Cryptocurrency Prices by Coinlib

What are you able to really do with Bitcoin in 2025?

The primary query each bitcoin holder asks

You’ve bought Bitcoin. Now what?

For years, the reply was easy: maintain it and hope the worth goes up. However in 2025, Bitcoin has developed into extra than simply “digital gold.” It’s one thing you'll be able to really use — for spending, borrowing in opposition to, and even incomes passive revenue.

Let’s break down precisely what you are able to do with Bitcoin right now and the way it matches into the larger image of constructing long-term wealth.

Borrowing in opposition to your Bitcoin

Promoting Bitcoin to cowl an expense can really feel like parting with a chunk of your future — particularly if you happen to imagine its worth will rise over time. That’s why extra individuals in 2025 are turning to crypto-backed credit score strains.

You utilize your Bitcoin as collateral, and in return, you get access to cash or stablecoins without selling your BTC. It’s like unlocking liquidity whereas retaining your funding intact.

For instance, say you’ve been holding Bitcoin for years however want funds for a house renovation. As a substitute of cashing out (and probably triggering a taxable occasion), you'll be able to borrow in opposition to your holdings. You’ll repay over time, and your Bitcoin stays in your possession — probably appreciating within the background.

After all, borrowing at all times comes with duty. Monitor your loan-to-value ratio, perceive the dangers of volatility, and solely borrow what you'll be able to comfortably repay.

Wish to borrow in opposition to your BTC with out promoting it? Nexo provides flexible crypto-backed credit lines that allow you to entry funds whereas retaining your Bitcoin in play.

