Cryptocurrency Prices by Coinlib

From programmable cash to the spine of tokenized finance

In July 2015, a brand new blockchain quietly launched with an audacious purpose: to develop into a “World Laptop.” Whereas Bitcoin established itself as digital gold—a safe, decentralized retailer of worth—Ethereum launched a complementary imaginative and prescient: a decentralized platform enabling functions to run with out intermediaries, servers, or downtime. It was not nearly cash. It was about rebuilding the web from the bottom up.

Ten years on, Ethereum has not simply survived the turbulent tides of tech cycles, regulatory uncertainty, and inner schisms – it has flourished. In the present day, Ethereum anchors an unlimited modular monetary stack, evokes cultural actions, and serves as public infrastructure for decentralized worth and identification. To know how Ethereum turned the beating coronary heart of Web3, we take a look at its defining pillars – accomplishments that replicate what it's and what it aspires to be.

Scaling the imaginative and prescient: Ethereum’s modular evolution

Ethereum's early success created its greatest rising ache: congestion. The 2017 CryptoKitties craze and the 2020 DeFi growth highlighted Ethereum’s myriad of use instances, but additionally limitations, with charges hovering and transaction velocity lagging. But slightly than abandoning its base layer, the Ethereum group embraced a layered future.

Layer 2 rollups now course of tens of thousands and thousands of transactions weekly. These off-chain scaling options batch and compress consumer exercise, settling it securely again on Ethereum. This structure preserves Ethereum’s decentralization whereas unlocking velocity, scale, and experimentation, fueling continued development.

Ethereum’s modular future is already right here. It now not tries to do all the pieces on Layer 1 – as a substitute, it anchors a complete ecosystem the place execution, knowledge availability, and functions function throughout a number of layers. It is a foundational shift, and it reaffirms Ethereum’s identification not as a single chain however as a settlement layer for the decentralized web.

Importantly, these Layer 2 networks will not be simply technical infrastructure – they're shaping consumer expertise, developer incentives, and even governance fashions. Every community usually comes with its personal native token, designed to incentivize utilization, safe the protocol, and fund future growth. Whereas Ethereum stays the widespread denominator, the variety of Layer 2 approaches – from optimistic to zero-knowledge rollups – implies that experimentation is going on in parallel at scale. This variety strengthens the ecosystem, even when it introduces new complexity.

