Cryptocurrency Prices by Coinlib

What may restart the bulls?

On this patch of your weekly Dispatch:

- ETH dominates stablecoins

- A vital inflation report

- Textbook BTC dip-buying

Market solid

Restoration in movement, conviction on maintain

On the weekly chart, Bitcoin is exhibiting indicators of restoration after bouncing off the center Bollinger Band (BB), a volatility gauge. Momentum indicators are beginning to lean bullish: each the Relative Energy Index (RSI) and the Stochastic oscillator are impartial however turning upward. Nonetheless, the Shifting Common Convergence Divergence (MACD) stays in adverse territory, whereas the Common Directional Index (ADX)—a measure of pattern power—continues to fade, pointing to a market that’s stabilizing however not but trending with conviction.

On the each day chart, the bullish case appears sharper. The MACD histogram is firmly constructive, the Stochastic oscillator sits in overbought territory with out exhibiting exhaustion, and the RSI is climbing increased, all suggesting consumers have the higher hand within the brief time period. The one warning flag comes from the ADX, which stays subdued, signaling that momentum is constructing however hasn’t translated into a robust directional pattern simply but.

Resistance sits at $113,500 and $115,000, whereas help holds at $110,000 and $107,500—ranges that can outline the subsequent decisive transfer.

The massive thought

The lacking items of the crypto (bull) market

The market is in a quick pause after the robust run earlier this 12 months, making it a superb second to look forward and ask what may reignite that momentum. A long-lasting bull market by no means builds itself out of skinny air — a couple of vital indicators want to come back into focus first. On this Dispatch, we have a look at essentially the most elementary drivers that might set the stage.

Charges that help digital belongings: An important shift is going on in financial coverage. The U.S. labor market is cooling quick: August’s payrolls grew by simply 22,000, whereas unemployment climbed to 4.3%, the very best since 2021. That has put the Federal Reserve below mounting strain to maneuver. Markets are already pricing in a roughly 90% likelihood of a 25bps reduce at subsequent week’s assembly, and there's nonetheless a non-trivial likelihood of a bigger 50-basis-point “catch-up” transfer. Standard Chartered now expects the Fed to chop by 50 foundation factors this month, whereas Barclays, Financial institution of America, and others forecast a collection of quarter-point cuts by December. Citi even sees the Fed delivering reductions at 5 consecutive conferences, arguing that inflation dangers can be tolerated in favor of supporting jobs.

For markets, the scale of the reduce issues lower than the route of journey. As soon as actual yields start to float decrease, liquidity normally returns to threat belongings first. Traditionally, these early phases of easing have been a few of the most supportive environments for crypto, as traders search for alternate options to low-yielding bonds and money.

A greenback that drifts weaker: The greenback has held most lately, however that may be deceptive. Morgan Stanley notes the buck’s bear cycle is “barely midway by,” pointing to U.S. GDP development slowing towards 1% by late 2025 and a Fed extra tolerant of inflation. With Europe and the U.Ok. nonetheless hawkish, the greenback could also be overvalued—opening room for crypto demand as international consumers acquire relative buying energy.

Company adoption strikes from headlines to behavior: Company demand isn’t simply anecdotal—it’s dominant. Simply final week, Technique and Tokyo-listed Metaplanet mixed to purchase 2,091 BTC, price about $230 million and equal to 66% of all Bitcoin mined throughout that interval. Technique now holds greater than 638,000 BTC, valued at over $71 billion, whereas Metaplanet has constructed a stash of 20,000 BTC. Add that to River Monetary’s discovering that firms as an entire now control around 6% of whole BTC provide, and it's clear that enterprise demand has grow to be a structural characteristic of the market.

Crypto adoption goes international: It isn’t simply crypto fanatics piling in. Chainalysis reviews a broader, global wave: India stays primary in crypto adoption, with the US climbing to quantity two. Asia-Pacific quantity jumped 69% year-over-year to $2.36 trillion, whereas North America and Europe led in absolute phrases, with $2.2 trillion and $2.6 trillion, respectively. That development factors to a maturing, geographically numerous base of crypto customers past merchants.

