Cryptocurrency Prices by Coinlib

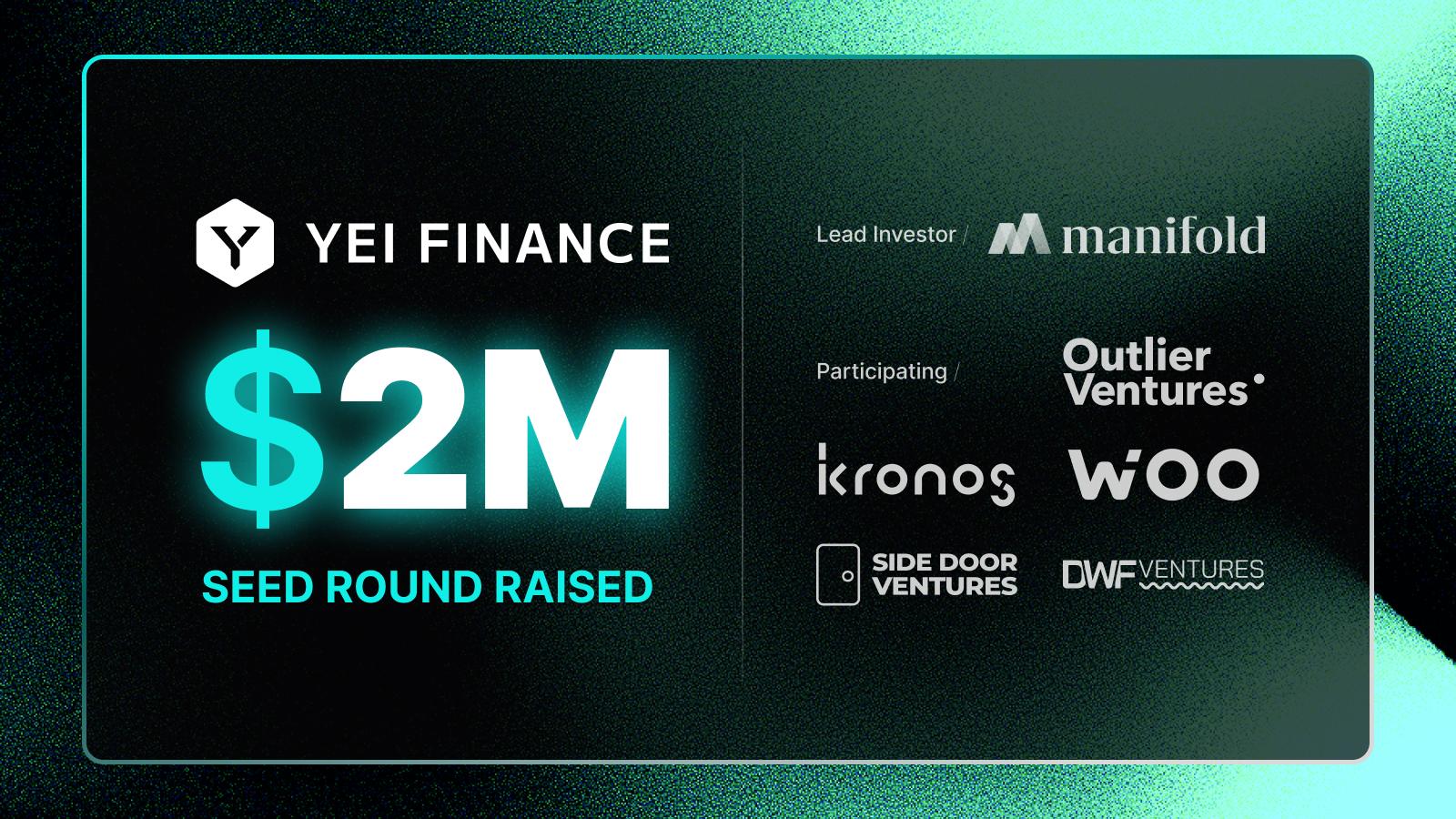

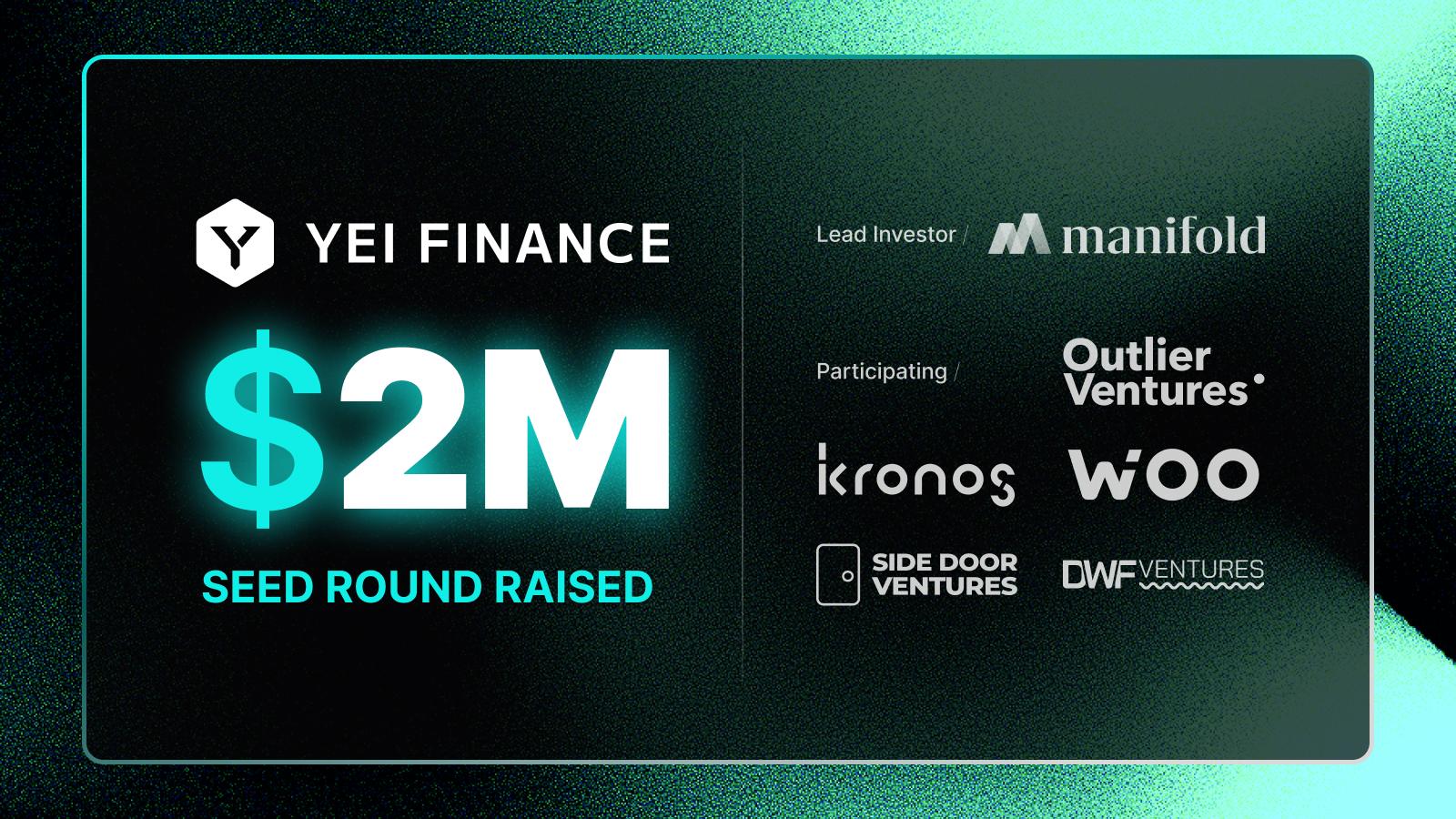

Yei Finance Secures $2M Seed Funding to Advance Omnichain Modular Lending

United States, New York, December sixteenth, 2024, Chainwire

Backed by Manifold and different notable companions, Yei Finance goals to redefine DeFi lending with cross-chain improvements.

