Cryptocurrency Prices by Coinlib

Will This autumn revive Bitcoin’s rally?

On this patch of your weekly Dispatch:

- A brand new stablecoin projection

- Solana’s newest foray

- One other week of labor (experiences)

Market forged

BTC: Impartial alerts in a decent vary

On the weekly chart, Bitcoin seems to be range-bound after a quick correction and rebound from the center Bollinger Band, a basic gauge of volatility and pattern. The ADX is fading, confirming weak directional power. Each RSI and the Stochastic Oscillator stay impartial, whereas the MACD sits beneath zero, providing little conviction.

The each day chart tells the identical story. Worth is urgent towards the center Bollinger Band, however most alerts level to uneven commerce. RSI and Stochastic keep impartial, whereas the MACD hovers close to zero — a bullish set off would require a moving-average crossover. With ADX readings extraordinarily low, the setup underscores simply how little pattern momentum the market at present has, with assist seen round $112,000–$110,000 and resistance capped close to $115,000–$117,000.

The large thought

Can Bitcoin regain momentum in This autumn?

Final week in Dispatch we unpacked the forces driving Bitcoin. However the world’s main crypto asset got here underneath strain, briefly sinking beneath $110,000. This week, we return to the query: what might push Bitcoin greater within the months forward? Historical past says This autumn tends to be favorable, however the path ahead will likely be formed by a mixture of macro, flows, resilience, and shortage.

Macroeconomic crosscurrents

This week’s U.S. labor knowledge takes on outsized significance: softer prints would strengthen the case for Fed charge cuts — a liquidity shift that danger property, together with crypto, are fast to cost in. Resilient knowledge, however, might hold the Fed in “greater for longer” mode, limiting upside. Past jobs, the This autumn calendar is heavy: GDP releases on Oct. 30, Nov. 26, and Dec. 19, Core PCE at every month-end, and CPI mid-month. Add within the Fed’s Oct. 28–29 and Dec. 9–10 conferences, and Bitcoin faces a macro gauntlet the place each print can tilt liquidity expectations.

Wall Avenue’s vacation purchasing checklist: extra Bitcoin

Heading into This autumn, institutional demand continues to set the tempo. Spot Bitcoin ETFs have now pulled in $21.5 billion in internet inflows year-to-date, with solely February, March, and August exhibiting outflows. That’s a median of $2.4 billion monthly, almost double Bitcoin’s contemporary issuance of round 450 BTC month-to-month, or $1.35 billion at $100,000. If this tempo persists, it units the stage for a textbook provide crunch, the place Wall Avenue’s regular bid absorbs greater than miners can produce, tilting the stability firmly towards demand.

Bitcoin’s value resilience underneath hearth

September dealt Bitcoin its sharpest wobble since spring, with costs sliding almost $3,700 in simply 5 days. That transfer briefly lifted the share of provide in loss from 6% to 11% and doubled UTXOs in loss from 2.7% to five.4%. Internet Unrealized Revenue/Loss (NUPL) contracted from 0.54 to 0.52, trimming paper beneficial properties however stopping properly in need of capitulation.

Volumes spiked into the decline earlier than fading rapidly — a stark distinction to March’s steep drop to $70,000, when loss-bearing provide ballooned to 26% and promoting strain grew to become self-reinforcing. This time, the market bent however didn’t break.

The lesson: at six-figure ranges, even modest pullbacks now develop loss-bearing provide, but the market has to date handled them as turbulence fairly than disaster. Bitcoin’s greater base is being stress-tested — and, for now, the construction is holding.

From BTC abundance to BTC shortage

With 95% of Bitcoin’s provide quickly in circulation, what issues now could be liquidity. Lengthy-term holders and huge entities controlling 1,000+ BTC are on observe to lock up over six million cash by year-end, almost a 3rd of all that can ever exist.

This tightening float has already powered contemporary highs and raises the stakes: shortage helps the long-term case, however concentrated promoting might nonetheless rattle markets. For buyers, the true query isn’t whether or not to carry Bitcoin, however how. Fastened-term yield methods, like these on Nexo, flip shortage into each appreciation and revenue.

