Cryptocurrency Prices by Coinlib

Dispatch #273: Quantitative easing: The following step up

On this patch of your weekly Dispatch:

- Bitcoin’s Christmas

- ETH’s Fusaka improve

- The ultimate 2025 macro take a look at

Market solid

Stabilising or settled: What's BTC's subsequent transfer?

Bitcoin’s technical setup leans cautious, with the weekly chart exhibiting the value hovering across the 100-period SMA — a long-term pattern gauge — whereas buying and selling under the decrease Bollinger Band, an indication that the latest draw back transfer could also be urgent the bounds of its standard volatility vary. The momentum indicators on this timeframe level to an identical image: the Stochastic oscillator is in oversold territory, the MACD histogram sits properly under zero to replicate weakened momentum, and the RSI is approaching the 30 degree, the place belongings usually start to stabilize. On the every day chart, the center Bollinger Band continues to behave as dynamic resistance after a number of unsuccessful makes an attempt to interrupt above it, whereas the oscillators right here give a extra combined learn: the Stochastic is impartial, the RSI is beginning to raise from low ranges, and the MACD histogram stays constructive however is steadily easing. Key ranges stay unchanged, with help at $85,000–$84,000 and $82,000 under, and resistance at $89,000 and $91,000.

The large thought

The (advanced) shift in BTC worth mechanics?

Bitcoin’s temporary transfer into the $90,000s pale over the weekend, reflecting a cooldown in a few of the demand engines that powered the early a part of the cycle. ETF inflows have normalized, stablecoin progress has paused, and futures leverage has eased. None of this breaks the broader pattern; it marks a shift from a mechanically bid market to 1 pushed extra by positioning.

Brief-term flows apart, the extra crucial story sits on the macro degree. As of December 1, the Federal Reserve ended quantitative tightening — a two-year drain of almost $2.4 trillion that quietly weighed on each nook of danger belongings, together with crypto. The Fed will not be calling this course of easing, and it isn’t QE, however directionally it means one factor: liquidity is now not shrinking on the tempo it as soon as was.

This issues as a result of the monetary system has reached the sensible limits of how a lot tightening it might take in. Financial institution reserves are lean, the excess-liquidity buffer is slim, and heavy Treasury issuance makes it more and more tough for the Fed to maintain circumstances tight with out creating stress elsewhere. When the system is that this stretched, even modest changes to make sure clean market functioning have a tendency to go away extra liquidity in place — and danger belongings really feel that shift shortly.

Crypto sits on the entrance of that sensitivity curve. Bitcoin traditionally responds extra to modifications in liquidity route than to the extent of rates of interest themselves. When liquidity stops contracting and begins to stabilize, even steadily, early flows usually reappear first in Bitcoin, then rotate into Ethereum, Solana, and the broader altcoin advanced. We noticed a model of this in 2019, when the pause in QT coincided with an altcoin backside and the early phases of Bitcoin’s subsequent leg — not an ideal analogue, however a helpful rhyme.

This cycle is completely different, however the setup is acquainted. Liquidity cushions are skinny, borrowing wants are excessive, and strain for gentler monetary circumstances is constructing. Markets are already leaning towards extra fee cuts in 2025 and the opportunity of a extra dovish Fed. Taken collectively, the surroundings forward appears meaningfully extra supportive than what crypto has endured over the past two years.

Ending QT received’t immediately restart Bitcoin’s demand engines, however it does change the enjoying discipline. The most important macro headwind has pale, changed by a backdrop the place liquidity is stabilizing and should start to tilt constructive. That’s a much better basis for danger belongings to seek out their footing. The approaching weeks will present whether or not this turns into a stabilizer or the beginning of one thing bigger — however the route of financial circumstances is shifting. In a market outlined by liquidity cycles, that issues greater than any non permanent softness in ETF flows or stablecoin provide.

The engines could also be cooling, however the tide beneath them is beginning to rise.

