Cryptocurrency Prices by Coinlib

Why Analysts Are Break up on Bitcoin Miner MARA's Prospects – Decrypt

Briefly

Bitcoin and crypto-related shares fell final week.

Analysts at JPMorgan reduce the value goal for prime Bitcoin miner MARA.

However researchers at Compass Level upgraded the inventory.

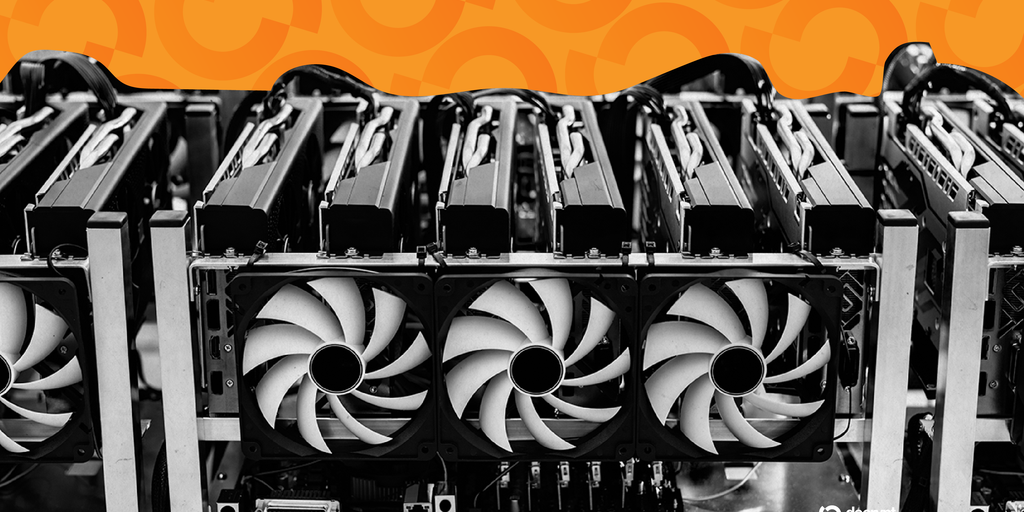

Two funding banks are break up over how prime American Bitcoin miner MARA Holdings will carry out, with JPMorgan slashing its most up-to-date value goal however Compass Level analysts upgrading its score in separate notes on Monday. The JPMorgan analysts reduce their December 26 value goal for the highest Nasdaq-listed miner from $20 to $13, noting that the dramatic fall of Bitcoin's value had decreased the worth of the corporate’s huge BTC holdings, whereas Compass Level highlighted the corporate’s stable fundamentals. The differing views got here as Bitcoin miners have been hard-hit in current weeks, together with different crypto-focused shares which have been stung by a dramatic downturn in crypto markets. MARA shares, inched up over $10 per share Monday morning, however have nosedived by about 43% over the previous month, in accordance with Yahoo Finance information. Bitcoin was not too long ago buying and selling at $88,417, up 1.6% over the previous 24 hours however down by practically 5% over the previous seven days, in accordance with crypto markets information supplier CoinGecko. The biggest digital asset by market worth is down practically 30% since hitting an all-time excessive of $126,088 in early October. Miami-based MARA is the second largest publicly traded crypto treasury, with 53,250 BTC price $4.6 billion at at the moment's costs. However Compass Level researchers stated in a Monday observe that the agency's basis was extra necessary—they usually up to date MARA's score whereas sustaining a $30 value goal. “We improve MARA to Purchase from Impartial as we imagine the sell-off associated to Bitcoin's retrace has overshot fundamentals,” the analysts wrote. “On a Bitcoin mining foundation alone, we view MARA as undervalued as the corporate continues to develop and leverage partnerships and cheaper energy,” they continued, including that the agency's “nascent AI enterprise” being “pure upside.” “We view MARA as a differentiated inventory within the AI sector for traders with considerations over capex cycles and long-term viability,” the analysts stated. JP Morgan analysts have been bullish on different miners, although, giving Cipher a value goal of $18 from $12 and CleanSpark an “obese” score. Additionally they raised IREN's goal to $39 from $28. CleanSpark shares have plummeted about 35% over the previous month, whereas Cipher and IREN are off greater than 20%. In a Myriad prediction market, two in three respondents anticipate Bitcoin to rise to $100,000 with the remaining believing its subsequent massive transfer can be right down to $69,000. Myriad is a unit of Dastan, the dad or mum of an editorially unbiased Decrypt.Every day Debrief NewsletterStart every single day with the highest information tales proper now, plus unique options, a podcast, movies and extra.