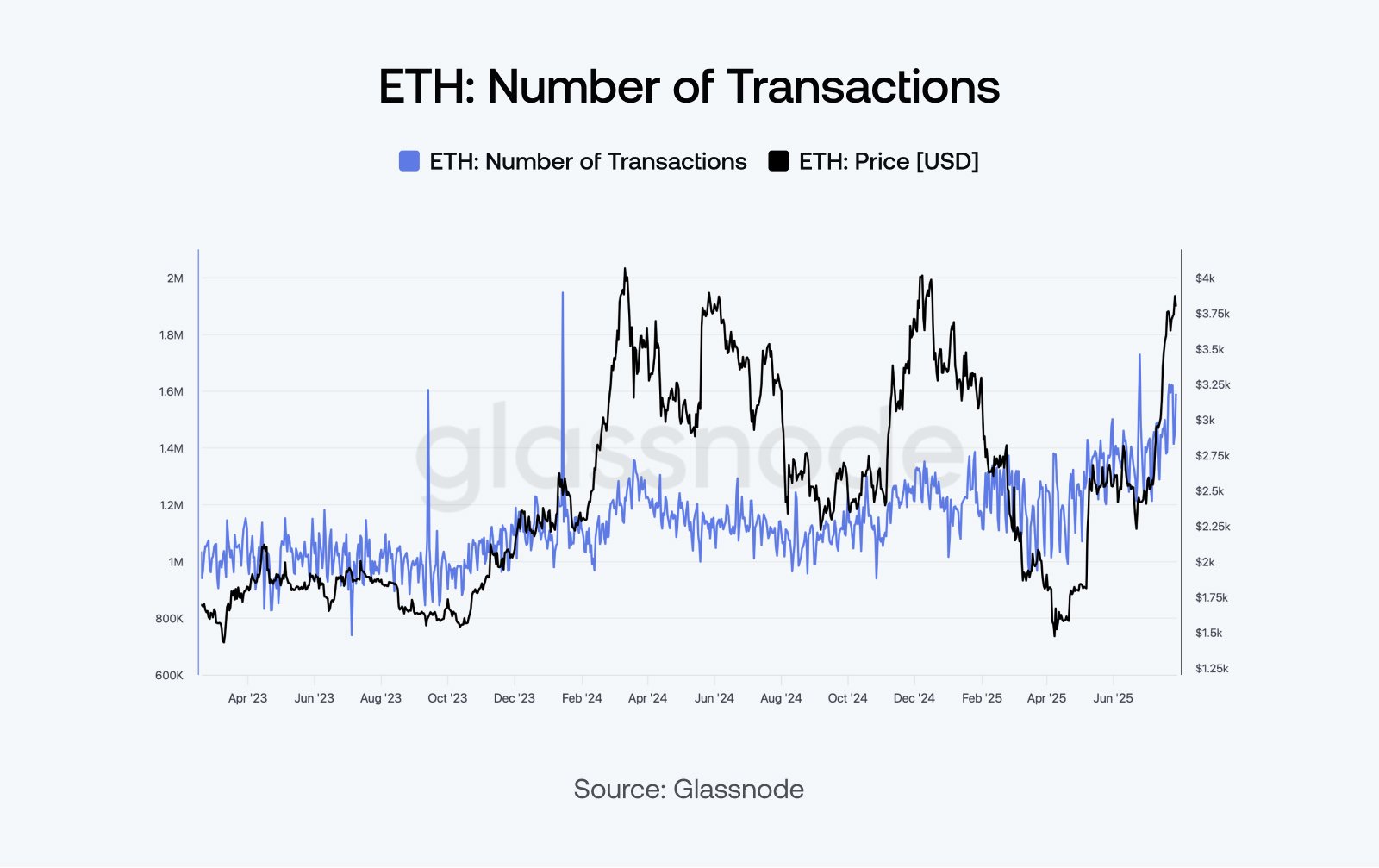

Whole Ethereum transactions, together with Layer 2 exercise, spotlight the protocol’s evolution right into a high-throughput settlement platform.

Reinvention by design: a blockchain that evolves

Ethereum’s capability for change is one in every of its most underappreciated traits, Ethereum being among the many few chains to embrace adaptation as a energy, not a flaw.

From the Ethereum Digital Machine (EVM) to Solidity, Ethereum gave builders programmable cash. However it didn’t cease there. The transition from proof-of-work to proof-of-stake in 2022 – often called The Merge – lowered Ethereum’s power use by over 99.9%, making it essentially the most vital sustainability shift in blockchain historical past.

Different upgrades adopted: EIP-1559 launched charge burns and added deflationary stress. Proto-danksharding (EIP-4844) lowered rollup prices. And Ethereum’s long-range roadmap – the Surge, Scourge, Verge, Purge, and Splurge – alerts its intent to maintain refining scalability, censorship resistance, and UX.

Ethereum doesn’t harden – it iterates. Its willingness to rewrite itself whereas staying dwell is a defining achievement.

Ethereum’s post-Merge financial coverage has stabilized provide development, aligning incentives for long-term community well being.

Actual-world property and on-chain finance

Tokenization was as soon as a buzzword. Now it’s actuality – and Ethereum is the place it’s occurring. From U.S. Treasury payments and cash market funds to non-public credit score and actual property, Ethereum has quietly develop into the default platform for real-world asset tokenization.

Main monetary establishments have moved from pilots to dwell deployments. Regulatory readability in jurisdictions just like the EU and UAE has accelerated the pattern. As of mid-2025, Ethereum and its scaling layers host round 60% of the tokenized asset market.