Scorching in crypto

Solana steps up

Solana has grabbed the highlight this week on each the ETF and infrastructure fronts. In response to Bloomberg’s James Seyffart, a wave of amended filings from Constancy, Franklin Templeton, CoinShares, Bitwise, Grayscale, Canary Capital, and VanEck suggests spot Solana ETFs with staking might hit the market inside weeks. Constancy even disclosed plans to stake its SOL holdings for yield — a notable transfer as issuers and the SEC look like ironing out particulars. Seyffart famous the updates present “indicators of motion” and will pave the best way for approval as early as mid-October.

On the tech facet, Leap Crypto’s Firedancer crew has proposed eradicating Solana’s per-block compute unit restrict after the Alpenglow improve, which already guarantees to slash block finality from 12.8 seconds to only 150 milliseconds. The plan might create a efficiency flywheel by incentivizing validators to improve {hardware}, although some warn of centralization dangers. Collectively, the ETF momentum and structural upgrades underline Solana’s drive to entrench itself as each an institutional product and a high-performance chain.

TradFi tendencies

Stablecoins scale into the trillions

The stablecoin market has smashed previous $300 billion in provide this 12 months, led by USDT’s $173 billion dominance and USDC’s surge following its IPO. Every day wallet-to-wallet transfers in Tether alone now high $17 billion, underscoring how deeply stablecoins have embedded themselves into international funds.

Citi added gasoline to the optimism, lifting its 2030 forecast to $1.9 trillion (bull case: $4 trillion), citing regulatory readability from the GENIUS Act and accelerating adoption. With transaction volumes already close to $1 trillion monthly, Citi sees deposit substitution, crypto market progress, and even banknote alternative driving the following leg greater.

Macroeconomic roundup

Will the labor market prepared the ground to decrease charges?

This week’s U.S. labor knowledge takes on outsized significance: softer prints would strengthen the case for Fed charge cuts — a liquidity shift that danger property, together with crypto, are fast to cost in.

JOLTS (Tue): Forecast at 7.1 million openings, down from July’s 7.2 million. One other decline would underline cooling demand and enhance rate-cut bets.

ADP Employment (Wed): Anticipated at +40,000, down from +54,000 in August. Weak hiring helps a softer Fed stance however dangers stoking recession fears.

Preliminary Jobless Claims (Thu): Seen at 228,000 vs. 218,000 prior. Larger claims would add to dovish strain, whereas regular prints hold the concentrate on inflation.

Nonfarm Payrolls & Unemployment (Fri): Payrolls seen at +45,000 vs. +22,000 final month, with unemployment regular at 4.3%. Modest beneficial properties with slack out there could be seen as liquidity-friendly for danger property.

