Cryptocurrency Prices by Coinlib

Crypto’s again on house turf

On this patch of your weekly Dispatch:

Market solid

Momentum cools, however development construction stays intact as Bitcoin exams its vary

On the weekly chart, Relative Energy Index (RSI) and Stochastic oscillator readings are pulling again from overbought territory, suggesting some softening in momentum. Nonetheless, the Transferring Common Convergence Divergence (MACD) stays in optimistic territory, and the Common Directional Index (ADX) continues to learn above 25 — a stage sometimes related to a robust development — indicating the broader uptrend hasn't misplaced steam.

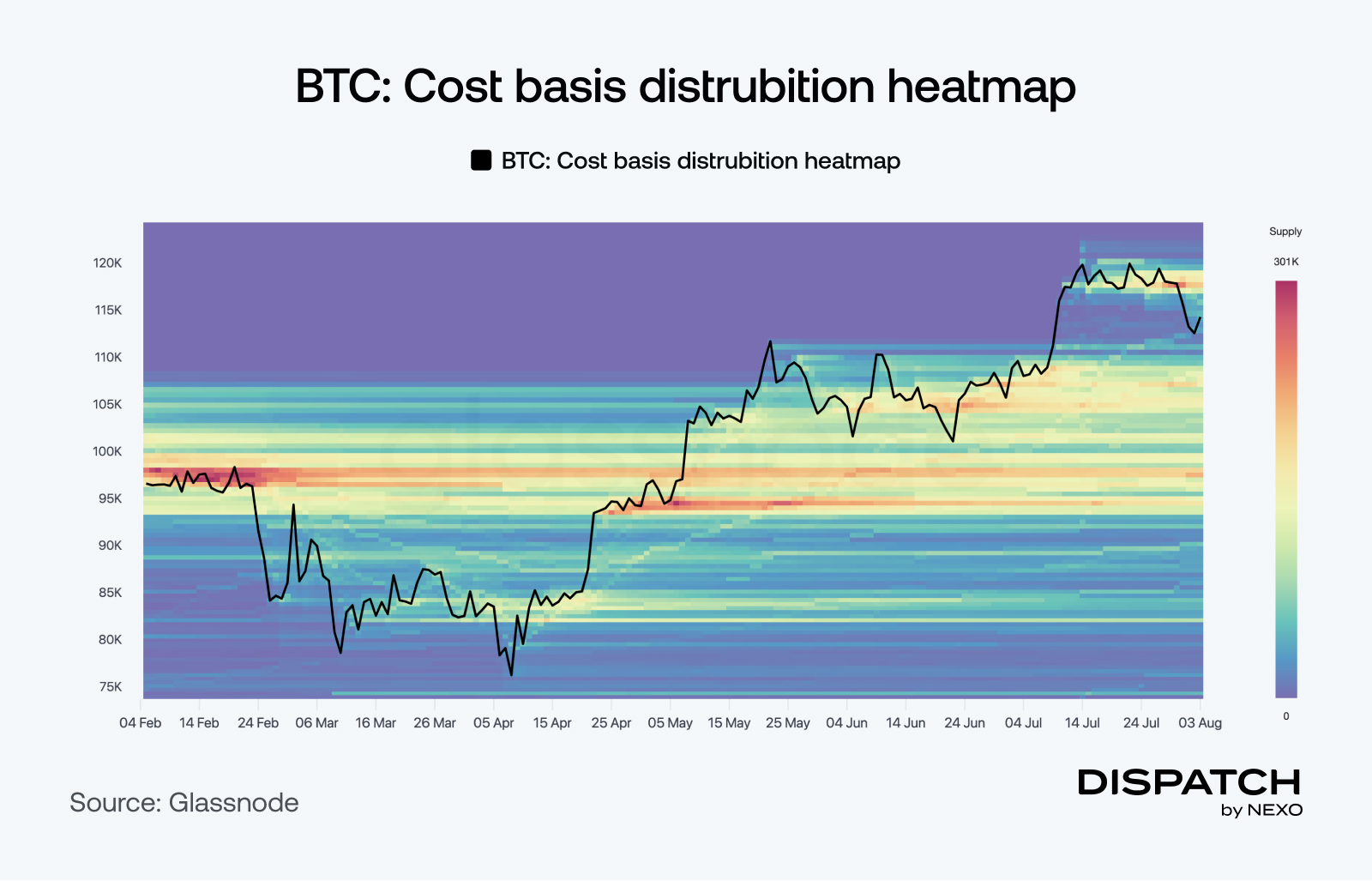

On the each day chart, the worth has slipped under the earlier vary’s decrease boundary, now turned help round $117,000, with combined indicators and indicators. MACD has turned unfavourable, ADX is weakening, and RSI hovers in impartial floor. The $120,000 area stays the important thing resistance to reclaim, whereas $112,000–$110,000 is rising as a important help zone – particularly in mild of the cost-basis air-gap highlighted on this week’s information story.

With macro indicators combined and coverage readability bettering, the market is anticipating cues – however not dashing to interrupt out simply but.

The massive concept

“Crypto, Welcome House.” What the U.S. stated – and what Nexo did

Final week, the U.S. Treasury Secretary Scott Bessent posted three phrases that may've sounded unthinkable only a 12 months in the past:

“Crypto, welcome house.”

Alongside that message got here a 168-page White Home report from President Donald Trump’s Working Group on Digital Asset Markets — an in depth blueprint to reestablish U.S. management in crypto and blockchain.

The report requires giving the Commodity Futures Buying and selling Fee (CFTC) clear authority to control crypto spot markets, guaranteeing higher oversight and investor safety. The framework additionally proposes protected zones and quicker approval processes for launching new tokens, encouraging innovation with out stress. Banking guidelines to be modernized, ending unofficial efforts to limit crypto firms’ entry to banks (sometimes called “Operation Choke Level 2.0”) and permitting banks to supply providers like crypto custody and stablecoin issuance. Final however not least, there’s a nationwide push to help dollar-backed stablecoins, supported by laws just like the GENIUS Act, to strengthen U.S. management in digital finance.