This shift displays greater than technical functionality. Ethereum gives transparency, programmability, and international accessibility. It's turning into the belief layer the place conventional finance meets open infrastructure.

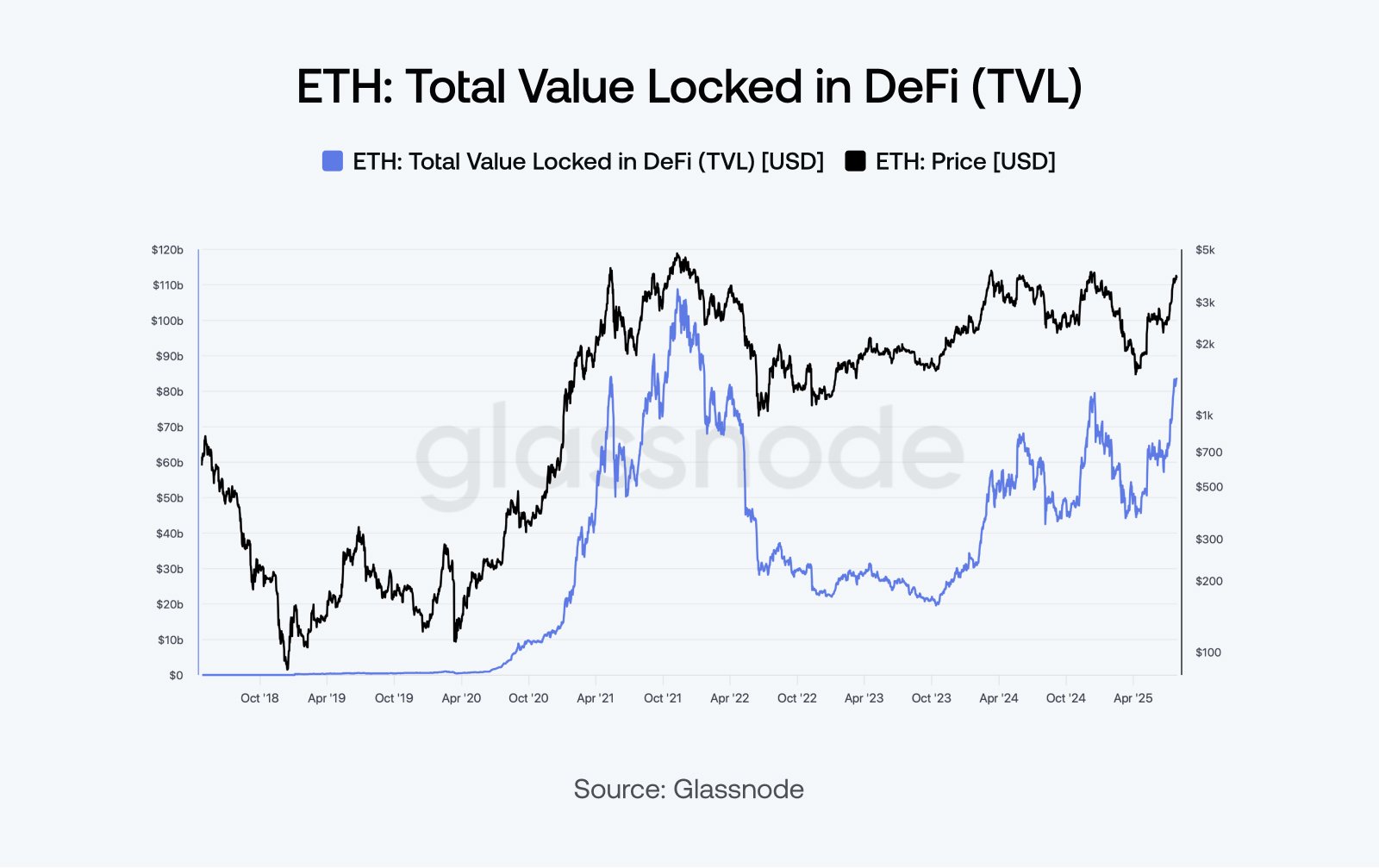

Ethereum continues to anchor DeFi’s capital base, with billions in real-world and native property locked throughout its ecosystem.