Guidelines of the highway begin to settle: The GENIUS Act has lastly given stablecoins a transparent federal framework, with full-reserve backing and month-to-month disclosures, opening the door for integrations like Visa and Mastercard’s settlement rollouts. The Fed is underscoring this shift with an October conference on stablecoins and tokenization, whereas the SEC and CFTC will meet in September to coordinate oversight. Collectively, these strikes sign that digital belongings are shifting from regulatory ambiguity to structured guidelines — a shift that may scale back uncertainty and unlock new capital.

The larger image: Whereas fireworks usually are not assured, these developments have gotten a sexy guidelines. If even two or three of those forces align, the outlines of the subsequent bull market might quickly come into sharper focus.

Bitcoin

US inches nearer to a Bitcoin Reserve

Washington is edging ahead with plans for a strategic Bitcoin reserve. A brand new Home appropriations invoice directs the Treasury to ship a report inside 90 days on the feasibility, custody, and cybersecurity of holding digital belongings on the federal government’s steadiness sheet.

The transfer follows President Trump’s March order to determine a Bitcoin reserve utilizing confiscated crypto. Treasury Secretary Scott Bessent has since hinted at “budget-neutral pathways” to develop the stockpile.

The U.S. isn’t alone: Kazakhstan is weighing a state crypto fund, and the Philippines has floated a ten,000-BTC reserve. Nations already maintain greater than 517,000 BTC, about 2.5 % of provide — a quantity that might rise if these proposals take root.

Ethereum

Ethereum units information

Ethereum simply set contemporary information throughout a number of fronts. Stablecoin provide on the community has doubled since early 2024, now topping $165 billion and giving Ethereum a commanding 57% market share. Tokenized gold has additionally surged to $2.4 billion, cementing Ethereum’s dominance in tokenized belongings from commodities to Treasurys.

Staking momentum is selecting up too: the validator entry queue has flipped above exits, with practically $4 billion in ETH ready to stake versus $3.3 billion set to withdraw.

With treasuries, gold, and stablecoins all shifting onchain, Ethereum’s function because the spine of tokenized finance appears stronger than ever.

Macroeconomic roundup

A most vital US inflation report

Traders are watching a packed information calendar this week, with Thursday’s Shopper Worth Index taking heart stage. Inflation is predicted to rise to 2.9% in August from 2.7% in July, the very best since January. Core inflation is forecast to stay at 3.1%, reflecting the continued affect of tariffs on items costs.

The report lands simply earlier than the Federal Reserve’s September 17 assembly, the place markets count on a 25-basis-point fee reduce. A stronger-than-expected CPI print may give officers motive to maneuver extra cautiously, whereas a softer studying would reinforce expectations for additional easing.

