Cryptocurrency Prices by Coinlib

Waves within the crypto ocean

Market forged

The basics earlier than Bitcoin

Bitcoin’s rally gained momentum following Trump’s US strategic reserve announcement on Sunday, briefly pushing BTC larger. Whereas it has since pulled again towards the decrease finish of final week’s vary, the most recent weekly candle on the BTC/USDT chart suggests potential for a bullish continuation, with additional affirmation awaited. All eyes are set on Friday’s Fed chair Powell’s speech.

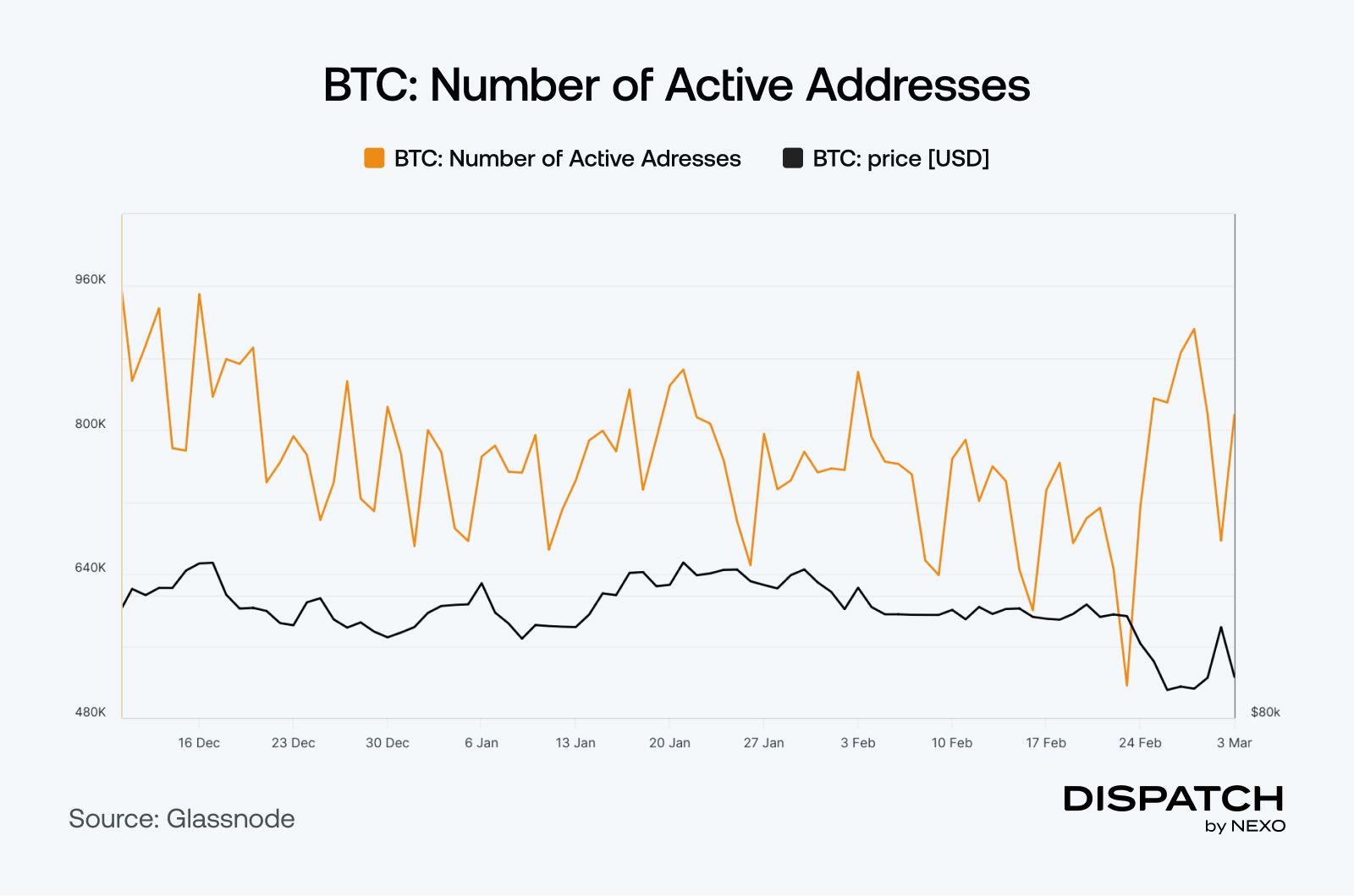

With technical indicators largely impartial, Bitcoin’s path this week will possible be pushed by broader market sentiment and fundamental news. On the upside, a weekly shut above $94,000 would sign robust long-term bullish sentiment and will push BTC towards a brand new all-time excessive. Conversely, with out supportive information, Bitcoin may slide again to the current low of $78,000 – and even check help close to $72,500.U.S. shares have turned decrease amid looming tariff considerations, and the transient increase from Trump's crypto reserve announcement has at present diminished. In the meantime, spot bitcoin ETFs reversed an eight-day outflow streak, pulling in $94.3 million on Feb. 28 after shedding over $3.2 billion throughout the downturn, seen within the chart under.

