Cryptocurrency Prices by Coinlib

Dispatch #269: ETH & SOL: Heavyweights on the radar

On this patch of your weekly Dispatch:

- Altcoin progress engines

- Macro knowledge in focus

- A wave of liquidity

Market solid

Between assist and resistance: Bitcoin’s crossroads

Bitcoin is testing a serious assist space on each every day and weekly charts. The worth trades just under the decrease Bollinger Band — a volatility indicator usually signaling oversold situations — whereas the 50-period easy shifting common (SMA), a key pattern gauge, sits close by, creating potential for a short-term bounce if promoting strain eases. Nonetheless, momentum indicators stay weak: the Relative Power Index (RSI) and Stochastic oscillators proceed to show decrease, with the latter already oversold, whereas the MACD histogram — a pattern and momentum hybrid — stays deep in damaging territory. On the every day chart, Bitcoin once more touches the decrease Bollinger Band as RSI nears 30 and the MACD holds under zero. The $104,000–$105,000 zone, strengthened by the weekly 50-SMA and the psychological $100,000 stage, stays essential assist, with resistance seen round $106,500 and $108,000.

The large concept

ETH and SOL: the heavyweights step in

October traditionally sees stronger efficiency for Bitcoin and digital property, however this 12 months’s short-term strikes diverged from expectations. Renewed U.S.–China commerce tensions, geopolitical uncertainty, and a cautious Federal Reserve signalling {that a} December charge reduce might not materialize weighed in the marketplace.

Bitcoin completed the month 5% decrease — its weakest October since 2018 — whereas November opened with one other pullback, bringing complete crypto market capitalization again to July ranges under $3.5 trillion.

After a 12 months of regular inflows and new highs, Bitcoin’s momentum has been stalled. Revenue-taking by long-term holders and softening ETF demand have weighed on sentiment. Broader altcoin efficiency has lagged all through the cycle as retail consideration drifts towards equities, drawn by simpler beneficial properties and decrease perceived danger.

The outcome has been a sentiment-driven correction — however not a structural breakdown. Quantitative tightening is fading, and coverage expectations for 2025 proceed to ease.

Brief-term strain has not altered long-term dynamics. And that’s the place Ethereum and Solana step in.

Ethereum: the liquidity engine

Ethereum’s October story wasn’t about worth; it was about depth. The community processed a report $2.82 trillion in stablecoin quantity, up 45% from September’s all-time excessive. Merchants rotated into stablecoins to not retreat however to seize yield and place for what’s subsequent.

USDC led with $1.62 trillion, adopted by USDT’s $895 billion, reaffirming Ethereum’s function as crypto’s liquidity coronary heart — the chain the place capital consolidates earlier than its subsequent deployment.

The following catalyst arrives on December 3 with the Fusaka hard fork, which quintuples Ethereum’s block fuel restrict (30M → 150M), doubles blob capability, and introduces PeerDAS — a data-availability system that enhances validator effectivity. It’s a serious step in strengthening Ethereum’s modular spine simply as adoption accelerates.

That infrastructure issues. Ethereum is changing into the settlement layer for real-world property (RWAs), with Commonplace Chartered projecting tokenized RWAs on the community to rise from $35 billion at present to $2 trillion by 2028, spanning money-market funds, equities, and personal credit score. With the GENIUS Act offering regulatory readability, Ethereum’s rails are widening for the subsequent cycle.

Solana: the pace play

If Ethereum is the system’s spine, Solana is its engine. The chain’s first-ever spot ETFs have attracted $269 million in cumulative inflows, pushing complete Solana ETF property above $500 million — the quickest begin amongst any new crypto ETP this 12 months. It’s a robust sign of institutional curiosity in Solana’s throughput and staking-yield attraction.

