Cryptocurrency Prices by Coinlib

Will 2025 give Bitcoin a runway into 2026?

- XRP’s ETF milestone

- SOL’s newest improve

- BTC’s robust assist

Market forged

BTC navigates assist amid blended indicators

Bitcoin continues to retrace on the weekly chart, with value motion pulling again towards the 100 SMA, now examined for the third time in latest weeks and nonetheless holding as a notable trend-support indicator. The weekly construction leans cautious: BTC is monitoring alongside the decrease Bollinger Band, whereas momentum indicators reminiscent of RSI and Stochastic sit close to subdued ranges. The MACD histogram, a measure of pattern power, stays beneath the zero line, suggesting momentum has but to stabilize.

The every day chart displays an analogous setup. Worth is pressed in opposition to the decrease Bollinger Band, the Stochastic oscillator has moved into oversold territory, and the RSI continues to point out softer momentum. The MACD has additionally registered a bearish crossover, maintaining the near-term bias tilted to the draw back.

Consideration now turns to the $86,000–$85,000 assist space, with $80,000 rising as the following significant degree if draw back strain persists. On the upside, preliminary resistance is seen round $88,000–$89,000, adopted by $92,000–$93,000 ought to consumers regain management.

The massive thought

Bitcoin reaches a crossroad: Rising tailwinds and quiet headwinds

With 2025 drawing to an in depth, Bitcoin’s floor appears to be like subdued, but the foundations are firming. Regulation is advancing, establishments are allocating once more, and world liquidity is popping increased simply as speculative froth clears. Quick-term headwinds stay – from uneven information to cussed consolidation, however the broader setup continues to tilt in Bitcoin’s favor. So, right here’s Bitcoin’s stance because the 12 months ends.

Tailwinds: Coverage readability, institutional demand, and a world liquidity push

U.S. regulation is progressing in a method the market hasn’t seen earlier than. Senate Banking Chair Tim Scott says “actual progress” is underway towards a bipartisan digital-asset market-structure invoice after assembly with the heads of Financial institution of America, Citi, and Wells Fargo. With the Home already having handed its model, the Senate’s negotiations now carry actual weight. For establishments, clearer guidelines imply fewer boundaries — and extra confidence in allocating to the sector.

Establishments outdoors the U.S. are already transferring. Itaú Unibanco, Latin America’s largest personal financial institution, is advising a near-3% Bitcoin allocation as a long-term diversification and currency-protection instrument – steerage that mirrors Bank of America’s own allocation framework for its wealth shoppers. Bitcoin is more and more handled as a part of a contemporary portfolio, not a speculative add-on.

Crucial tailwind, nonetheless, is world liquidity. After three Fed cuts in late 2025 and the tip of quantitative tightening, liquidity is increasing once more. World M2 has reached an all-time high near $130 trillion, pushed largely by China however strengthened by U.S. Treasury measures designed to maintain funding circumstances easy. Traditionally, when liquidity rises, threat property observe – although crypto has not but mirrored this shift, with the entire market cap nonetheless down greater than 20% in This fall. That disconnect leaves room for a rebound as liquidity traits proceed into early 2026.

Altogether, coverage, institutional positioning, and liquidity level in the identical route: the pressures that outlined 2025 are easing.

Headwinds: Close to-term Chop, range-bound buying and selling, and macro wildcards

Within the quick run, Bitcoin’s chart nonetheless displays hesitation. The market is transferring inside a good vary, with liquidity clustering round $95,000 – a degree prone to appeal to value earlier than any decisive transfer. The broadly watched every day “bear flag” has merchants cut up, however on-chain information exhibits speculative losses and robust long-term holder conviction, a mixture usually seen earlier than recoveries moderately than pattern breaks.

Macro circumstances may add temporary volatility. CPI and unemployment information arrive this week, and the Financial institution of Japan’s potential price hike stays considered one of Bitcoin’s few clear short-term dangers given its historical past of tightening world liquidity. However these are tactical headwinds – not structural ones, and none meaningfully alter the bettering setup for 2026.

