Cryptocurrency Prices by Coinlib

Dispatch #278: Crypto begins 2026

On this patch of your weekly Dispatch:

- BTC’s bullish indicators

- ETH transactions surge

- Labour market information dash

Market solid

Early bullish indicators for BTC?

Bitcoin enters the week having reclaimed the $93,000 degree. Sentiment is enhancing beneath the floor, supported by renewed institutional demand through spot ETFs and a broader early-year restoration throughout crypto markets.

On the weekly chart, value has rebounded from the 100-period easy transferring common, a key development assist, and is now approaching resistance on the 50-period SMA and the mid-Bollinger Band (20-period SMA). Momentum indicators are turning constructive: the Stochastic oscillator has exited oversold territory, the RSI stays impartial however trending increased, and whereas the MACD histogram stays barely unfavorable, the narrowing hole between sign strains factors to fading bearish strain.

The every day chart reinforces this enhancing bias. Worth has pushed above the higher Bollinger Band, signalling sturdy upside momentum. The Stochastic oscillator is holding above 80, the RSI is elevated, and the MACD histogram is firmly constructive – confirming near-term energy, whilst situations seem stretched.

From a ranges perspective, $90,000 is the primary assist, with $87,000 under, whereas resistance sits close to $94,000 forward of the psychological $100,000 mark.

The massive thought

Crypto’s first indicators in 2026

The primary days of a brand new yr usually arrive quietly in markets, with positioning mild, volumes skinny, and expectations nonetheless forming. Crypto is not any exception. As 2026 begins, value motion feels measured somewhat than pressing – much less about daring strikes and extra about studying the panorama.

At the beginning of 2026, crypto value motion is being formed much less by headlines and extra by macro information, capital flows, and on-chain positioning.

That shift issues as a result of 2025 delivered almost all the pieces the market had been pushing towards for years. Institutional validation moved from promise to actuality. Regulatory readability improved materially. Spot ETFs launched and scaled, Bitcoin set new all-time highs, and strategic reserve narratives entered the mainstream.

With so many long-awaited milestones now behind us, the query for 2026 is now not what crypto nonetheless wants to realize, however what really drives markets as soon as these packing containers are checked.

Macroeconomic information: January’s macro calendar is dense and market-moving. U.S. labor market stories – together with ADP employment, jobless claims hovering close to the 200,000 degree, and December Nonfarm Payrolls anticipated round 50,000–60,000, will form expectations round progress and financial coverage. Inflation stays central to the outlook, with U.S. CPI close to 2.7% year-on-year and eurozone inflation round 2.1%. These releases feed instantly into charge expectations forward of the Federal Reserve’s January coverage choice. Bitcoin’s current buying and selling suggests it's more and more absorbing these inputs with out outsized reactions.

ETF flows as a measure of institutional positioning: Capital flows are providing clearer indicators. After greater than $6 billion in mixed Bitcoin and Ethereum ETF outflows throughout November and December, early January introduced a significant reversal. On January 2 alone, spot Bitcoin and Ethereum ETFs recorded roughly $646 million in web inflows – among the many strongest every day totals in weeks.

Lengthy-term holder positioning on-chain: Beneath the floor, long-term holders stay a stabilizing pressure. Regardless of volatility final yr, promoting strain from this cohort has stayed restricted. Trade balances stay comparatively constrained, and on-chain information factors to a provide base that continues to favor longer holding intervals somewhat than short-term distribution. Taken collectively, these numbers assist clarify why early-2026 value motion feels measured but constructive. Strikes might take longer to develop, however they're more and more grounded in macro information, observable capital flows, and a holder base with longer time horizons.

Crypto enters 2026 not looking for validation, however working inside a extra disciplined market construction – one the place macro stories, ETF flows, and long-term holder habits collectively form the trail ahead.