The massive concept

The Trump impact(s) on crypto markets

It’s been a busy week of worth motion and market re-adjustment. Volatility, like a ship in open seas, was buoyed by Donald Trump’s tariff-driven powerful discuss, solely to pivot when he unveiled a daring new transfer – a strategic crypto reserve. As Nexo Co-Founder Antoni Trenchev defined in a CNBC interview, the Trump administration cares deeply about crypto. Throughout such intervals of recalibration, entry to liquidity – whether or not by way of lending, borrowing, or strategic portfolio administration—turns into notably related. Here's what occurred:

Trump’s Crypto Reserve announcement

Markets sprang into motion over the weekend when Trump introduced plans for a “Crypto Strategic Reserve” that includes Bitcoin, Ethereum, XRP, Solana, and Cardano – with BTC and ETH at its core. This transfer goals to spice up U.S. monetary clout, reshape international regulatory debates, and improve liquidity. Over a dozen states are already exploring crypto reserve methods, echoing the nation’s rising digital asset integration.

Regulatory developments within the U.S.

Legislative momentum is selecting up, with U.S. policymakers forging a extra structured regulatory path for digital belongings. The launch of a bipartisan Congressional Crypto Caucus, together with debates over stablecoin frameworks and market construction reforms, alerts a powerful push towards cementing U.S. management in fintech.

Regardless of an preliminary surge, the affect of those bulletins remains to be in flux – Bitcoin, for instance, spiked above $94,000 earlier than briefly pulling again under $80,000. But it’s not simply crypto markets feeling unsure — traditional indices slumped too. The S&P 500 fell 1.76% on Monday to five,849.72, its worst day since December, whereas the Dow and Nasdaq additionally tumbled amid looming tariffs. Dispatch editors spoke about these actions with main media retailers – from the market bottom and the market reversal to the emergence of the Texas Strategic Bitcoin reserve. Comparable episodes spotlight the significance of efficient liquidity administration—notably for buyers seeking to regulate publicity with out liquidating belongings. In fast-moving markets, being able to borrow in opposition to holdings or deploy capital effectively generally is a key benefit, whether or not to hedge dangers or capitalize on market swings.

As main cryptocurrencies strategy crucial ranges, buyers are more and more taking a look at methods that protect their core positions whereas sustaining flexibility. The flexibility to unlock liquidity with out promoting belongings is turning into a necessary software for navigating a dynamic monetary panorama.

Stablecoins

A stablecoin star within the making?

You merely know that stablecoins are within the highlight when Financial institution of America CEO Brian Moynihan expresses optimism about dollar-backed stablecoins. Till now, BoA hasn’t been capable of make the most of stablecoins, but the financial institution is able to “go into that enterprise” with its “Financial institution of America coin.”

With the stablecoin market already valued at over $230 billion, regulatory progress may unlock even higher potential. Furthermore, Ripple’s launch of the RLUSD stablecoin, after NYDFS approval, additional highlights the momentum on this house. Crypto analyst ZachXBT identified that the circulation of stablecoins is an important metric for assessing blockchain legitimacy, whereas Cardano’s Frederik Gregaard famous that networks are poised to draw extra main issuers as their capabilities increase.

XRP

It’s easy distribution

XRP dazzled the crypto group with a 34% rally on March 2 after information of its potential inclusion in a U.S. strategic reserve. Nonetheless, it retraced most of its positive aspects, however what may very well be the reason? A pure distribution part, it appears, in accordance with CryptoQuant – a interval the place token holdings are realigned as a part of market recalibration somewhat than a sell-off. “This is among the most pronounced distribution phases we have seen,” famous founder Ki-Younger Ju, underscoring that the present market exercise is about strategic rebalancing.

Macroeconomic spherical up

It’s all in regards to the Fed discuss

Macroeconomics have strengthened their grip on crypto belongings. Here's what to look at for this week:

- ADP Employment Report (Wed): Anticipated at 143,000. A robust report could increase the USD and stress BTC; a weak print may gas Fed cuts and raise BTC.

- Preliminary Jobless Claims (Thu): Forecast round 243,000. Decrease claims sign energy; larger claims may push buyers towards safe-haven BTC.

- US Unemployment (Fri): Forecast 160,000 new jobs and a 4.1% charge. Sturdy knowledge could dampen charge reduce hopes; disappointing figures may help BTC.

- Jerome Powell’s Speech (Fri): All eyes on Powell for financial coverage clues. A dovish tone may weaken the greenback and increase urge for food for BTC.

The week’s most attention-grabbing knowledge story

BTC spikes in handle exercise

Bitcoin’s lively addresses have surged to over 912,300 on the finish of February to mark a three-month excessive which will sign a reversal second. Glassnode knowledge reveals this degree hasn’t been seen since December 16, 2024, hinting that promoting may be over. Crypto intelligence platform IntoTheBlock additionally shares the opinion on X.

The numbers

High 5 stats of the week

- 440 million XRP – XRP whales elevated their holdings by almost $1 billion, following Monday's market decline.

- $6.8 million –The revenue on one Bitcoin lengthy place simply earlier than Trump’s announcement.

- $500,000 – Commonplace Chartered’s Geoff Kendrick revisits Bitcoin’s goal amid market dips.

- 17.5% – Bitcoin’s February stoop is the largest loss since 2022.

- $150,000 – The most recent year-end BTC prediction by Nexo’s Antoni Trenchev.

Sizzling subjects

A prime example of buying the dip?

Strength in unity – a solid strategy.

It’s not only crypto that’s pulling back, you know.

Dispatch is a weekly publication by Nexo, designed to help you navigate and take action in the evolving world of digital assets. To share your Dispatch suggestions and comments, email us at [email protected]