Cryptocurrency Prices by Coinlib

Find out how to Spend money on Crypto and Construct Your Lengthy-Time period Wealth Targets

From shopping for crypto to constructing wealth

Possibly you’ve simply purchased Bitcoin for the primary time. Or maybe you’ve been watching the market and questioning, “How do individuals really use this to construct wealth?”

It’s a standard query. Most guides about crypto investing cease at “purchase and maintain.” However wealth isn’t constructed by ready — it’s constructed by making your belongings give you the results you want.

That’s why we’re going to have a look at the way to spend money on crypto with a method in thoughts so it helps your long-term objectives.

Getting began the proper method

Step one is selecting a trusted platform the place you'll be able to buy digital assets like Bitcoin, Ethereum, or stablecoins.

From there, investing with readability means three issues: safe your belongings, diversify throughout totally different digital belongings, and suppose long-term as a substitute of chasing fast wins.

Crypto investing can transcend shopping for and holding. When you personal digital belongings, you can too put them to work via financial savings, lending, or different instruments that may assist your monetary objectives.

Make your crypto give you the results you want

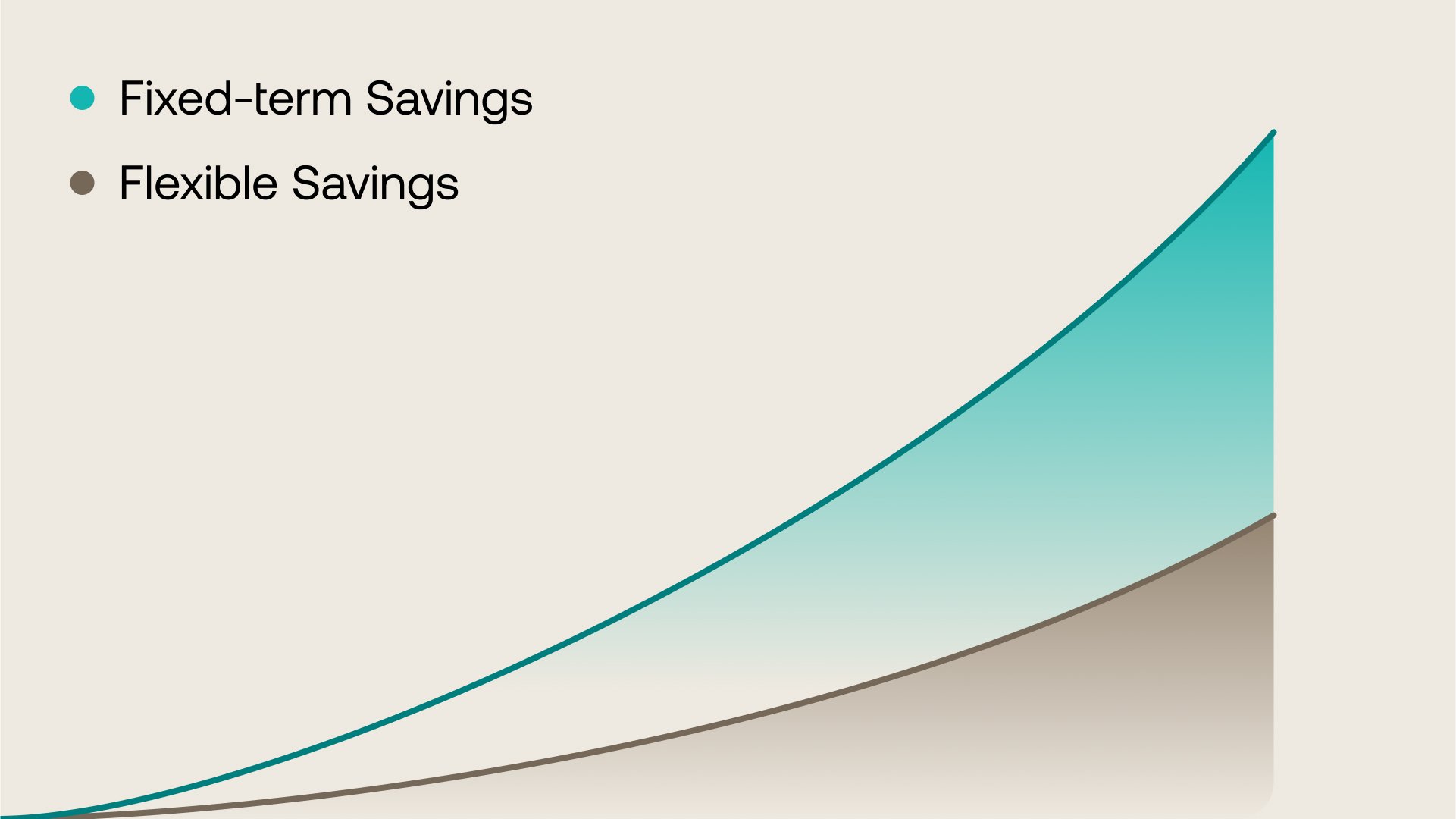

Identical to conventional financial savings accounts pay curiosity on money, some platforms provide methods to earn in your holdings. Two of probably the most sensible choices are Versatile Financial savings and Fastened-term Financial savings:

- Versatile Financial savings: Your crypto earns interest daily, whereas your belongings can be found to commerce always. It’s best for novices or anybody who values fast entry to their funds.