That is greater than a headline rotation. Solana’s monolithic design retains all execution on one ledger, permitting immediate confirmations and sub-cent charges. The upcoming Firedancer consumer — constructed for redundancy and scale — will drive finality under 150 milliseconds, making Solana one of many quickest decentralized techniques in existence. The community that when buckled beneath congestion now runs with precision.

Resilience past the pullback

Whilst at present’s correction weighs on costs, Ethereum and Solana carry distinct strengths that underpin the broader digital property market. One leads on liquidity and institutional integration; the opposite on efficiency and usefulness. Their fundamentals are diverging from short-term sentiment, setting the stage for future appreciation even when momentum takes time to rebuild.

Bitcoin’s pause doesn’t mark an finish — it’s a recalibration. The market is rotating towards the place worth accrues subsequent. And on this part, Ethereum and Solana are those carrying the torch.

TradFi traits

A liquidity wave lifts all boats

After months of tightening liquidity, the tide is popping. The Federal Reserve injected $29 billion into the U.S. banking system — its largest single-day repo operation because the dot-com period, as stress in Treasury markets deepened and short-term funding prices spiked. Throughout the Pacific, China’s central financial institution matched the transfer with a report money infusion into home lenders, aiming to stabilize credit score progress and counter deflationary strain. Collectively, these actions mark a notable flip in international liquidity dynamics — a coordinated push to ease funding stress and re-energize danger sentiment.

With yields easing and cash provide increasing, markets are shifting again towards danger publicity, and Bitcoin is more and more a part of that dialog. The world’s largest crypto usually mirrors international liquidity cycles, and the newest central financial institution strikes recommend situations may once more be aligning in its favor. For now, buyers gauge how far policymakers are prepared to go.

Macroeconomic roundup

November’s macro barometer

Bitcoin’s macro sensitivity is again in play as merchants digest a resolved U.S.–China tariff truce and a cautious Federal Reserve. Regardless of tariff reduction and a 25-bps reduce that ended QT, Powell’s warning {that a} December charge reduce “isn’t a given” hijacked sentiment, sending BTC down 1.7% on the week.

JOLTS Job Openings (Tuesday): A comfortable learn would trace at labor cooling and revive easing hopes; stronger knowledge may cement a December maintain.

ADP Employment (Wednesday): A key preview for Friday’s payrolls — an upside shock dangers tightening liquidity sentiment.

ISM Companies PMI (Wednesday): Gauges demand and enterprise resilience; a dip would assist the Fed’s dovish bias.

BoE Fee Determination (Thursday): Markets count on a maintain at 4.00%. Any dovish sign may bolster international danger urge for food.

Geopolitical readability might have returned, however financial uncertainty retains the market on edge. For now, Bitcoin stays the barometer.