A ahead look: Indicators of the following transfer

The clearest signal {that a} bigger shift is approaching comes from Bitcoin’s choices market. Practically $56 billion in open curiosity is stacked round one expiry – December 26, and one degree at $100,000. Gamma and max-pain align across the mid-$90,000s to 6 figures, successfully pinning spot costs till the expiry clears. As soon as it does, hedging unwinds, liquidity resets, and the market begins buying and selling with fewer constraints, proper as macro information and world liquidity flip a brand new web page.

So whereas value feels subdued, the underlying format suggests transition moderately than stagnation. Coverage readability is advancing, liquidity is increasing, establishments are leaning in, and speculative extra is being flushed out.

Bitcoin enters 2026 not with explosive momentum, however with a stronger basis – and traditionally, that’s when essentially the most sturdy upside begins.

XRP

Quiet power behind an ETF milestone

Spot XRP ETFs have topped $1.1 billion in property and posted 30 straight days of inflows since launch – a consistency Bitcoin and Ethereum ETFs didn’t match. The sample suggests structural, long-term allocation moderately than short-term buying and selling.

If momentum holds close to $200 million every week, inflows may exceed $10 billion by 2026, organising a possible provide squeeze. In the meantime, XRP trades close to $2.00, with whales accumulating into weak spot, a classic bottoming signal. XRP’s value could also be quiet, however circulation information exhibits deepening institutional conviction heading into 2026.

TradFi traits

Regulators step again: Crypto now not a “threat”

The Monetary stability oversight councils 2025 report drops digital property from its roster of financial-system vulnerabilities, ending three years of systemic-risk warnings. Crypto is now handled as a “market development to monitor,” reflecting rising institutional participation moderately than contagion considerations.

The shift aligns with this 12 months’s coverage reset: the White Home formally backed the accountable progress of digital property, Congress handed the GENIUS Act to control stablecoins, and financial institution regulators reopened channels by rescinding SAB 121 and allowing broader crypto intermediation.

World our bodies stay cautious on AML and cross-border dangers, however the U.S. macroprudential stance has clearly softened. For Bitcoin heading into 2026, the elimination of “vulnerability” language clears a significant institutional barrier.

Macroeconomic roundup

Catalyst-heavy: The macro week forward

Markets have been buying and selling cautiously, with equities stabilizing after latest swings and Bitcoin consolidating close to $90,000. A dense run of U.S. information and a intently watched BOJ assembly now units the tone for the week forward. With bullish fairness technicals however fragile tech sentiment and elevated yields, upcoming releases will decide whether or not threat property lengthen their momentum or slip into increased volatility.

Nonfarm Payrolls (Tuesday): The important thing information catalyst. A delicate print helps dovish Fed expectations; a powerful one dangers hawkish repricing.

Retail Gross sales (Wednesday): A pulse verify on client power as progress expectations stay excessive.

Preliminary Jobless Claims (Thursday): Rising claims bolster easing bets; decrease readings may cool threat urge for food.

November U.S. CPI (Thursday): The pivotal inflation learn. Softer CPI would gasoline a risk-on tilt; a warmer print threatens draw back for equities and crypto.

Financial institution of Japan Assembly (Fri): A possible world inflection level. A hawkish stance may raise yields worldwide and strain threat property.