Ethereum

ETH’s tried-and-tested: An improve and a rally?

Ether seems to be discovering its footing after a 22% month-to-month pullback that noticed the asset drop under $3000. With stablecoin lending yields nonetheless close to 4%, Santiment points to a market removed from overheating — leaving room for a renewed push larger. ETF flows have turned constructive as properly, with spot ETH merchandise taking in $312.6 million this week, reversing a stretch of outflows. The ETH/BTC weekly chart is closing in on its first bullish ribbon flip in 4 years, sentiment has recovered from excessive lows, and December has traditionally averaged a 6.85% acquire for ETH. The backdrop is enhancing throughout the board.

This reset comes simply forward of Fusaka, scheduled for December 3, Ethereum’s second main improve of 2025. Its headline characteristic, PeerDAS, lets validators confirm solely slices of L2 information as an alternative of full blobs — lowering bandwidth, reducing settlement prices, and making L2 transactions sooner and cheaper. With 12 EIPs enhancing each L2 throughput and mainnet effectivity, and establishments like Constancy highlighting its strategic significance, Fusaka arrives as a possible near-term tailwind for ETH.

Macroeconomic roundup

The ultimate take a look at for the Fed’s fee reduce

A pivotal first week of December brings 4 main U.S. information releases that can form expectations forward of the Fed’s December 10 assembly. With markets already pricing a fee reduce, the setup leans supportive for danger belongings — and Bitcoin traditionally thrives when easing expectations construct. Contemporary forecasts from Financial institution of America add to the tailwind, projecting 2.4% U.S. progress in 2026 pushed by shopper power, AI funding, and friendlier commerce coverage. If that progress comes with the softer actual yields BofA anticipates, the macro backdrop turns into more and more constructive for BTC.

Powell Speech & Finish of QT (Mon): Powell’s remarks land because the Fed formally halts quantitative tightening. Any trace on December coverage or management uncertainty might swing rate-cut odds and danger sentiment.

ADP Employment (Wed): Final month noticed simply 42,000 jobs added. A softer print reinforces easing expectations; a stronger quantity might dent them.

Preliminary Jobless Claims (Thu): A clear learn on labor momentum. Rising claims help coverage easing; decrease claims argue for endurance.

PCE Inflation (Fri): The Fed’s most well-liked gauge. Cooling core PCE would validate disinflation and strengthen the case for a reduce; a warmer print dangers unsettling a market positioned for lodging.

The week’s most attention-grabbing information story

Will Christmas deliver again the $100K Bitcoin?