Incomes with Bitcoin

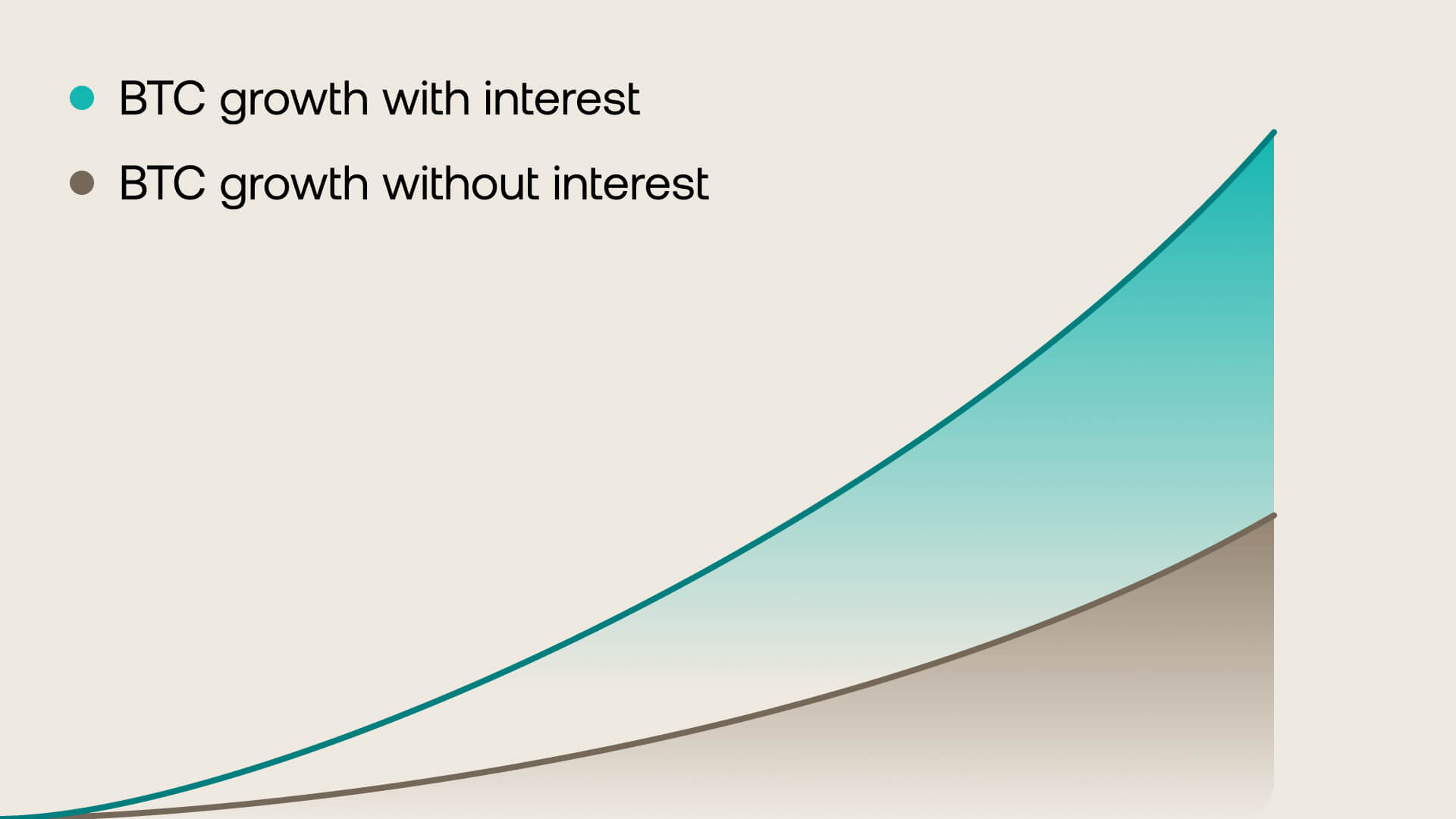

One in all Bitcoin’s most underestimated roles in 2025 is as an income-generating asset. Gone are the times when “holding” was the one technique. Now, you'll be able to put your Bitcoin to work and earn a return with out promoting it.

For long-term holders, this will offset volatility: even when the market dips, your general steadiness grows. For newcomers, it’s a method to take part with out making complicated trades.

Spending BTC in on a regular basis life

In Bitcoin’s early days, the thought of shopping for your morning espresso with crypto felt like science fiction. In 2025, it’s as regular as tapping your debit card — a minimum of within the locations which have caught up.

From espresso outlets in Berlin to on-line electronics shops in Tokyo, retailers are embracing Bitcoin, typically with out you even noticing. Cost processors now allow you to use Bitcoin by Apple Pay, Google Pay, and even bodily crypto playing cards.

It’s not simply the hip cafés anymore. Airways settle for it for tickets, subscription companies like VPNs and streaming platforms take it for month-to-month charges, and you'll e-book whole holidays with out touching a checking account.

For a lot of, that is the reply to “What's Bitcoin used for right now?”: it’s cash you'll be able to really spend — borderless, prompt, and free from intermediaries.

Buying and selling methods

Not all Bitcoin holders are content material to easily retailer their cash. In 2025, instruments for buying and selling are extra accessible than ever.

Greenback-cost averaging (DCA) helps you to purchase small quantities at common intervals, lowering the influence of value swings. Many freshmen begin right here.

Goal value swaps permit you to set purchase or promote orders that set off routinely at your chosen value.

Futures trading with Bitcoin goes a step additional — it’s an settlement to purchase or promote BTC at a set value sooner or later. This may allow you to speculate on value strikes with out proudly owning the asset immediately, or hedge in opposition to value drops if you happen to already maintain Bitcoin.

Bitcoin’s place in 2025

Fifteen years in the past, Bitcoin was a daring experiment. In 2025, it’s a working a part of the worldwide monetary system — a forex you'll be able to spend, an asset you'll be able to borrow in opposition to, and a retailer of worth you'll be able to develop.

Do you suppose we’ve answered “What's Bitcoin, and what's it used for?” If that's the case, the subsequent step is seeing how its completely different makes use of might align with your personal method to managing and rising wealth.

Discover Bitcoin’s full potential with Nexo.

Incessantly requested questions

1. What's Bitcoin used for in 2025?

Bitcoin is used for on a regular basis funds, borrowing in opposition to as collateral, incomes curiosity by financial savings merchandise, and as a long-term retailer of worth.

2. What's Bitcoin used for right now in comparison with the previous?

In its early days, Bitcoin was primarily a distinct segment fee software. Right now, it has grown right into a multi-purpose asset: individuals spend it with retailers worldwide, use it to safe crypto-backed loans, and earn yield with out promoting their holdings.

3. Are you able to earn curiosity on Bitcoin?

Sure, many platforms now provide interest-bearing accounts for Bitcoin. By holding your BTC in such accounts, you'll be able to earn passive revenue whereas retaining possession of your cash.

4. Is it higher to promote Bitcoin or borrow in opposition to it?

Promoting Bitcoin provides you quick money however could imply lacking out on future value progress. Borrowing in opposition to it helps you to entry liquidity whereas retaining your BTC publicity. Every choice has dangers and rely in your monetary objectives and danger tolerance.

These supplies are accessible globally, and the provision of this data doesn't represent entry to the companies described, which companies will not be out there in sure jurisdictions. These supplies are for basic data functions solely and never meant as monetary, authorized, tax, or funding recommendation, provide, solicitation, advice, or endorsement to make use of any of the Nexo Providers and should not personalised, or in any means tailor-made to replicate explicit funding goals, monetary scenario or wants. Digital property are topic to a excessive diploma of danger, together with however not restricted to unstable market value dynamics, regulatory modifications, and technological developments. The previous efficiency of digital property shouldn't be a dependable indicator of future outcomes. Digital property should not cash or authorized tender, should not backed by the federal government or by a central financial institution, and most should not have any underlying property, income stream, or different supply of worth. Unbiased judgment based mostly on private circumstances needs to be exercised, and session with a certified skilled is beneficial earlier than making any choice.