The week’s most fascinating knowledge story

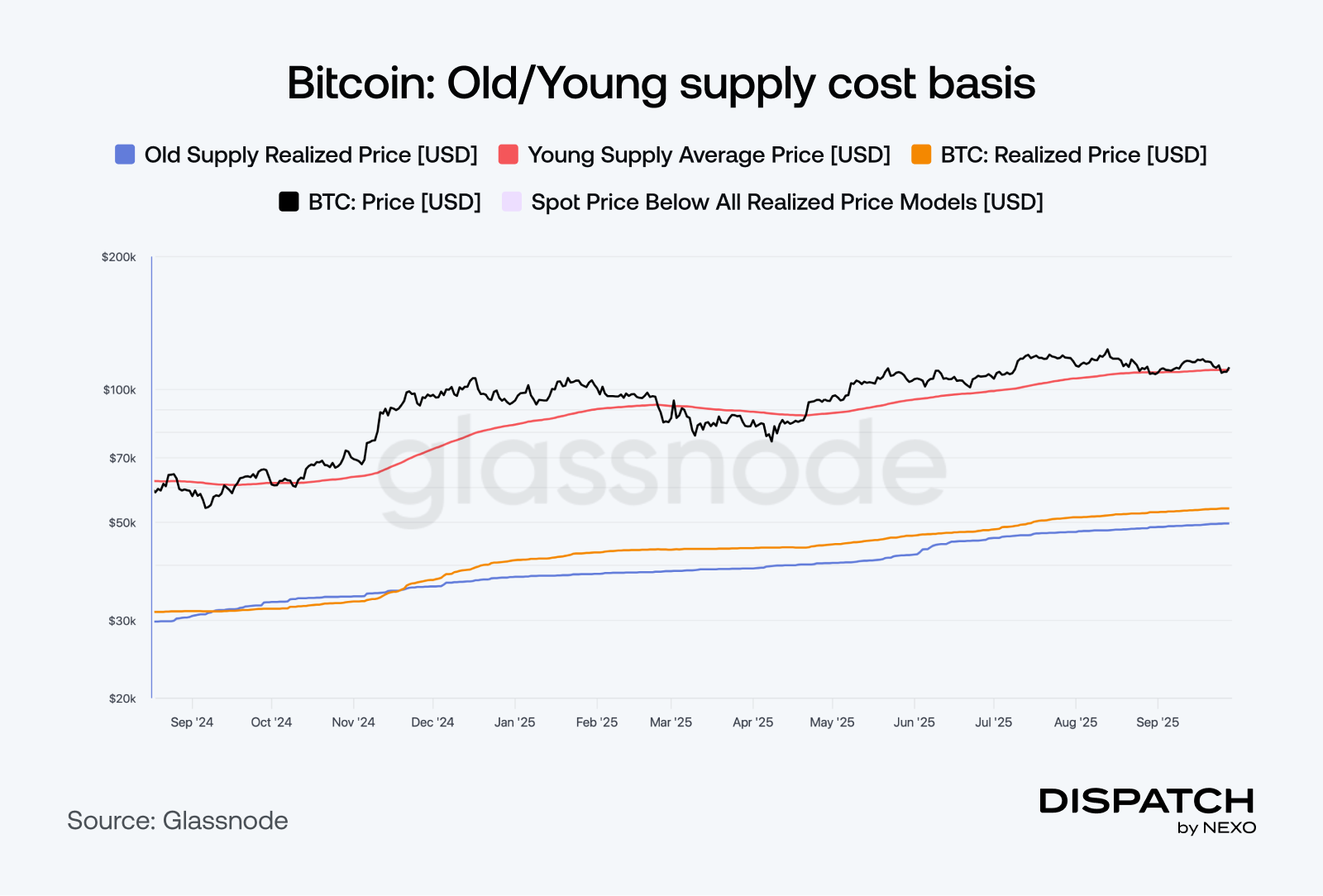

Previous vs new BTC holders

Bitcoin’s value motion displays a tug-of-war between previous and new holders. Lengthy-term holders — those that gathered years in the past — resolve how a lot provide stays locked away, successfully setting the ground by limiting liquidity. In the meantime, short-term holders, with cash acquired up to now six months, usually decide when income are realized. Their price foundation, at present clustered close to $110,775, has repeatedly acted as a pivot in latest months. On this method, Bitcoin’s ranges are formed each by the conviction of previous holders and the willingness of recent entrants to take revenue.

The numbers

The week’s most fascinating numbers

- 640,031 BTC — Technique’s stash, price $71.8 billion.

- $46 billion — Stablecoin internet inflows over the previous 90 days.

- 71.8 million SOL — Solana’s ATH futures open curiosity price $14.5 billion.

- $300,000 — Analysts’ projected vary for Bitcoin’s bull market, with upside potential fueled by gold correlation.

- 90%+ — CME FedWatch odds of a 25 bps Fed charge minimize on the subsequent October assembly.

Scorching subjects

The evolution of the world’s leading digital asset.

Is that a dip on the charts?

How cool is that Nexo chip!

Dispatch is a weekly publication by Nexo, designed to help you navigate and take action in the evolving world of digital assets. To share your Dispatch suggestions and comments, email us at [email protected].