Cryptocurrency Prices by Coinlib

Unlock new prospects in Futures buying and selling with our enhanced Margin Danger formulation

Within the quickly altering world of crypto, staying on the forefront calls for relentless innovation. We're dedicated to repeatedly refining our choices to ship distinctive worth to merchants constantly.

Constructing on this dedication, thrilling developments are on the horizon with a major improve to our Futures buying and selling product. Beginning March 26, 2025, we are introducing an enhanced methodology for calculating Margin Danger, paving the way in which for a lot of new alternatives.

This variation permits for: larger most Place Values for BTC and ETH, new leverage choices as much as 100x, and prolonged place life. The enhancements are designed to help merchants by granting them the flexibleness they should excel in a aggressive market.

Beneath is an summary of the enhancements and particular data for managing open positions.

Elevated most leverage and place values

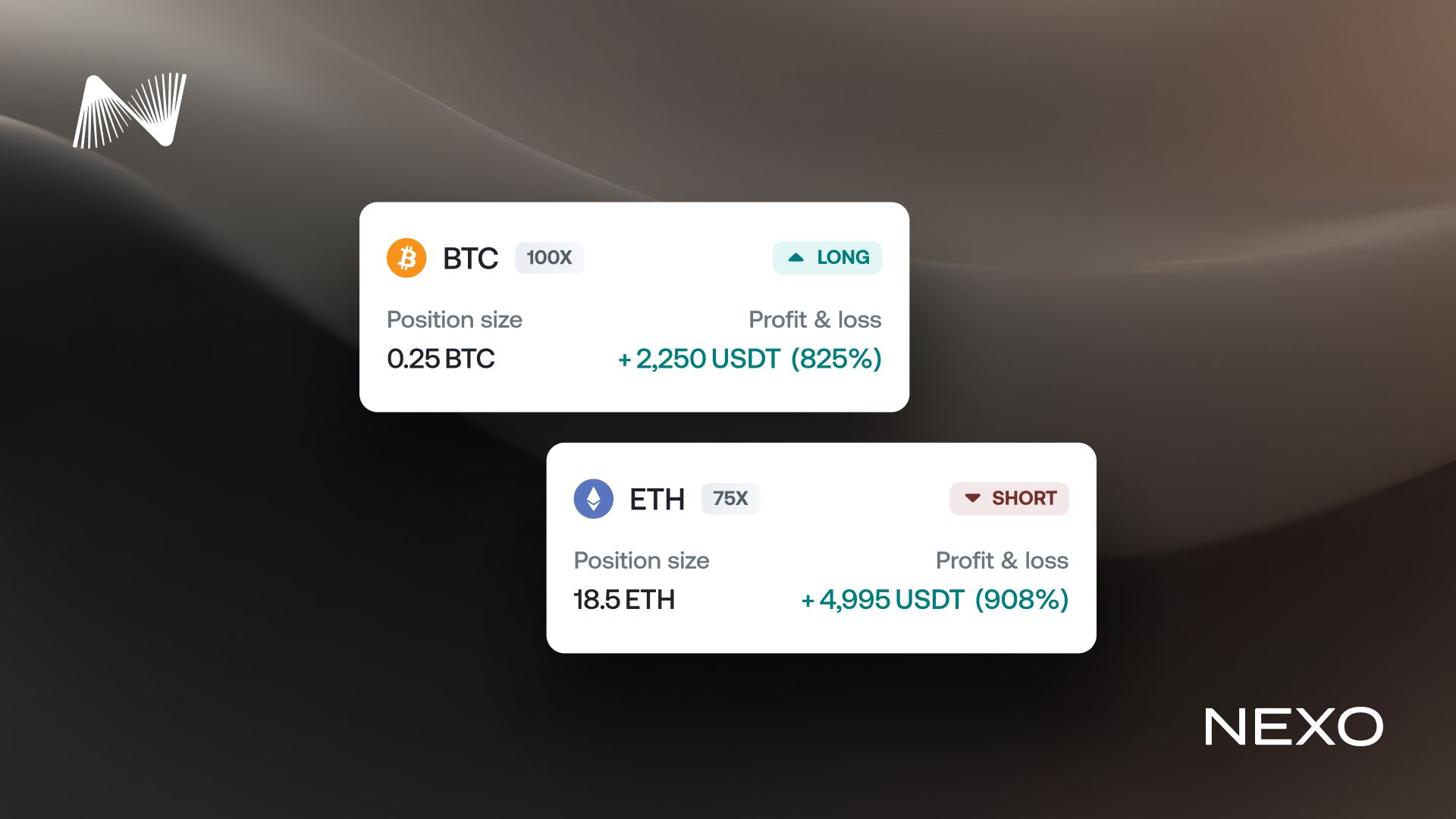

Beginning March 26, 2025, we're including two further leverage ranges (75x and 100x) for the BTC and ETH perpetual contracts, denominated and settled in USDT.

This improve in leverage opens the door for extra substantial positions with much less collateral, permitting you to amplify the buying energy of your digital belongings extra successfully. Beneath, we offer an instance to display the influence of this elevated leverage.

Instance: Presently, the utmost leverage is 50x, which means that if in case you have 200 USDT in collateral, you may open a BTCUSDT place valued at 10,000 USDT. With the upcoming modifications, leverage will improve to 100x, permitting you to boost the worth of your place to twenty,000 USDT.