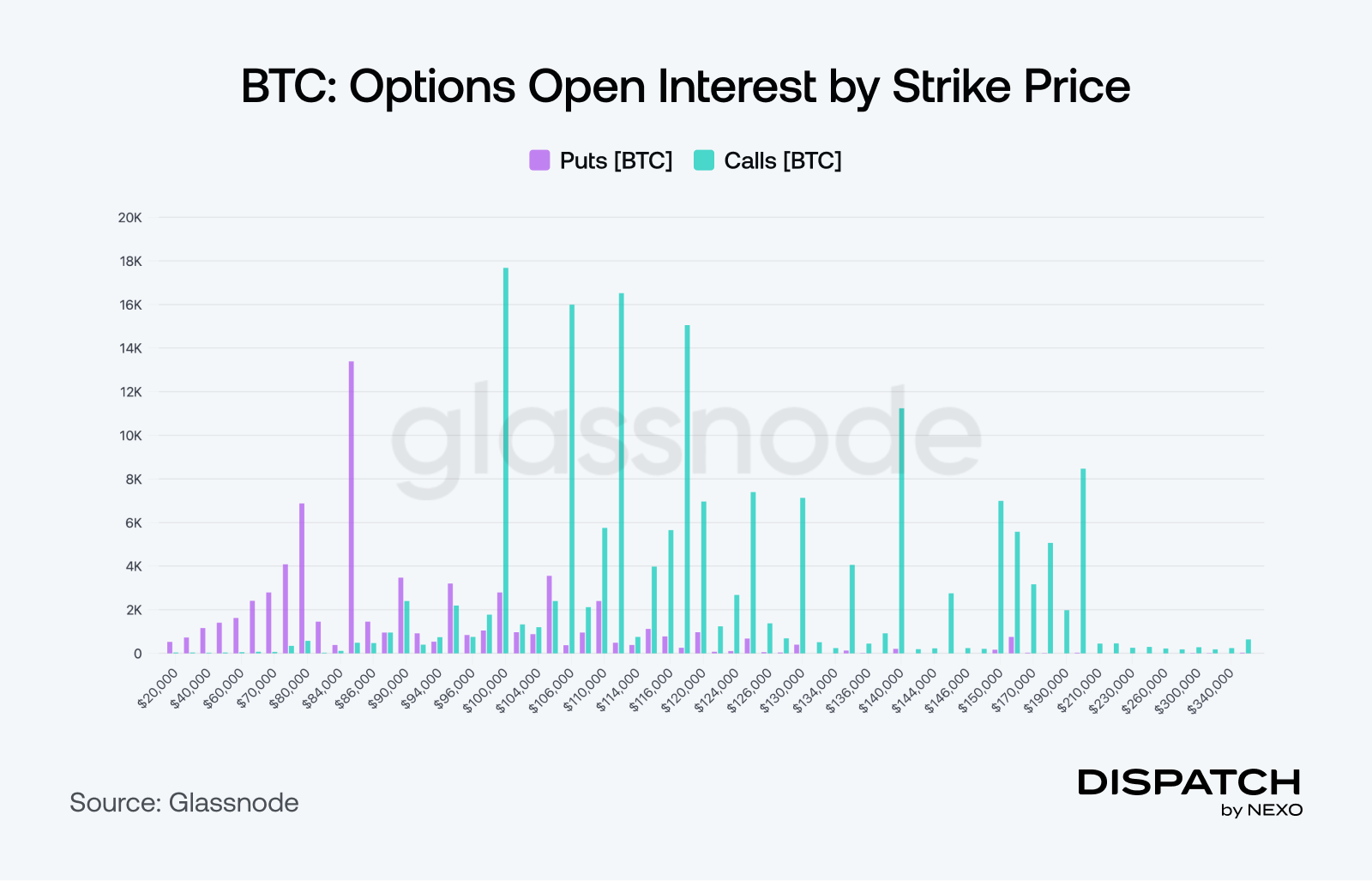

Bitcoin choices merchants are positioning for a year-end rebound, however not a moonshot. Current stream reveals huge gamers concentrating on a end round $100,000, with most bets capping upside nearer to the $110,000 vary. It’s an indication of cautious optimism: merchants see room for a restoration, simply not the euphoric “Santa rally” some hoped for. The broader learn is that confidence is returning, however expectations stay grounded. A transfer past $120,000 is mostly seen as a 2026 story quite than a December end result.

The numbers

The week’s most attention-grabbing numbers

$1.07 billion — Contemporary inflows into international crypto funds final week, snapping a $5.7B outflow streak and signaling revived demand.

65% — The upside some analysts see for XRP as spot ETFs draw $644M in November, whilst BTC and ETH merchandise noticed promoting.

$185 billion — ERC-20 stablecoin provide at all-time highs, with Binance reserves surging — main “dry powder” ready to deploy.

$4,836 — Ether’s composite honest worth throughout 12 valuation fashions, suggesting ETH is undervalued by 58%.

85% — The market’s conviction that the Fed will reduce charges in December.

Scorching matter

It appears the dip has been bought yet again.

Is the ETF-effect in sight for SOL and XRP?

Silver is on the move — and available to trade on Nexo and MetaTrader 5.

Dispatch is a weekly publication by Nexo, designed to help you navigate and take action in the evolving world of digital assets. To share your Dispatch suggestions and comments, email us at [email protected].