- Fastened-term Financial savings: You commit your crypto for a set interval and obtain a better return in alternate. It’s designed for individuals with a longer-term outlook who need stronger yields.

Consider it this manner:

- Versatile Financial savings = comfort and management.

- Fastened-term Financial savings = larger rewards for endurance.

By selecting the method that matches your life-style, you’re letting your funding give you the results you want in a method that’s aligned along with your wealth objectives.

With Nexo’s Versatile and Fixed-term Savings, you'll be able to earn day by day curiosity or larger returns.

Borrowing: The wealth tactic of the wealthy

There’s a quiet secret in conventional finance: the rich not often promote their most useful belongings. As an alternative, they borrow towards them. That method, their belongings keep invested, proceed to develop within the background, and infrequently keep away from triggering taxable occasions.

Crypto brings this similar technique to anybody, not simply the ultra-wealthy. With a crypto-backed credit score line, you'll be able to use your Bitcoin or Ethereum as collateral and access funds with out promoting belongings you suppose would possibly recognize sooner or later.

Why this issues:

- You retain your crypto in place, so it could actually profit if the market rises.

- You get the funds you want for bills, investments, or alternatives.

- You keep away from the “purchase excessive, promote low” lure that comes from panic-selling throughout volatility.

If you borrow agains your crypto, two issues outline your expertise:

- Rates of interest → That is the price of borrowing. With Nexo, charges will be as little as 2.9% should you hold your Mortgage-to-Worth (LTV) under 20%, making it one of the crucial environment friendly methods to unlock liquidity with out promoting.

- Mortgage-to-Worth (LTV) → This exhibits how a lot you'll be able to borrow in comparison with the worth of your crypto. A decrease LTV means decrease threat (and decrease rates of interest), whereas a better LTV provides you extra funds however at a better price and threat.

Staying protected as you make investments

Begin by choosing platforms with a strong reputation.

- Safety first: Search for suppliers with industry-leading custodians, insurance coverage, and regulatory oversight.

- Diversification: Unfold your holdings throughout totally different digital belongings like Bitcoin, Ethereum, and stablecoins. This method will help stability your portfolio throughout market shifts.

- Mindset: Volatility is regular. Keep targeted in your long-term objectives as a substitute of reacting to short-term worth swings.

Investing is about constructing confidence. With the proper habits, crypto can transcend a speculative guess and grow to be a sensible instrument for constructing long-term wealth.

Why this method is forward-thinking

For years, crypto was seen as a big gamble — purchase a few of it, maintain, and hope for the perfect. However 2025 seems very totally different. Crypto has matured into a worldwide asset class, with instruments that go far past hypothesis.

By placing your belongings to work via financial savings merchandise, or borrowing towards them as a substitute of promoting, you’re following methods that the rich have used for generations — however with a brand new stage of flexibility and accessibility.

For this reason crypto is a method to construct and protect wealth that appears to the long run. You’re not solely a part of the digital economic system — you’re shaping how wealth itself evolves.

Incessantly requested questions

1. Is investing in crypto a good suggestion in 2025?

Crypto remains to be risky, nevertheless it has matured into a worldwide asset class. If approached with diversification and wealth methods in thoughts, it may be a part of a forward-looking portfolio.

2. Find out how to spend money on crypto?

Begin by selecting a regulated platform. Then discover methods to purchase digital belongings like Bitcoin or Ethereum. After which you can discover methods like incomes curiosity, accessing liquidity, or rising your portfolio over time.

3. Find out how to spend money on crypto safely?

Use regulated platforms, diversify your belongings, allow safety instruments like 2FA, and concentrate on long-term development as a substitute of chasing fast features.

4. What's LTV in crypto borrowing?

LTV, or Mortgage-to-Worth, measures how a lot you borrow in comparison with the worth of your crypto. For instance, should you borrow $2,000 utilizing $10,000 value of Bitcoin, your LTV is 20%. A decrease LTV normally means decrease rates of interest and fewer threat if the market strikes.

These supplies are accessible globally, and the supply of this info doesn't represent entry to the companies described, which companies is probably not out there in sure jurisdictions. These supplies are for common info functions solely and never meant as monetary, authorized, tax, or funding recommendation, provide, solicitation, advice, or endorsement to make use of any of the Nexo Providers and are usually not customized, or in any method tailor-made to replicate explicit funding goals, monetary scenario or wants. Digital belongings are topic to a excessive diploma of threat, together with however not restricted to risky market worth dynamics, regulatory modifications, and technological developments. The previous efficiency of digital belongings isn't a dependable indicator of future outcomes. Digital belongings are usually not cash or authorized tender, are usually not backed by the federal government or by a central financial institution, and most shouldn't have any underlying belongings, income stream, or different supply of worth. Unbiased judgment based mostly on private circumstances ought to be exercised, and session with a certified skilled is really useful earlier than making any choice.