

Scorching in crypto

SUI subsequent on the principle stage?

Sui (SUI) has skyrocketed over 80% in November, buying and selling round $3.40 because it rides a wave of rising adoption and exercise. Day by day lively addresses surged 140%, boosting its market cap to $9.9 billion. Builders reward Sui’s easy-to-use Transfer programming language and excessive throughput, making it a favourite for purposes like gaming. The ecosystem’s development can also be attracting conventional finance, with Franklin Templeton partnering to discover blockchain innovation on Sui.

The week’s most attention-grabbing information story

The bullishness in ETH

Ethereum is driving a bullish wave, with futures open curiosity hitting a document $20.8 billion for a 12% surge reflecting the rising hypothesis amongst merchants. Optimistic funding charges and a document leverage ratio level to sturdy long-position dominance, signaling optimism for value development, highlight CryptoQuant analysts. The message is evident: Ethereum isn’t simply holding its floor—it’s cementing its standing as a cornerstone of the crypto market. With Bitcoin not too long ago posting document highs and open curiosity figures, may Ethereum be poised to observe go well with?

The numbers

Prime 5 stats of the week

$3.4 Trillion – Crypto market cap hits a document excessive.

0.35% – Ethereum’s inflation charge, with provide at 120.4M ETH.

1,111 Days – Solana’s wait between first and second all-time highs.

$107.49 Billion – Complete web property in U.S. spot Bitcoin ETFs.

170 Volcanoes – President Bukele suggests harnessing them for Bitcoin mining in El Salvador.

Scorching subjects

In the minds of altcoin bulls.

Let’s see if the trend continues!

Beware the leverage.

Dispatch is a weekly publication by Nexo, designed to help you navigate and take action in the evolving world of digital assets. To share your Dispatch suggestions and comments, email us at [email protected].