Cryptocurrency Prices by Coinlib

How Jackson Gap examined Bitcoin and boosted Ethereum

On this patch of your weekly Dispatch:

- ETH’s contemporary tailwinds

- Nexo leads in lending

- Economics at Jackson Gap

Market forged

BTC: Maintain on assist, bounce on macro?

On the weekly chart, Bitcoin has eased again to the center Bollinger Band, a stage that always acts as a springboard for renewed momentum. The Common Directional Index (ADX), a gauge of pattern power, stays above 25, suggesting the broader pattern remains to be intact. Momentum indicators are cooling, with the Relative Energy Index (RSI) and the Stochastic oscillator drifting decrease from impartial zones, whereas the Transferring Common Convergence Divergence (MACD) histogram has slipped just below the zero line.

On the each day chart, worth motion is extending decrease and at the moment sits beneath the decrease Bollinger Band, usually an indication of stretched situations. The Stochastic has moved into oversold territory, the MACD histogram is firmly unfavorable, and the RSI is approaching 30 — ranges that previously have preceded potential stabilization.

Key ranges to look at embrace assist round $109,000, with stronger footing close to $104,000 to $105,000, whereas resistance is seen at $112,000 after which $115,000.

The large thought

Jackson Gap and the crypto response

In case you’ve been studying Dispatch, you understand we’ve been monitoring Bitcoin’s moves, Ethereum’s rise, and Powell’s every word — and this weekend, all three storylines got here into one. On the heart of it stood Jackson Gap, the place Jerome Powell struck a dovish chord, opening the door to a September price minimize as development cools, tariffs push up costs, and labor-market momentum stalls.

Powell described the U.S. financial system as resilient however going through a “shifting steadiness of dangers.” Inflation has fallen sharply from its post-pandemic highs to 2.6%, but stays sticky in core providers, and tariffs are starting to filter into shopper costs. In the meantime, job creation has slowed dramatically to simply 35,000 a month — down from 168,000 final 12 months — leaving the labor market in what Powell known as a “curious steadiness”.

The message was clear: dangers to jobs at the moment are rising quicker than dangers from inflation. The Fed is making ready to pivot towards assist, even when tariffs complicate the inflation image. Powell additionally scrapped the 2020 “make-up technique” of tolerating inflation overshoots, returning to versatile inflation concentrating on. In brief, the Fed is on the point of minimize charges whereas reasserting it received’t let short-term worth spikes morph into lasting inflation. Markets took it as a inexperienced mild.

Bitcoin: Examined and trusted

The dovish tilt lifted BTC almost 4% to $117,000, echoing equities’ rally. However whales had the final phrase. An early investor pockets that after held over 100,000 BTC has been unloaded, depositing almost 23,000 BTC — price $2.6 billion, into markets over simply 5 days. The gross sales triggered a flash crash beneath $111,000, leaving Bitcoin at its weakest stage since early July and erasing its Jackson Gap beneficial properties. On a relative foundation, BTC has slipped 5% over the previous month, with dominance falling to 58.2%, its lowest since January.

But, at the same time as short-term flows weigh, the long-term case for Bitcoin continues to deepen. Allianz, a $2.5 trillion asset supervisor, declared BTC a “credible store of value” citing its deflationary design, decentralized governance, and low correlation to conventional markets. And establishments show it too: allocations into Bitcoin ETFs climbed to $33.6 billion in Q2, with funding advisors now holding greater than hedge funds and even college endowments like Harvard including BTC publicity — in some instances bigger than gold.

Ethereum reaches ATH

A lot of the capital pulled from Bitcoin is flowing into Ethereum. That same whale purchased roughly 473,000 ETH price $2.2 billion, opened sizable lengthy positions, and stored including spot — one other 23,500 ETH simply this week. Even after taking partial earnings, the deal with continues to carry over 40,000 ETH in leveraged longs with wholesome beneficial properties, signaling conviction in Ethereum’s upside.

