Cryptocurrency Prices by Coinlib

The logic in Bitcoin’s all-time excessive

On this patch of your weekly Dispatch:

- Bitcoin’s true bull-market sign

- The stablecoin report

- A dozen of ETFs await

Market forged

Robust shopping for strain retains BTC's momentum

After setting a brand new all-time excessive, Bitcoin is testing the higher Bollinger Band, signaling sustained bullish momentum. The momentum indicators — the Relative Energy Index (RSI) and the Stochastic Oscillator — are each rising towards overbought ranges, reflecting sturdy shopping for strain. The development indicator, the Common Directional Index (ADX), is approaching the important thing 25 stage, which usually confirms the presence of a robust development. In the meantime, the Shifting Common Convergence Divergence (MACD), which bridges each momentum and development evaluation, is near a bullish crossover, reinforcing the optimistic setup.

On the each day chart, the development stays intact. The ADX sits above 30, confirming a mature uptrend, whereas the RSI and Stochastic present no indicators of exhaustion. The MACD histogram continues to strengthen, indicating persistent upside momentum. A decisive break above the current peak may pave the way in which towards the $130,000 psychological stage, whereas former resistance zones close to $120,000 and $117,000 are probably to supply assist on any short-term pullbacks.

The massive concept

Bitcoin’s Uptober conquest

Bitcoin surging to report highs above $126,228. has as soon as once more turn into the clearest reflection of market sentiment, a macro barometer, and a secure haven born of shortage.

The logic is easy: when the general market surroundings is dynamic, buyers flip to what’s finite, particularly Bitcoin. This yr’s Uptober isn’t pushed by euphoria however by warning. A U.S. authorities shutdown, weak employment knowledge, and fading confidence in fiscal self-discipline have reignited the debasement trade — capital rotating towards property that stand exterior the normal system. Buyers aren’t chasing hype; they’re looking for a hedge in opposition to financial uncertainty. Although with a Concern & Greed studying of 62, market conviction is clearly flirting with market greed. That is validated by an increase in open curiosity, which at over $50 billion, can be flirting with all-time highs.

Behind the transfer lies the ETF machine. U.S. spot Bitcoin funds absorbed $3.2 billion in inflows last week, the second-largest haul on report, pushing cumulative 2025 inflows close to $60 billion. These automobiles have reshaped market construction, changing speculative bursts into regular, regulated accumulation. As provide on exchanges continues to skinny, ETFs have turn into the engines of Bitcoin’s ascent, pulling liquidity from the normal system onto the chain.

Institutional adoption is reinforcing the identical dynamic. Morgan Stanley now recommends allocating 2–4% of portfolios to Bitcoin, a transfer that would channel up to $80 billion in new inflows given the agency’s $2 trillion in suggested property. JPMorgan’s fashions level to a good worth of $165,000 on a gold-adjusted foundation, whereas Customary Chartered tasks between $135,000 and $200,000 by year-end as ETF demand and institutional publicity deepen. Every new forecast underscores the identical conclusion: Bitcoin’s position within the macro ecosystem is now not experimental — it’s structural.

This rally isn’t about short-term hypothesis; it’s a few market recalibrating to a brand new financial actuality. Bitcoin continues to rise. In an age outlined by instability, it’s not stunning that buyers are selecting the one asset that was constructed for it. Shortage, it seems, is probably the most dependable hedge in opposition to uncertainty.

Sizzling in crypto

$300 billion and counting: stablecoins attain all-time excessive

They might not swing like altcoins, however stablecoins are quietly powering certainly one of crypto’s largest shifts this yr. The sector’s whole market capitalization simply surpassed $300 billion, a brand new all-time excessive that highlights accelerating inflows beneath an already buoyant market.

Based on DeFiLlama, provide is up 6.5% previously month, led by Tether (USDT) with 58% share and USDC with practically 1 / 4. Stablecoins now characterize over 7% of the crypto market, cementing their position because the ecosystem’s settlement and liquidity spine.

TradFi developments

Is an ETF wave in sight?

A flood of recent crypto ETFs is ready for the inexperienced mild, whereas the U.S. authorities shutdown has put them on maintain. Not less than two dozen funds have been filed final week, masking property from XRP, Litecoin (LTC), and Bitcoin Money (BCH) to Sui (SUI) and Hype (HYPE), with some together with staking options.

The timing was preferrred: the SEC’s current approval of recent itemizing requirements means these ETFs may skip the gradual 19b-4 assessment course of, paving the way in which for quicker launches as soon as operations resume.

When the federal government reopens, the company may clear a number of merchandise in batches — setting the stage for the broadest growth of crypto ETFs but, spanning each blue-chip and rising tokens, and signaling how deeply conventional finance is embedding into the digital-asset market.

Macroeconomic roundup

Macro nonetheless units the tone

Bitcoin’s macro sensitivity is again in play this week, with the Fed as soon as once more setting the tone. Merchants will parse the newest FOMC minutes, Powell’s remarks, and jobless claims for clues on the central financial institution’s coverage path — indicators that would steer each liquidity expectations and crypto sentiment.

FOMC Minutes (Wed): The September assembly marked the primary charge lower in 9 months, reducing the federal funds charge to 4.00–4.25%. This week’s minutes could reveal whether or not policymakers view the transfer as a one-time adjustment or the beginning of an extended easing cycle. A dovish tone may lengthen Bitcoin’s rally, whereas a cautious stance could cool urge for food for danger.

Jerome Powell Remarks (Thu): Hours after the minutes’ launch, Fed Chair Powell will communicate, an occasion that always proves decisive for short-term market path. Merchants will pay attention for whether or not he frames coverage as “danger administration” or indicators endurance. Dovish hints may raise crypto alongside equities; a firmer tone may spark a pullback.