Word: Whereas larger leverage settings can considerably amplify the worth of your positions, additionally they improve the potential for each profits and losses. For risk-free apply, we provide a simulated trading environment on the Nexo App, permitting you to hone your buying and selling expertise with out monetary danger.

We're additionally elevating the utmost Place Worth for BTCUSDT and ETHUSDT on March 26, 2025, to align with the brand new leverage capabilities. Beneath is a breakdown.

Tip: The Place Worth is evaluated by multiplying the leverage by the worth of your collateral within the Futures Pockets. For instance, to open a Place Worth value 600,000 USDT with 10x leverage, you must have 60,000 USDT collateral.

Prolonged place life

Beginning March 26, 2025, we're elevating the Margin Danger threshold required to set off liquidation from 83.33% to 100.00%. This adjustment implies that positions will stay energetic longer, permitting you to navigate market fluctuations extra comfortably and capitalize on potential alternatives.

As illustrated above, the brand new Margin Danger calculation will undertake an exponential development, rising slowly at first and accelerating after reaching a particular threshold depending on elements such because the variety of energetic positions and the Unrealized P&L.

In gentle of those modifications, we advise you to commerce responsibly, notably when using larger leverage settings.

What's Margin Danger?

Recall that Margin Danger is a proportion reflecting the connection between the worth of the collateral in your Futures Pockets and your open futures positions, each measured in USDT. A decrease Margin Danger signifies a more healthy state in your energetic positions.

Once you open a place, you will notice an preliminary Margin Danger charge (e.g., 15.30%). This charge will later improve in case your positions generate a detrimental Unrealized P&L and reduce in case your positions are worthwhile.

All energetic positions are robotically closed when the Margin Danger liquidation threshold is reached or exceeded. This emphasizes the significance of monitoring your positions, particularly when utilizing larger leverage, to successfully navigate the unstable crypto market.

Diving into the brand new Margin Danger calculations

Efficient March 26, 2025, as a part of the brand new Margin Danger formulation, we're introducing a brand new parameter often known as Upkeep Margin, which shall be used together with the Fairness in your Futures Pockets to calculate the Margin Danger.

Formulation: Margin Danger = Upkeep Margin / Fairness

Key issues:

- The Upkeep Margin represents the minimal Fairness you could preserve in your Futures Pockets to maintain your place open and keep away from liquidation. This important worth shall be displayed on the platform interface, as proven above.

- However, Fairness is calculated because the USDT in your Futures Pockets plus the Unrealized income or losses on any open positions. In case you have 100,000 USDT within the Futures Pockets and your open place has generated 30,000 USDT revenue, then the Fairness shall be 130,000 USDT.

Instance: As an instance you will have an open Lengthy place for 1 BTCUSDT. Your complete fairness stands at 20,000 USDT, whereas the system has assessed the required Upkeep Margin to be 2,000 USDT. On this state of affairs, the calculation of your Margin Danger can be:

- Step 1: Margin Danger = Upkeep Margin / Fairness

- Step 2: Margin Danger = 2,000 / 20,000

- Outcome: Margin Danger = 10.00%

- Understanding and monitoring your Upkeep Margin and Fairness may help you higher handle your publicity to the market.

- All energetic positions are factored into the Upkeep Margin, which shall be displayed on the platform interface.

New Margin Name thresholds

We're additionally introducing new Margin Name thresholds on March 26, 2025.

Preliminary notification: In case your energetic positions start to build up detrimental Unrealized PnL, pushing your Margin Danger to 65%, we could ship a push notification. This alert prompts you to both improve the collateral in your Futures Pockets or shut some positions to handle danger.

Word: These notifications are for informational functions solely. It's the shopper's duty to watch and handle their Futures Pockets steadiness and take obligatory actions.

How will the modifications influence energetic positions?

The upcoming enhancements scheduled for March 26, 2025, may also have an effect on positions opened earlier than this date. Right here’s how these modifications will unfold:

Recalculation of Margin Danger: The Margin Danger for present positions shall be recalculated utilizing the brand new formulation. The precise change in Margin Danger proportion will rely on varied elements, together with the variety of energetic positions you will have and their Unrealized PnL.

Modified liquidation threshold: Liquidations will now be triggered at a 100.00% Margin Danger (beforehand 83.33%). This adjustment implies that the liquidation value for every place shall be additional away from its present market value.

Show of Upkeep Margin: The platform interface will present the entire Upkeep Margin for all energetic positions. This worth consists of the sum of the person Upkeep Margin values of every place, permitting you to higher handle your buying and selling dangers.

Elevated leverage and place values: The enhancements embrace elevated most leverage and Place Values. Relying on the precise contract you're buying and selling, you'll have the choice to both improve your place dimension or leverage, providing larger flexibility in the way you commerce.

These modifications help you modify the parameters of your energetic positions according to your buying and selling and danger administration methods as soon as the updates are applied.

Buying and selling Futures on the Nexo platform is unavailable for shoppers residing within the USA, Canada, Australia, the UK, and a few nations within the EEA. The content material and examples offered on this article are for informational and academic functions solely and embrace no warranties. They shouldn't be interpreted as monetary recommendation or a advice to purchase particular belongings. Please be aware that digital belongings are unstable, and the worth of your funding can fluctuate primarily based on market circumstances. We advise you to commerce responsibly. Though we could take affordable steps to inform you of any modifications within the Margin Danger, Nexo reserves the appropriate to liquidate your collateral or shut your Futures Contracts with out prior discover, particularly when market circumstances require instant motion.