Cryptocurrency Prices by Coinlib

Act on short-term market strikes with built-in leverage

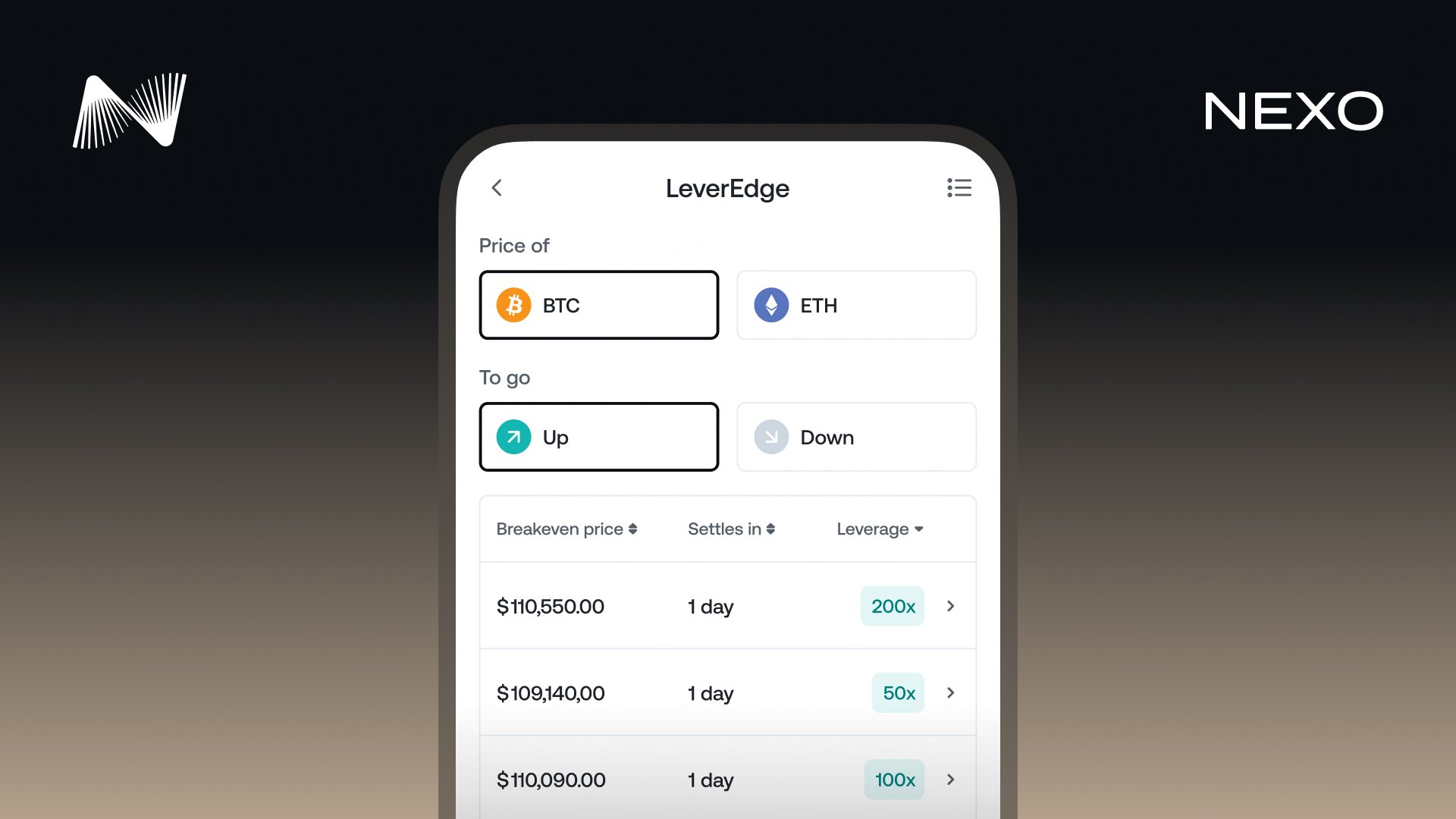

LeverEdge is Nexo’s newest product that provides you a strategy to specific your short-term market view on BTC or ETH, with as much as 200x leverage with out computerized closure of your place.

Whether or not you anticipate the market transferring up or down, LeverEdge lets you choose from predefined methods that match your view, whereas realizing probably the most you possibly can lose is the quantity you allocate.

This weblog unpacks how LeverEdge works, what units it aside as a sophisticated incomes product, and the best way to get began.

How does LeverEdge work?

LeverEdge makes use of built-in leverage to amplify each your potential income and losses (PnL) based mostly on the value motion of BTC or ETH. Right here, leverage means your PnL adjustments extra for each motion within the asset’s worth.

For instance, with 100x leverage, a 1% change within the worth of BTC or ETH may result in a 100% change in your PnL.

In contrast to crypto futures trading, the place leverage entails borrowing funds and the chance of liquidation, with LeverEdge, you don’t borrow funds, and there's no realized loss earlier than settlement.