The place coverage begins, progress takes motion. And at Nexo, we’ve already taken the primary steps.

Earlier this 12 months, we announced our return to the U.S. market at an occasion with Donald Trump Jr. On July 29 – simply days earlier than the White Home report’s launch – President Trump personally inaugurated the brand-new course for the upcoming Nexo Championship in Scotland, joined by Nexo’s founders and senior management.

A brand new period begins.

From coverage readability to public belief, from tokenization to tournaments, we see the place the long run is headed. With a U.S. blueprint that features market construction reform, stablecoin adoption, and modernized banking guidelines, the trail ahead is changing into clearer – and if that is how we enter the world of golf, you may solely think about the place we’re headed subsequent.

Bitcoin

World wealth and the IMF

Bitcoin ended July at $115,644 – its highest month-to-month shut in its 16-year historical past – as new IMF-backed requirements put crypto into the world’s monetary ledgers. That’s regardless of one of many largest notional Bitcoin gross sales – the switch of 80,000 BTC, or over $9 billion primarily based on then market costs, for a Satoshi-era investor— a transfer the market absorbed with hanging effectivity.

That confidence now has statistical legitimacy. For the primary time, Bitcoin and different crypto belongings shall be included in nationwide wealth information, due to updates to the System of Nationwide Accounts (SNA) – the worldwide framework used to trace nationwide financial efficiency. Coordinated by the IMF, the modifications will classify eligible crypto holdings as “non-produced nonfinancial belongings.”

Whereas crypto received’t depend towards GDP, the replace means Bitcoin will now seem on sovereign steadiness sheets, putting it alongside extra conventional types of nationwide wealth. Translation: even when they received’t say it, the IMF simply admitted that crypto counts.