The week’s most fascinating information story

$85,000: The strong BTC assist

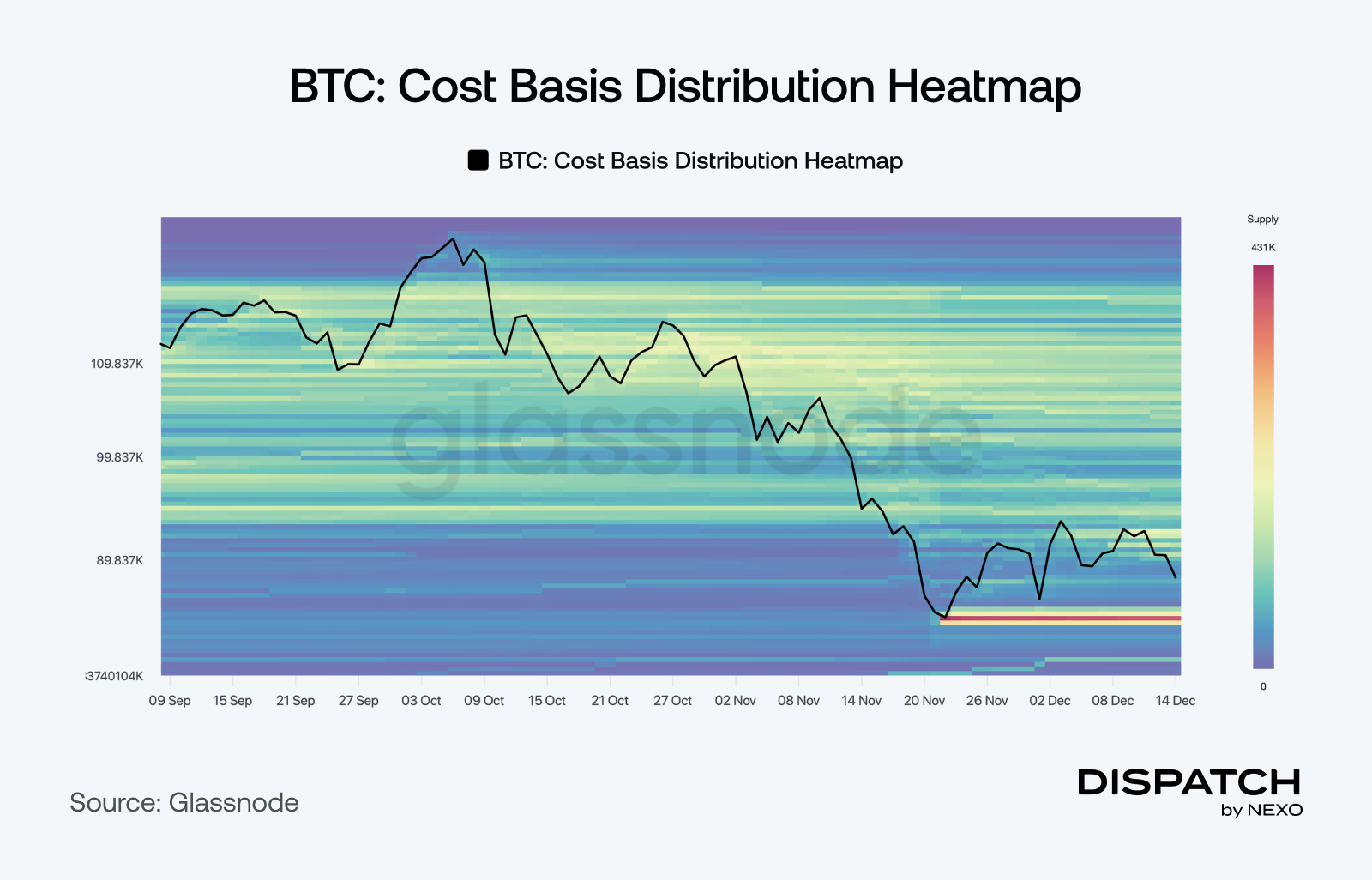

On-chain information exhibits Bitcoin constructing a significant assist base round $85,000, with roughly 400,000 BTC acquired on this zone. This vary aligns with the True Market Imply, the volume-weighted value foundation of U.S. spot ETFs, and the common 2024 acquisition value – three indicators pointing to heavy institutional accumulation. With spot buying and selling close to $92,000, Bitcoin stays traditionally near considered one of its strongest structural assist ranges of the 12 months.

The numbers

The week’s most fascinating numbers

$1,000,000 TPS — Firedancer’s breakthrough throughput take a look at, bringing Solana nearer to its imaginative and prescient.

1 in 30,000 — The chances a solo miner beat this week to win a full Bitcoin block reward price roughly $282,000.

€1.1 billion — Tether’s all-cash bid to purchase Juventus, a daring growth play from the world’s largest stablecoin issuer.

$864 million — Web inflows into world crypto funding merchandise final week, marking the third straight week of capital returning.