Ethereum

ETH’s on-chain exercise hits report ranges

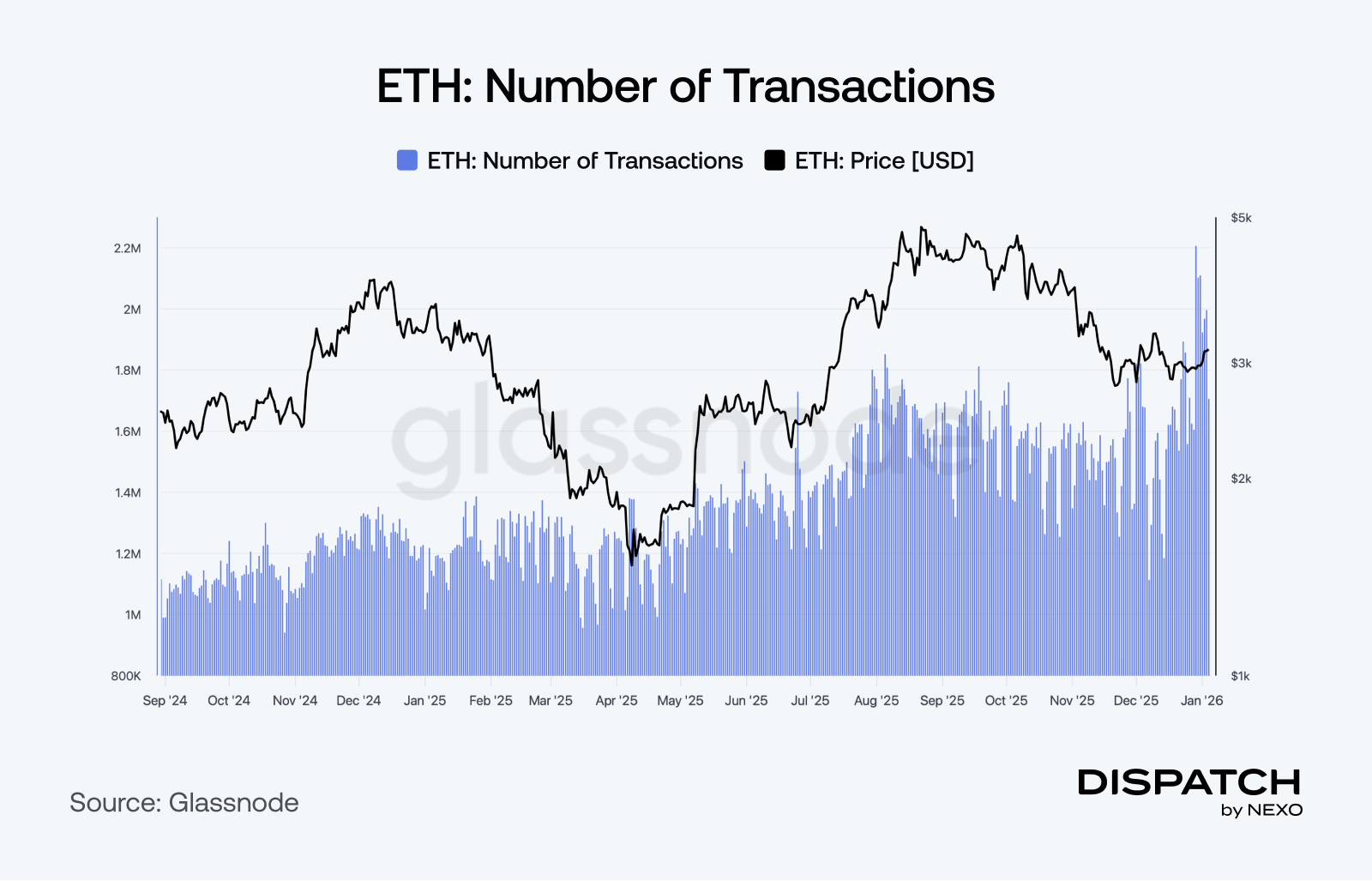

Ethereum closed 2025 with a pointy acceleration in community utilization. Each day transactions climbed to 1.87–2.23 million, lively month-to-month addresses reached 10.4 million, and new tackle creation marked its strongest day since 2018 – a development we study extra carefully on this week’s information part.

Institutions move cash on-chain: Institutional adoption is changing into extra concrete. JPMorgan’s launch of MONY, a tokenized cash market fund issued natively on Ethereum, locations short-term U.S. Treasuries instantly on a public blockchain, with possession and every day yield accrual recorded on-chain.

Stablecoins drive real-world usage: Ethereum processed over $8 trillion in stablecoin transfers in This fall, almost double Q2 volumes. Stablecoin issuance on the community rose 43% in 2025 to $181 billion, leaving Ethereum with 57% of world stablecoin provide and roughly 65% of on-chain real-world asset worth.

Upgrades reinforce the long-term roadmap: Following the Pectra and Fusaka upgrades in 2025, Ethereum’s roadmap extends into 2026 with additional scalability positive aspects and early zkEVM adoption. Vitalik Buterin argues these advances have successfully resolved the blockchain trilemma in apply, supporting increased throughput with out sacrificing decentralization.

Macroeconomic roundup

Catalyst-heavy: Labor information units the tone for crypto

Markets enter the primary full buying and selling week of 2026 cautiously positioned. Equities are regular, yields stay delicate, and Bitcoin is consolidating close to current ranges as buyers weigh early-year positioning towards a dense run of U.S. labor information. With Fed rate-cut expectations finely balanced, this week’s releases will form near-term threat urge for food.

ADP Employment (Wednesday): Forecasts level to a modest 47K job achieve. A weak print would reinforce easing expectations; a pointy upside shock dangers firmer yields and softer threat sentiment.

JOLTS Job Openings (Wednesday): Anticipated close to 7.65M. A continued decline would assist a soft-landing narrative, whereas stabilization may weigh on easing bets.

Preliminary Jobless Claims (Thursday): Claims are seen round 216K. A gradual rise would bolster the labor-cooling thesis; a drop again towards 200K may problem it.

Employment Report & Wages (Friday): Payrolls are projected at 57K with unemployment close to 4.5%. Wage progress stays key. Comfortable jobs and moderating pay would assist threat belongings; resilience on both entrance may strain Bitcoin into the shut.

The yr’s most attention-grabbing information story

Is ETH’s on-chain surge sending out a sign?

A quiet however important shift is unfolding on Ethereum. Each day transactions reached a brand new all-time excessive at 1.87 million on a seven-day common, surpassing each the 2021 DeFi peak and final yr’s highs, whereas lively addresses climbed to 728,904 and new tackle creation hit its strongest single day since 2018. Earlier surges in community exercise have usually coincided with intervals of stronger value efficiency, as rising utilization finally fed into market narratives. Notably, this upswing in on-chain exercise is happening whilst ETH stays range-bound close to $3,000, suggesting utilization momentum could also be constructing forward of broader market recognition.

The numbers

The week’s most attention-grabbing numbers

$100,000 – The Bitcoin value degree focused by probably the most lively January name choices, reflecting bullish positioning in early 2026.

8,888 BTC – The quantity of Bitcoin Tether purchased in This fall 2025 below its coverage of allocating 15% of quarterly income to BTC.

320,000 ETH – The amount of Ethereum collected by whales in current days, whilst derivatives positioning stays crowded.

Scorching subject

New year, same Bitcoin whale moves?

Will 2026 start with a memecoin season?

Will the Fed keep interest rates then?

Dispatch is a weekly publication by Nexo, designed to help you navigate and take action in the evolving world of digital assets. To share your Dispatch suggestions and comments, email us at [email protected].