With LeverEdge, you don’t earn within the conventional sense. As a substitute, you allocate a certain quantity and select from a listing of accessible short-term methods.

Every technique is outlined by:

- The asset: BTC or ETH

- The course: up (bullish) or down (bearish)

- The foreign money you allocate: BTC, ETH, or USDC

- A predefined breakeven worth, leverage multiplier, and length (from 1 to 30 days)

Your end result is dependent upon whether or not the market price of the asset reaches (or passes) the predefined breakeven worth when the technique ends.

For instance, somebody seeking to acquire bitcoin publicity may go for a 7-day, 50x leverage BTC technique with a $100,000 breakeven worth.

Notice: Leverage, length, and breakeven worth aren’t customisable per subscription. As a substitute, you select from a set of predefined technique combos that embrace these parameters.

What does a technique appear like?

Let’s say you select BTC, count on it to go up, and allocate 1,000 USDC. You choose a technique with the next parameters:

- Breakeven worth: $100,000

- Period: 7 days

- Leverage: 50x

If BTC settles at $102,000 after 7 days, you obtain your authentic 1,000 USDC plus a return that displays how far the value moved above the breakeven worth.

If BTC settles slightly below $100,000, relying on how shut the ultimate worth is to the breakeven worth, you could obtain a part of your 1,000 USDC again.

If BTC finishes nicely under $100,000, the technique ends with no return. Your most loss is the 1,000 USDC you allotted.

How is your return calculated?

Right here’s the formulation used to find out your return, assuming you count on BTC to go up:

Payoff [Up direction strategy] = Subscription Quantity + [Subscription Amount × Leverage × (Settlement Price – Breakeven Price) / Breakeven Price]

For instance, in case you allocate 1,000 USDC to a 50× leverage technique with a breakeven worth of $100,000 and BTC settles at $102,000, your return can be:

Payoff = $1,000 + [$1,000 × 50 × ($102,000 – $100,000) / $100,000]= $1,000 + [$1,000 × 50 × 0.02]= $1,000 + $1,000= $2,000 complete in USDC.

If the result's damaging, your payoff is lowered. You'll be able to solely lose the quantity you allocate.

Most publicity, minimal capital

Amplify your market view with as much as 200x built-in leverage.

Predefined, time-bound methods

You select from curated choices with mounted leverage, breakeven costs, and durations.

A number of funding choices

Use BTC, ETH, or USDC to activate a technique.

Constructed-in PnL projection

Earlier than you allocate your required quantity, you possibly can see projected beneficial properties or losses based mostly on the place the asset worth may settle.

Technique limits by leverage

Most technique dimension is dependent upon the leverage stage. For instance:

- 5x leverage: as much as $500,000

- 10x leverage: as much as $250,000

- 25x leverage: as much as $100,000

- 50x leverage: as much as $50,000

- 100x leverage: as much as $30,000

- 200x leverage: as much as $15,000

When you're seeking to amplify your crypto publicity, LeverEdge presents a short-term incomes technique with clear projections.

Methods to begin?

- You might have to take a quick quiz to verify your understanding of how LeverEdge works.

- Add funds in a supported asset (BTC, ETH, or USDC).

- Select your technique by choosing an asset, course, and one of many predefined choices that suit your view.

Notice: LeverEdge is out there in choose jurisdictions. To entry the product, you could want to finish a brief quiz as a part of the onboarding course of.

Continuously requested questions.

Can I lose greater than I allocate?

No. The quantity you allotted is the utmost you possibly can lose.

Do I select the leverage and length?

In a roundabout way. These are preset as a part of every technique possibility.

How do I do know what I may earn or lose?

You’ll see an interactive PnL projection earlier than confirming your technique. This exhibits the projected return based mostly on the place the value settles.

Is there an early exit?

Sure, you possibly can exit early in case your projected payoff is at the least $10. This selection turns into accessible after 2 hours and closes 5 minutes earlier than your LeverEdge subscription expires.

Is that this the identical as Futures?

No. LeverEdge makes use of predefined end result logic and by no means exposes you to losses past what you allocate. There isn't any collateral upkeep or open place administration.

Does this work for ETH, too?

Sure. You may also discover Ethereum subscriptions by choosing ETH as your asset.

Earlier than you begin

The content material and examples offered on this article are for informational and academic functions solely and embrace no warranties. They shouldn't be interpreted as monetary recommendation or a suggestion to interact in transactions involving particular property. Please observe that digital property are risky, and the worth of the funds you subscribed with might fluctuate with market circumstances. LeverEdge doesn't assure any returns, as all outcomes rely fully on the value motion of digital property. You might lose the total quantity you subscribe to. Please use superior incomes methods responsibly.

*The LeverEdge product is unavailable for shoppers residing in Australia, the UK, the United Arab Emirates, and a few nations within the EEA.