The impact is obvious within the broader market. ETH touched a record $4,946 last week, remains to be up 23% over the previous month, and has pushed Ethereum dominance to 14.98%, its highest since 2024. JPMorgan highlights four drivers: anticipated approval for ETF staking, company treasuries including ETH, regulatory readability round liquid staking tokens, and in-kind ETF redemptions that make the merchandise extra environment friendly. And the momentum is seen in actual time: U.S. spot ETH ETFs simply logged $443.9 million in each day internet inflows, greater than double Bitcoin’s on the identical day to mark their third straight session of beneficial properties.

The narrative is one in every of a market break up. Bitcoin is cementing its function as digital gold, with institutional giants now brazenly embracing it as a cornerstone of world finance. And Ethereum is carving out a unique path — as a yield-bearing, institution-friendly asset with rising treasury adoption and regulatory momentum. Jackson Gap gave crypto a dovish nudge, however what adopted wasn’t simply volatility: it was a reminder that Bitcoin is laying the inspiration, whereas Ether appears prepared to steer the cost.

TradFi Developments

Central banks flip to crypto blockchains

The ECB is now weighing Ethereum and Solana as potential settlement layers for a digital euro, a notable shift that places public blockchains on the desk for Europe’s flagship CBDC venture. Whereas no choice is imminent — laws can be required after 2025 — the sign is obvious: crypto-native infrastructure is getting into the central banking playbook.

In Asia, South Korea’s “Large 4” banks met with Tether and Circle to debate stablecoins and the distribution of USD tokens. The talks come as Seoul pivots away from its CBDC pilot and towards private-issuer fashions.

Scorching in Crypto

Right here come Solana tresuries

Galaxy Digital, Multicoin, and Soar Crypto are reportedly lining up $1 billion for a Solana treasury, with Cantor Fitzgerald advising on a public-company construction. If accomplished, it could be the most important devoted SOL steadiness sheet thus far.

Macroeconomic roundup

Extra macro, extra volatility?

A packed U.S. calendar will take a look at whether or not Powell’s dovish tilt carries into September:

CB Shopper Confidence (Aug 26): Anticipated to dip to 96.5 from 97.2, pointing to softer family demand and weaker threat urge for food.

Nvidia Earnings (Aug 27): The AI bellwether studies after the shut — a beat may stoke one other tech rally, whereas a miss dangers spilling into broader threat sentiment, together with crypto.

Preliminary Jobless Claims (Aug 28): Forecast at 230,000 vs. 235,000 prior; resilience may mood minimize hopes, whereas sticky persevering with claims spotlight labor-market cracks.

PCE Inflation (Aug 29): Headline seen at 2.6% YoY, with core edging to 2.9%. A warmer print would weigh on minimize bets, whereas sticky inflation may reinforce Bitcoin’s hedge attraction.

Chicago PMI (Aug 29): Gauges Midwest manufacturing; consensus sees a modest slowdown, one other knowledge level on development fatigue.