The week’s most attention-grabbing knowledge story

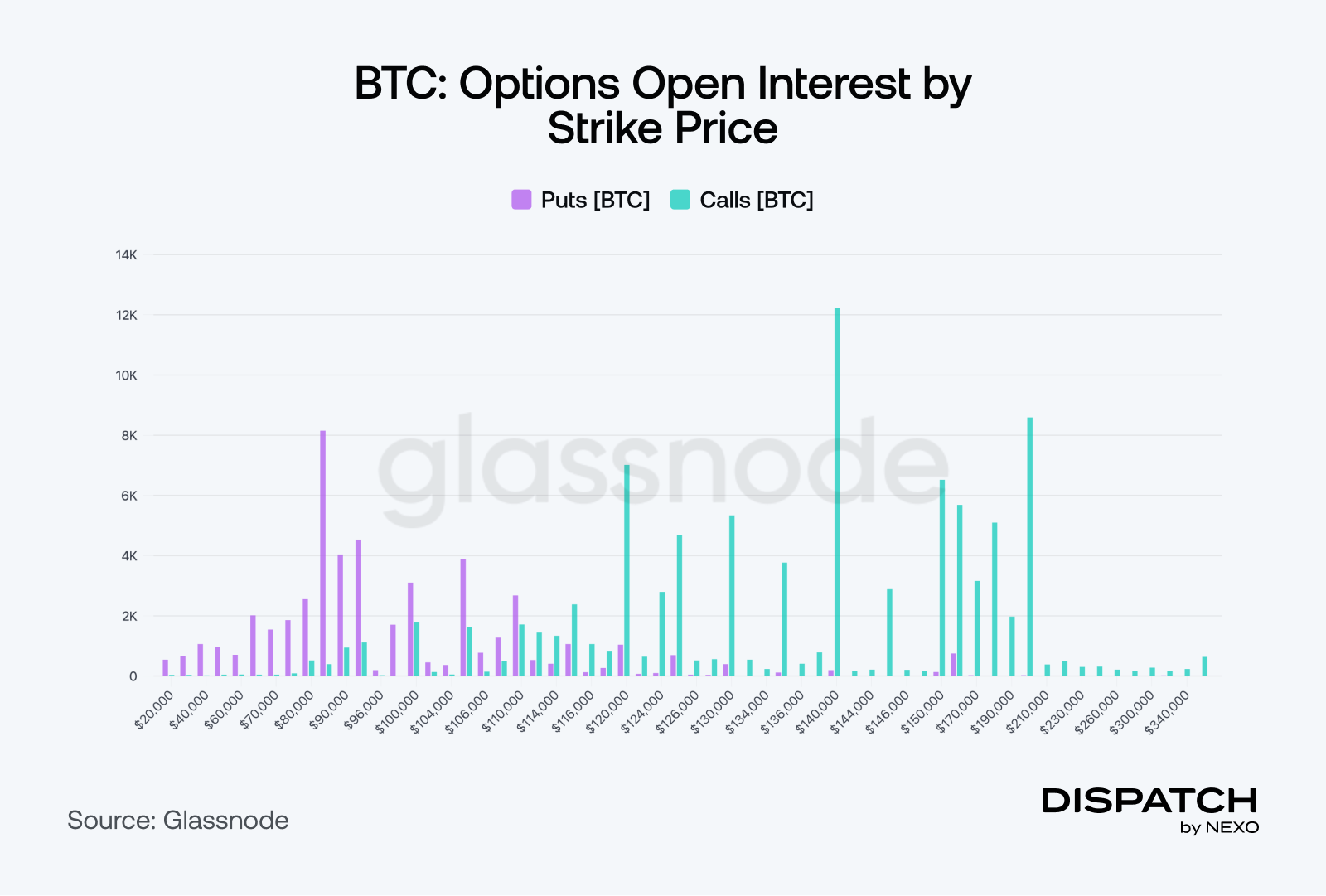

What are the choices for BTC in 2025?

Positioning in Bitcoin stays broadly bullish regardless of a comfortable begin to November. BTC is hovering under $108,000 after weekend range-trading and renewed ETF outflows, however merchants are largely viewing the pullback as consolidation inside an ongoing uptrend. Many nonetheless goal $140,000 by Christmas, betting that contemporary spot demand and bettering liquidity will revive momentum. Whale cohorts proceed to carry the majority of provide, derivatives leverage has eased, and volatility has cooled — a setup that implies the market is resetting, not reversing.

The numbers

The week’s most attention-grabbing numbers

$10 billion — Tether’s year-to-date revenue surpasses Financial institution of America and nears Goldman Sachs, pushed by returns on United States Treasuries.

$1 trillion — OpenAI is making ready a 2026 preliminary public providing that would ease its reliance on Microsoft’s 27 % stake.

70 million — Solana now handles tens of thousands and thousands of every day transactions, with decentralised trade exercise exceeding $143 billion this month.

Sizzling matter

So it’s only up now?

Bitcoin for treasury!

Are we going to see a scale-up in price?

Dispatch is a weekly publication by Nexo, designed to help you navigate and take action in the evolving world of digital assets. To share your Dispatch suggestions and comments, email us at [email protected].