Cryptocurrency Prices by Coinlib

Bitcoin’s balancing forces in play

On this patch of your weekly Dispatch:

- A significant date for Bitcoin

- An Ethereum improve

- The following key macro report

Market forged

Is BTC cooling on the springboard?

Bitcoin’s weekly chart suggests the rally could also be pausing for breath, with the Common Directional Index (ADX), a trend-strength indicator, easing under 25. Momentum gauges are additionally softening: the Relative Energy Index (RSI) and the Stochastic oscillator are turning decrease, although each stay comfortably in impartial territory. The Transferring Common Convergence Divergence (MACD), one other momentum software, has seen its histogram slip barely unfavorable, but the current pullback discovered help proper on the center Bollinger Band, outlined by the 20-week easy transferring common (SMA), a stage that has usually acted as a springboard in previous consolidations.

On the day by day chart, momentum alerts lean extra cautious as oscillators drift decrease and the MACD strains cross down, although the Stochastic has already reached oversold situations, hinting that sellers may quickly run out of steam. With $112,000 and $110,000 offering sturdy help and resistance capped at $115,000–117,000, the setup factors much less to a breakdown and extra to a cooling section inside a broader uptrend.

The large concept

The complexity of Bitcoin’s strikes

Bitcoin has been seesawing by means of September, rallying on brief squeezes one second and retracing on profit-taking the following. Amid bursts of momentum, the asset has not managed the clear break above all-time highs that many anticipated this fall. As a substitute, it stays within the low $100,000s, suspended between optimism and consolidation.

This standoff displays three highly effective forces at work: buying and selling exercise, macroeconomics, and investor conduct. Collectively, they type the tightrope Bitcoin should stroll to maintain its advance.

The sparks of buying and selling exercise: Nowhere is that this balancing act clearer than in buying and selling exercise, the place leverage and derivatives have amplified each transfer, turning routine swings into fireworks. Perpetual open curiosity peaked at practically 395,000 BTC earlier than FOMC-driven swings trimmed leverage, settling nearer to 380,000 BTC. Shorts have been squeezed into the choice, pushing Bitcoin towards $118,000, adopted by some lengthy positions being pared again as profit-taking set in.