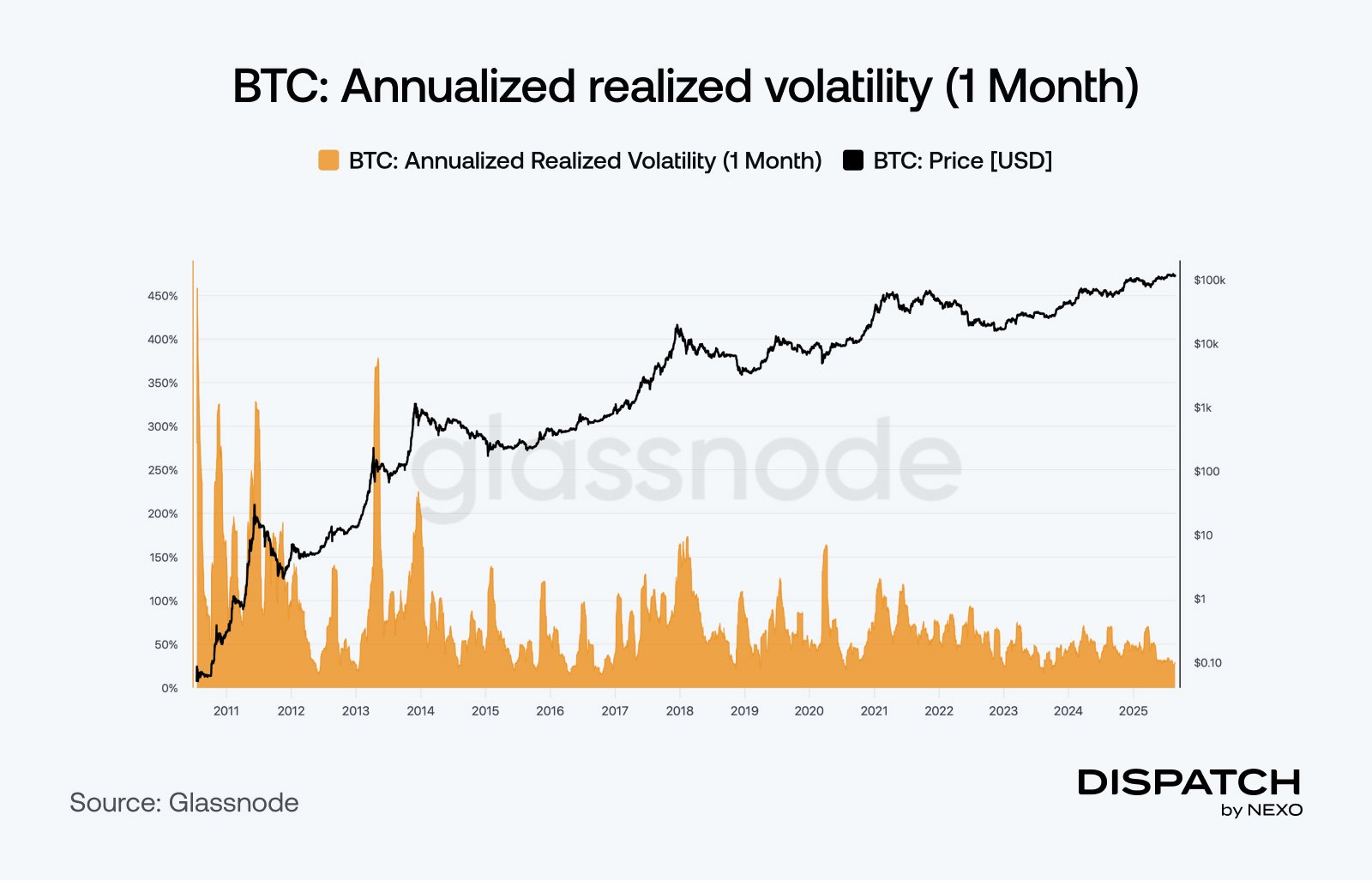

The week’s most fascinating knowledge story

Bitcoin’s maturity

Bitcoin is shedding its wild-child repute. Its 30-day realized volatility has fallen to a five-year low — typically even beneath mega-cap tech shares like Nvidia. That shift is hanging given Bitcoin’s surge to contemporary highs and subsequent pullbacks, which in previous cycles would have produced a lot sharper whipsaws. As a substitute, broader ETF possession, institutional allocations, and integration into retirement portfolios are dampening the extremes. The result's a market that appears much less like a speculative rollercoaster and extra like a maturing asset class discovering its place in mainstream portfolios.

The numbers

The week’s most fascinating numbers

- 10,000 BTC — Goal of the Philippines’ proposed Strategic Bitcoin Reserve Act.

- 40% — Ethereum’s YTD acquire in 2025, outpacing Bitcoin.

- $400 trilion — TradFi market dimension that might be tokenized, vs. simply $26.5B on-chain right now.

- $2.2 billion — Ethereum purchased in that spree, together with 473K ETH spot and leveraged longs.

- $2.6 billion — Bitcoin offloaded by a whale in 5 days, a lot of it rotated into ETH.

Scorching subjects

Here’s one way to look at the last pull-back.

What do you see, Dispatch readers?

By now, you should know where to park your assets.

Dispatch is a weekly publication by Nexo, designed to help you navigate and take action in the evolving world of digital assets. To share your Dispatch suggestions and comments, email us at [email protected].