The liquidity layer: stablecoins on Ethereum

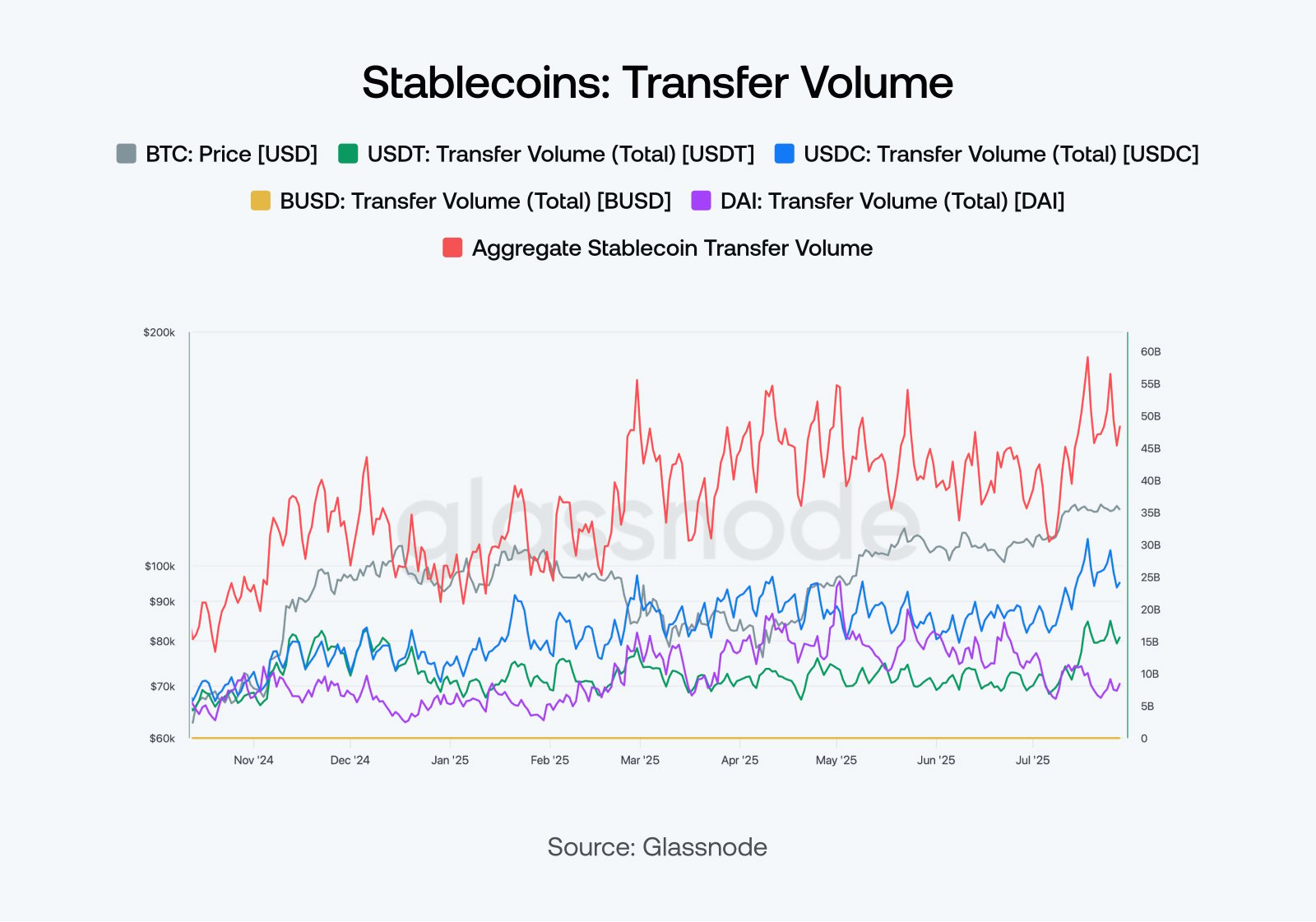

If Ethereum is a decentralized economic system, stablecoins are its money. Ethereum continues to host the vast majority of international stablecoin quantity, enabling all the pieces from cross-border funds to on-chain financial savings.