A Notable Milestone on the Path to V2

Yei Finance, a rising platform in decentralized lending, has introduced the profitable shut of its $2M seed funding spherical. Led by Manifold, with extra participation from DWF Ventures, Kronos Analysis, Outlier Ventures, Facet Door Ventures, and WOO, together with distinguished business figures like Matt Dobel (@mattdobel) and 0xZHUANG.

Yei Finance has additionally prolonged a particular due to the Sei Basis for his or her help. This funding will help the event of V2, a big step in constructing an omnichannel cash market that addresses inefficiencies within the present DeFi ecosystem.

What’s Subsequent: The Imaginative and prescient for V2

Yei Finance V2 introduces modern options aimed toward enhancing consumer expertise, scalability, and capital effectivity throughout blockchains. This subsequent section is outlined by a number of initiatives.

Modular Lending Markets

Yei Finance is introducing remoted lending swimming pools designed for particular belongings, danger profiles, and techniques. These swimming pools will help cross-chain borrowing and lending whereas yield-bearing tokens like yUSDC will work to reinforce capital effectivity. This method unlocks new liquidity alternatives, giving customers flexibility and safety.

Yei App Chain with Hub-and-Spoke Structure

On the coronary heart of Yei Finance’s imaginative and prescient is a devoted app chain that acts because the protocol’s core. This structure features a centralized credit score layer for managing collateral, debt, and rates of interest, in addition to cross-chain governance and incentivized mechanisms. This ensures scalable and safe cross-chain operations, setting a powerful basis for development.

Omnichain Cash Market

Yei Finance is making a unified liquidity pool that simplifies borrowing and lending throughout blockchains. By integrating Circle’s CCTP for native USDC transfers, the protocol eliminates reliance on wrapped tokens or third-party bridges. This streamlines capital utilization and reduces liquidity fragmentation, offering a seamless consumer expertise.

Strengthening the DeFi Panorama

Yei Finance is growing essential improvements like good routing for optimum cross-chain lending and a strong liquidation framework to mitigate systemic dangers. These options place Yei Finance as a distinguished protocol within the omnichain lending area.

“This funding permits us to understand our imaginative and prescient of making a very omnichain cash market that eliminates inefficiencies and drives DeFi adoption,” stated Austin, Co-Founding father of Yei Finance. “With V2, we’re unlocking the complete potential of decentralized finance by way of seamless interoperability and user-centric design.”

Wanting Forward

With the $2M raised on this seed spherical, Yei Finance presents:

A Recent, Consumer-Pleasant Design: They're revamping the platform’s interface to make it extra intuitive and simpler to navigate. Monitoring customers' portfolio and interesting with their options might be less complicated and extra seamless than ever.Versatile Modular Lending: Their modular lending markets will permit customers to entry remoted lending swimming pools tailor-made to particular belongings and techniques. This provides higher flexibility, safety, and customised choices for all.Omnichain Cash Market: They're constructing a unified liquidity pool to allow easy borrowing and lending throughout a number of blockchains. This can eradicate inefficiencies, scale back fragmentation, and enhance capital utilization.

This marks the start for Yei Finance because it continues to broaden and develop. Extra updates are on the horizon. $YEI.

About Yei Finance

Yei Finance is a significant DeFi protocol on the Sei community, boasting the biggest cash market within the ecosystem with a TVL of $130 million since launching in June 2024.

With its Cross-Chain Bridge, powered by Stargate and Circle’s CCTP, Yei Finance allows seamless and safe asset transfers throughout main blockchains like Ethereum, Avalanche, and Arbitrum. This innovation reduces transaction prices, improves capital effectivity, and eliminates liquidity fragmentation, setting a brand new customary for interoperability.

As Yei Finance builds towards V2, it continues to reshape decentralized lending with scalable, omnichain options.

They're simply getting began on their mission to remodel decentralized lending and create seamless monetary options throughout blockchains. Customers can keep linked and be a part of their journey:

Web site:

Web site | Twitter | Discord | Medium | GitBookContactMarketing ManagerCarrieYei Financecarrie@yei.finance

Disclaimer: It is a sponsored press launch and is for informational functions solely. It doesn't mirror the views of Crypto Day by day, neither is it meant for use as authorized, tax, funding, or monetary recommendation.