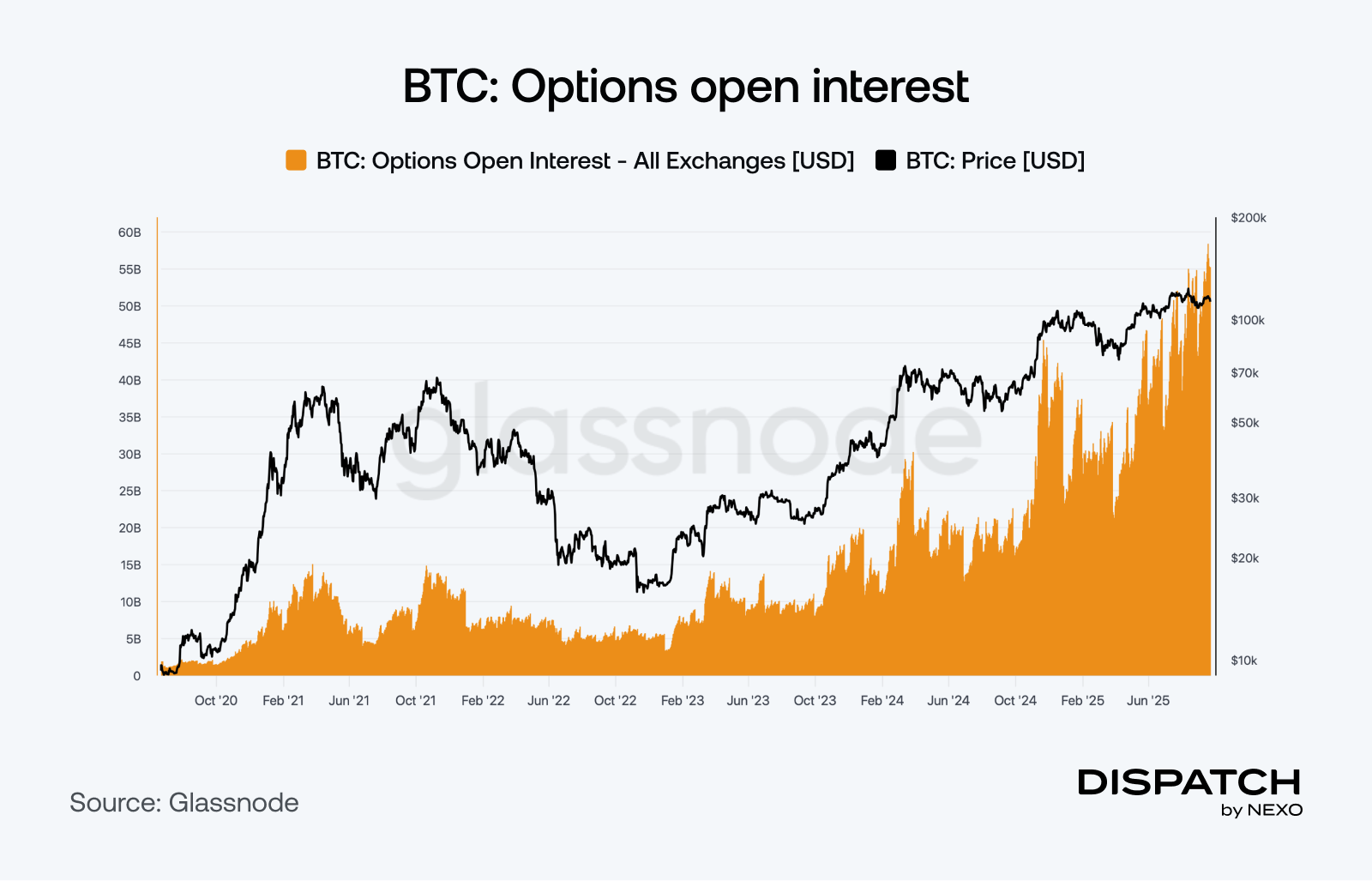

Choices markets are additionally flashing historic alerts, with open curiosity at document highs and expiry flows set to play an outsized position – extra on this on this week’s knowledge story under.

The counterweight of macroeconomics: The Fed’s 25bps lower on September 17 lifted Bitcoin briefly, however Fed chair Jerome Powell described it as “risk management” and careworn no urgency for speedy easing. Markets now look to October 29 and December 10 for additional cuts, with the tempo hinging on labour knowledge. A powerful jobs image would let the Fed proceed cautiously, whereas weak point – rising unemployment or softer payrolls, may drive deeper cuts, releasing liquidity that helps threat property.

The influence is already seen: digital asset funds drew $1.9 billion within the week after the choice, $977 million into Bitcoin. 12 months-to-date inflows of $25 billion spotlight firepower ready for affirmation.

The balancing in investor conduct: On-chain, Bitcoin trades above the $115,200 cost basis of 95% of supply. Holding this line alerts confidence; dropping it dangers a contraction again towards $105,500–$115,200. Sentiment-wise, long-term holders remain regular, whereas short-term merchants await a breakout above $124,000 to substantiate the following leg.

Company treasuries proceed to build up, if at a slower tempo. Technique added 850 BTC, whereas Japan’s Metaplanet was extra aggressive. Establishments are reinforcing the thesis, with Deutsche Financial institution evaluating Bitcoin’s adoption arc to gold’s transition from skepticism to a reserve asset. Volatility is already close to historic lows, underscoring its rising position in portfolios.

This week’s huge concept is steadiness — and up to now in 2025, Bitcoin has tilted it in its favor. By holding above key ranges, attracting inflows, and retaining long-term conviction intact, it has saved the scales leaning its means. Buying and selling flows gasoline volatility, macro units the load, and investor conviction steadies the rope. The following gust of wind will determine the following transfer.

Ethereum

Is energy constructing beneath ETH’s floor?