Stablecoins are built-in throughout DeFi protocols, used as base pairs for decentralized exchanges, and underpin on-chain credit score markets. They’re not solely important to crypto-native use instances – in addition they serve individuals in inflationary economies, enabling entry to dollar-denominated property with out financial institution accounts.

Ethereum’s function because the spine of digital greenback liquidity isn't any accident. Its infrastructure is safe, composable, and battle-tested.

Ethereum constantly handles the vast majority of international stablecoin switch quantity, anchoring its function as crypto’s liquidity layer.

The tradition layer: identification, creativity, and web3 expression

Ethereum is greater than finance – it’s the place code meets tradition. The rise of NFTs in 2021 turned Ethereum into the canvas of the web. Artists, musicians, and creators used the blockchain to promote, license, and remix digital work in methods by no means earlier than attainable.

ENS names turned moveable identities. DAOs advanced from governance instruments to digital cooperatives. Wallets stopped being mere key vaults – they turned your social passport, your on-chain resume.

This isn’t a fringe motion. Ethereum helps outline what digital identification, group, and possession imply within the age of Web3.

Ethereum vs. Bitcoin: two philosophies, one ecosystem

Bitcoin is sound cash. Ethereum is programmable infrastructure. Each have benefit, and each are higher understood in distinction.

Ethereum’s flexibility permits it to combine with monetary programs, energy complicated apps, and adapt to consumer wants. Bitcoin’s simplicity ensures its safety and readability of goal. Whereas Bitcoin stays steadfast, Ethereum embraces change.

Collectively, they’ve formed how we take into consideration worth, management, and code. However Ethereum’s ambition – to develop into the settlement layer for all the pieces – makes it a essentially completely different form of venture.

Public good infrastructure: Ethereum’s governance and ethos

In contrast to a standard tech firm, Ethereum is stewarded by its group. The Ethereum Basis, Gitcoin, and Protocol Guild help growth by grants, retroactive funding, and collective coordination.

The community’s continued success hinges on 4 unresolved challenges: consumer expertise, scalability, decentralization, and privateness. Every is being addressed – from account abstraction and rollups to zero-knowledge tech and funding experiments. However Ethereum’s energy is that it doesn’t faux the job is completed.

As a substitute, it makes that unfinished work public – and invitations others to assist.

Ethereum’s second decade begins

Ethereum has gone from an thought in a whitepaper to a settlement layer for billions in worth, tradition, and group. It launched sensible contracts to the world, powered a decentralized monetary system, and created the instruments for on-line identification and expression.

It did all this with out a CEO, with out a centralized roadmap, and with out giving up on its founding ideas.

If the final decade was about experimentation, the subsequent is about integration throughout finance, society, and even AI. Ethereum might not dominate each area of interest. However like TCP/IP or Linux, it might develop into important infrastructure for the age of worth.

The World Laptop is now not theoretical. It’s operational – and it is simply getting began.