Preliminary Jobless Claims (Thu): Labor stays the important thing macro gauge for Bitcoin. Claims round 260,000–300,000 on the four-week common would increase recession issues and gas expectations of additional easing. Briefly, macro will set the stage this week — however Bitcoin is again within the starring position.

The week’s most fascinating knowledge story

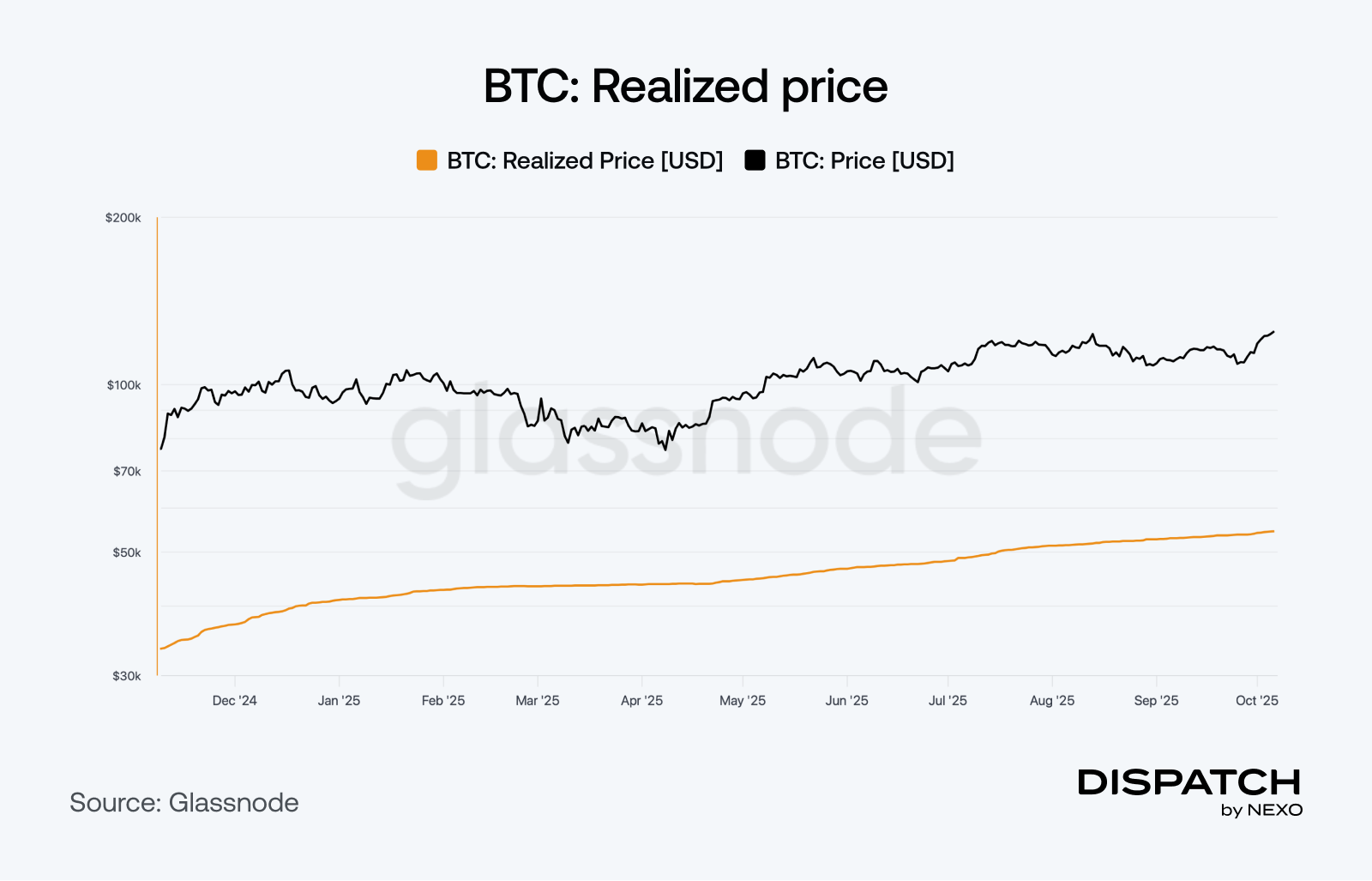

Bitcoin’s flooring of conviction

Bitcoin’s realized worth — the chain’s true value foundation — simply hit a report $54,000, a robust on-chain sign that the bull market is real. It means cash are altering arms at larger costs throughout each short- and long-term holders, with outdated provide transferring into ETF and institutional custody. This sort of synchronized rise solely occurs when demand is deep and structural, not speculative. The community’s “common value” has shifted larger — elevating Bitcoin’s flooring, tightening revenue margins, and displaying that possession is rotating into stronger arms. When realized worth rises, Bitcoin’s flooring of conviction strikes up with it — making every dip costlier, and each rally extra anchored in real possession fairly than hype.

The numbers

The week’s most fascinating numbers

- $4010 — Gold’s latest all-time excessive, after gaining 51% year-to-date.

- $5.95 billion — Document weekly inflows into crypto funds, as buyers sought refuge from smooth U.S. jobs knowledge.

- $530 million — Mixed worth of Solana Firm’s Solana holdings and money reserves.

- $1 trillion — Estimated shift from emerging-market financial institution deposits into stablecoins over the following three years.

- 10% — Of all Ethereum now sits in ETFs and company treasuries, a milestone for institutional adoption.

Sizzling subjects

Does that make the Bitcoin ETF the best ETF?

There’s only one answer to a weak USD.

$644,000 per BTC is a nice round number.

Dispatch is a weekly publication by Nexo, designed to help you navigate and take action in the evolving world of digital assets. To share your Dispatch suggestions and comments, email us at [email protected].