Еthereum

Treasuries and tides

Final week, Ethereum closed out its strongest ETF streak so far: 20 consecutive days of internet inflows in July totaling almost $5.4 billion, surpassing all earlier runs in each size and quantity. Spot ETH ETFs have now seen inflows in 12 straight weeks, with simply 9 outflow days previously three months, reinforcing ETH’s rising foothold amongst institutional allocators.

On the similar time, Ethereum treasury holdings are booming. Since June, company patrons have amassed 1.26 million ETH – 1% of whole provide – almost matching ETF inflows. Commonplace Chartered expects that determine to 10x, reaching 10% of all ETH in circulation.

Driving this development: companies like BitMine, now the world’s largest public ETH holder with 833,000 ETH price $2.9 billion, backed by ARK Make investments and Peter Thiel’s Founders Fund. Treasuries are betting not simply on worth, however on ETH’s distinctive utility: staking yields, DeFi entry, and programmability.

TradFi tendencies

U.S. capital markets x blockchain

Final week, SEC Chair Paul Atkins unveiled Undertaking Crypto, a broad effort to modernize securities regulation for digital belongings. The initiative will introduce clearer guidelines round token classifications, custody, and buying and selling – with an emphasis on supporting tokenized belongings. The SEC additionally signaled openness to DeFi platforms working inside regulated frameworks and known as self-custody “a core American worth.” It took the U.S. CFTC one enterprise day to in flip announce a “Crypto Dash,” an initiative to actualize suggestions from the digital asset report from President Trump’s working group.

Analysts at Bernstein described Undertaking Crypto because the boldest shift in U.S. crypto coverage so far, evaluating its ambition to previous monetary turning factors like digital buying and selling within the Nineteen Nineties. Of their view, it lowers long-standing limitations to entry and opens a path for brand spanking new gamers – from fintechs to decentralized protocols – to take part in capital markets. The message: American monetary infrastructure is starting to maneuver from on-line to on-chain. WDYT?

Macroeconomic roundup

Companies, charges, and labor

A seemingly lighter macro calendar, however with key exams for providers, charges, and labor.

U.S. ISM Non-Manufacturing Buying Managers Index (Aug 5): Forecast to tick as much as 51.1%, this intently watched gauge of U.S. providers exercise might both dampen or speed up rate-cut bets relying on whether or not it lands above or under expectations.

U.Ok. Curiosity Charge Choice (Aug 7): Markets count on a reduce to 4.00% as inflation cools and development stalls, however inner divisions on the BoE underscore the unsure path forward for UK financial easing.

U.S. Preliminary Jobless Claims (Aug 7): A modest rise to 221,000 is predicted, reinforcing labor market softness that might weigh on the Fed’s tightening bias – and probably help Bitcoin’s macro setup.

The week’s most attention-grabbing information story

Anchored on the prime

Bitcoin’s Value-Foundation Distribution reveals a dense cluster of investor accumulation between $117,000 and $122,000 – an indication that current patrons are getting into with conviction, even at elevated ranges. Just under, the chart exhibits a light-weight quantity zone from $115,000 to $110,000, a results of the speedy rally that supplied little time for transactions. Whereas not all such gaps invite pullbacks, they'll grow to be areas the market revisits to substantiate help. For now, Bitcoin seems well-anchored close to all-time highs, with patrons exhibiting resilience at the same time as macro indicators stay combined.

The numbers

The week’s most attention-grabbing numbers

$10 billion – Technique’s Q2 2025 internet earnings, pushed by BTC worth positive aspects.

17,595 BTC – Metaplanet’s BTC holdings after their newest buy.

$1.3 billion – Unrealized Bitcoin positive aspects as buyers resist promoting stress.

Sizzling subject

A phrase once unimaginable.

It’s tee time, we told you.

Three years and counting.

Dispatch is a weekly publication by Nexo, designed to help you navigate and take action in the evolving world of digital assets. To share your Dispatch suggestions and comments, email us at [email protected].