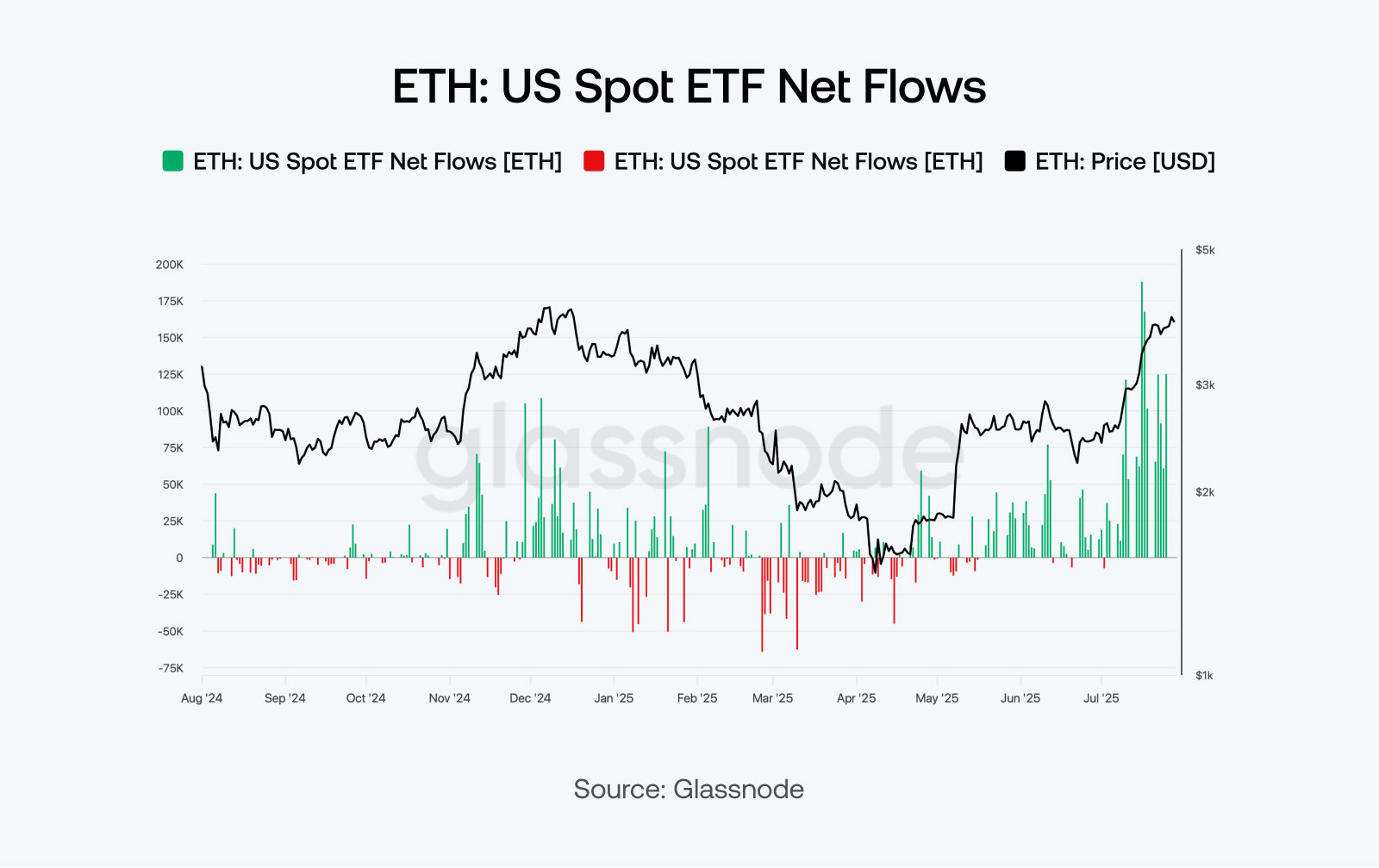

Surging spot ETH ETF inflows replicate Ethereum’s rising function in institutional portfolios and long-term strategic positioning.

Key Ethereum numbers on ETH's tenth anniversary:

- Each day Transactions (7-day avg): ~1.5 million

- Lively Addresses (7-day avg): ~550,000

- New Addresses (7-day avg): ~130,000

- Blocks Produced Per Day: ~7,000

- ETH Provide Staked: ~30%

Scorching matter

An important image, other than being a cool NFT.

Is that this the most important achievement, although?

Completely happy tenth anniversary, Ethereum!