Ether has cooled close to $4,200 after a failed push above $4,700, however community and investor alerts stay constructive. Charges rose 35% final week and energetic addresses climbed 10%, lifting validator yields and accelerating ETH’s burn. Company treasuries added practically 878,000 ETH prior to now month, whereas spot ETFs swelled to $24.7 billion in AUM. Alternate balances are at five-year lows, lowering near-term promote stress.

What may spark momentum again? One catalyst is the Fusaka improve, set for December 3, with additional expansions later within the month and into January that can greater than double blob capability. The improve is designed to make Layer-2s cheaper and extra environment friendly, reinforcing Ethereum’s scaling roadmap. With stable on-chain exercise, institutional demand, and Fusaka on the horizon, the foundations for a breakout toward $5,000 probably stay in place.

TradFi tendencies

Will crypto make it to retirement financial savings (formally)?

A brand new coverage shift in Washington is opening the door for digital property to enter mainstream retirement plans. President Trump’s Government Order 14330, signed in August, directs regulators to replace guidelines so savers can diversify past conventional shares and bonds, explicitly backing “different property” that embrace cryptocurrencies.

Quick ahead to in the present day, lawmakers are now pressing the SEC and Division of Labor to maneuver shortly, arguing that thousands and thousands of retirement savers ought to have the identical entry to digital property as establishments. If carried by means of, the change would deliver crypto immediately into 401(okay)-style plans, increasing demand effectively past in the present day’s ETF buildings and embedding Bitcoin and Ethereum alongside the core constructing blocks of long-term wealth.

Macroeconomic roundup

The countdown to the following Fed fee lower

Fed Chair Jerome Powell set the tone this week, warning of the dual dangers of sticky inflation and a softening job market whereas insisting coverage is “not on a preset course.” His balanced stance highlights a break up amongst Fed officers—some pushing for sooner cuts to protect employment, others urging warning with inflation nonetheless above goal, leaving markets assured of one other quarter-point trim on the October 29 assembly. Right here’s what’s on the radar this week as potential alerts for the trail forward:

Jobless Claims (Thu): Preliminary claims have trended larger since July, with final week at 231,000 and forecasts for a modest rise to 235,000. Continued will increase would strengthen bets on deeper cuts and help short-term BTC demand, whereas regular numbers preserve the deal with inflation dangers.

PCE Inflation (Fri): The Fed’s most popular inflation gauge is predicted to be hotter at 0.3% MoM and a couple of.7% YoY, with core PCE regular at 0.3% month-to-month however rising to three% yearly. A sticky print would restrict the Fed’s flexibility, weighing on crypto, whereas softer knowledge would open the door to extra aggressive easing.

The week’s most attention-grabbing knowledge story

The BTC choices compass

Bitcoin choices open curiosity has climbed to an all-time excessive of just about $60 billion, underscoring the rising position of derivatives in shaping market dynamics. The main focus now turns to the September 26 expiry, the biggest in Bitcoin’s historical past. Expiries of this measurement can affect spot costs within the run-up, as seller hedging flows reply to concentrated positions. With a lot of the market clustered round $110,000, expiry day may act as a gravitational pull earlier than releasing the marketplace for sharper strikes.

The numbers

The week’s most attention-grabbing numbers

32 — The variety of international locations now pursuing Bitcoin publicity by means of laws or state-backed packages

241,700 — That’s the estimated variety of crypto millionaires worldwide, up 40% year-over-year.

$37.7 million — First-day buying and selling quantity for the brand new XRP ETF, the strongest debut of any U.S. ETF in 2025.

$632 million — Metaplanet’s newest Bitcoin purchase, making it the fifth-largest company holder with 25,555 BTC value $2.7B.

Week 38 — This week marks the thirty eighth of the 12 months, traditionally Bitcoin’s third-worst, with common returns of -2.25%, per Coinglass.

Scorching matters

Surely, Bitcoin can beat that.

Do you remember 2017?

Crypto regulation goes transatlantic.

Dispatch is a weekly publication by Nexo, designed to help you navigate and take action in the evolving world of digital assets. To share your Dispatch suggestions and comments, email us at [email protected].