The week’s most fascinating information story

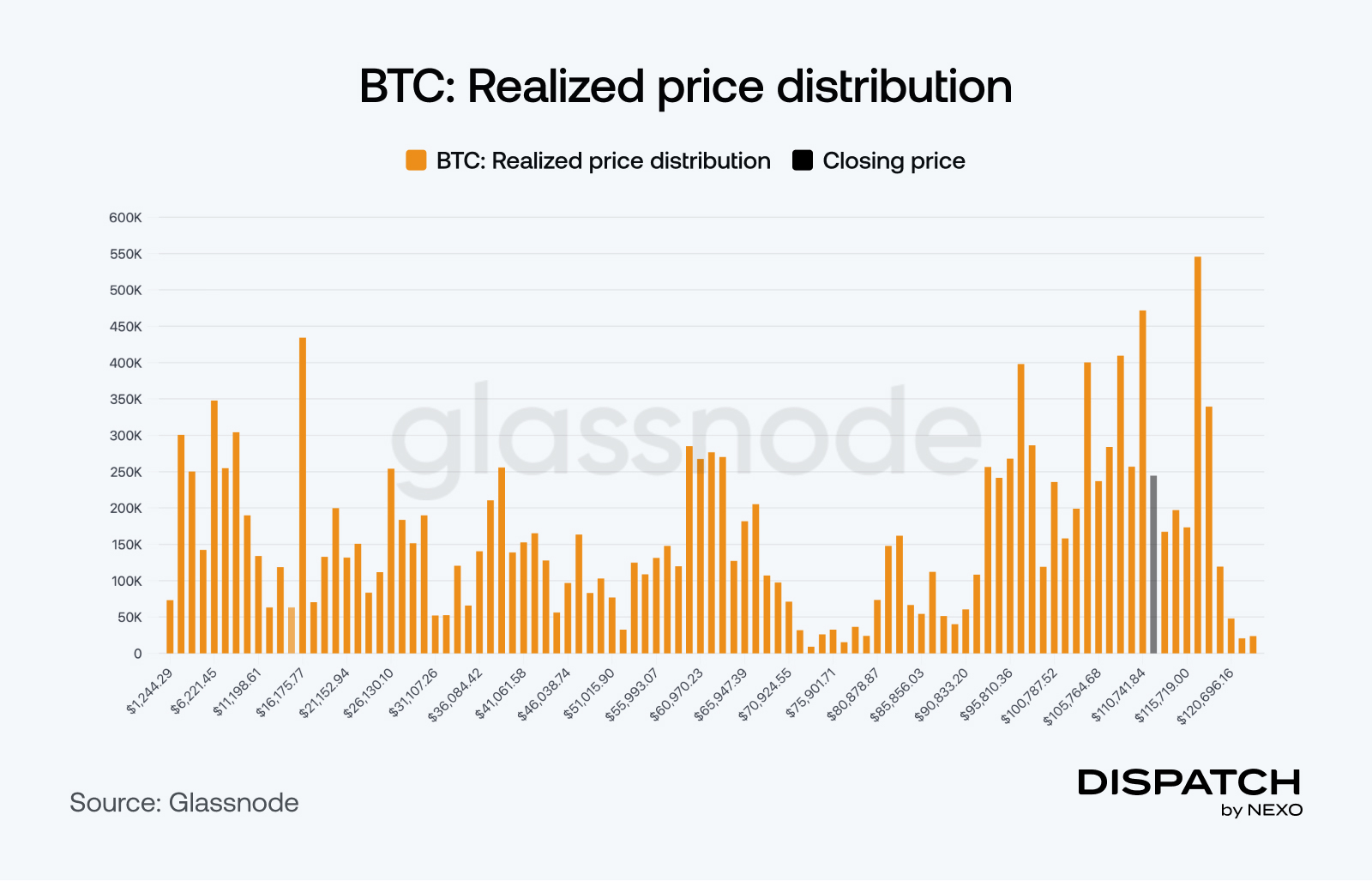

The BTC dip has been purchased

Bitcoin’s slide to $108,000 appeared like the beginning of deeper hassle, however on-chain data shows the opposite. Traders rapidly gathered within the $108,000–$116,000 “air hole,” a zone that had little prior exercise, successfully turning a void right into a base of help.

This dip-buying has helped regular costs close to $112,000 and displays rising conviction amongst holders. Whereas the vary stays fragile and additional consolidation is feasible, the truth that consumers stuffed the hole so decisively factors to underlying demand ready to step in on weak point.

The numbers

The week’s most fascinating numbers

- $350,000 — Rewards received by a solo miner towards odds of as soon as in 100 years.

- $3,635/oz — Gold futures hit a brand new document as Fed fee cuts loom.

- $1.6 billion — Scale of institutional Solana treasuries from Nasdaq-listed SOL Methods and friends.

- $12.2 billion — Solana’s whole worth locked hit an all-time excessive, up 57% from June lows.

- $6 billion — Additional Bitcoin ETF inflows modeled if the Fed delivers 100–125 bps of cuts by year-end.

Sizzling subjects

Could this be a hidden catalyst for another bull run?

It’s all about the macro, apparently.

That’s a decent projection.

Dispatch is a weekly publication by Nexo, designed to help you navigate and take action in the evolving world of digital assets. To share your Dispatch suggestions and comments, email us at [email protected].