Cryptocurrency Prices by Coinlib

Can Bitcoin maintain the rebound?

- BTC’s bullish alerts

- ETH transactions surge

- Labour market knowledge dash

Market forged

BTC: Pause earlier than stronger restoration?

Bitcoin’s restoration has slowed in latest classes, with geopolitical headlines including a notice of warning to an in any other case stabilising technical setup.

On the weekly chart, worth is hovering across the $91,000 assist stage, which beforehand acted as resistance and is now being examined as a possible base. Momentum indicators akin to RSI and the Stochastic Oscillator stay in impartial territory, whereas the trend-following MACD is sitting near the zero line, signalling a scarcity of robust directional momentum.

On the each day timeframe, short-term momentum has weakened. A bearish crossover within the MACD factors to near-term stress, whereas RSI is trending decrease however stays nicely above oversold ranges. The Stochastic Oscillator is approaching oversold territory, suggesting draw back momentum could also be fading somewhat than accelerating. The 50-day easy shifting common is the following key space to observe, because it may act as dynamic assist if promoting continues.

For now, assist sits within the $90,000–$91,000 zone, adopted by $88,000, whereas resistance stays round $94,000 and $98,000. Total, the setup factors to consolidation somewhat than a broader pattern breakdown.

The large concept

Can Bitcoin’s restoration flip right into a sustainable rally?

Bitcoin’s rebound has been quick sufficient to attract consideration – however not but decisive sufficient to settle the controversy. With the technical image established, the main focus now shifts from worth ranges to market high quality. Bitcoin’s latest rebound leaves it at an inflection level, the place bettering structural alerts meet lingering macro uncertainty.

The true query isn’t whether or not Bitcoin has bounced, however whether or not this section has the foundations to grow to be extra sturdy. Sustainable rallies are inclined to reveal themselves not by pace, however by construction: how worth behaves underneath stress, how leverage resets, and whether or not demand emerges with out being compelled.

ETF demand is offering a stabilizing base: One of many clearest constructive alerts has been the return of U.S. spot Bitcoin ETF inflows. Final week noticed roughly $1.4 billion in net inflows – the strongest weekly complete since early October, suggesting renewed institutional engagement regardless of elevated volatility. That issues much less as a worth catalyst and extra as a structural one. ETF flows symbolize comparatively affected person, price-insensitive demand, serving to take up provide throughout pullbacks and lowering the market’s reliance on leveraged positioning to maintain upside. Whereas inflows alone don’t outline a rally, their re-emergence lowers the fragility of latest worth motion.

Worth dipped – leverage adjusted: Crucially, the latest pullback has been accompanied by reasonable deleveraging somewhat than panic-driven repositioning. Regardless of the sharp spot transfer, derivatives indicators level to contained danger discount. Funding charges briefly dipped unfavourable earlier than stabilizing close to impartial to barely constructive throughout main venues, suggesting leverage cooled with out flipping decisively bearish. Bitcoin futures open curiosity declined modestly with a roughly 1.1% drop over a brief window, earlier than stabilizing and partially recovering, in line with measured de-risking somewhat than compelled exits.

Positioning metrics reinforce that view. The lengthy/quick account ratio has risen step by step from 0.9 to 1.3, remaining near impartial and nicely beneath ranges usually related to crowded positioning or squeeze danger. In contrast with prior drawdowns marked by persistent unfavourable funding and sharp open-interest collapses, the market now seems structurally more healthy, with leverage already reset to extra sustainable ranges.

Regulatory readability is changing into a tailwind: Momentum across the U.S. CLARITY Act suggests a gradual shift towards a extra outlined regulatory atmosphere, serving to transfer the market dialog from uncertainty towards structure. Whereas this evolution is unlikely to affect short-term worth motion, it performs a significant position in long-term resilience by encouraging broader institutional participation. Regulation isn’t driving the restoration, however it's quietly altering the character of participation — reinforcing Bitcoin’s means to maintain good points somewhat than chase them.

The macro sign, briefly: Exterior crypto, early-cycle alerts are quietly aligning. Gold and copper have moved larger whilst central banks keep cautious coverage rhetoric – a sample that traditionally displays markets repricing liquidity circumstances forward of formal easing. Bitcoin has usually lagged that adjustment, responding later as soon as real-yield compression turns into extra persistent.

For now, Bitcoin stays range-bound somewhat than responsive – a well-recognized place within the early levels of previous liquidity shifts.

The larger image: Bitcoin doesn’t have a tendency to maneuver first – it tends to maneuver hardest as soon as circumstances are in place. The latest restoration hasn’t but confirmed itself as a full-fledged rally. However it additionally doesn’t resemble a hole bounce pushed purely by leverage or narrative momentum. As a substitute, it seems to be like a market in transition: absorbing provide, cooling excesses, and ready for a clearer liquidity sign to tip the stability. Sustainable rallies not often announce themselves on the highs. They’re constructed quietly, in durations the place worth holds collectively higher than anticipated – and the place construction improves earlier than sentiment does. Bitcoin should still be in that section.

Macroeconomic roundup

Coverage alerts take centre stage

This week’s macro focus shifts to U.S. coverage alerts and world central financial institution dynamics, with markets navigating fragile rate-cut expectations amid elevated geopolitical uncertainty. Bitcoin has remained resilient close to key psychological ranges, however upcoming knowledge and selections will take a look at danger urge for food as buyers reassess the outlook for financial easing and world liquidity.

U.S. President Trump Speaks (Wednesday): Feedback from Davos could form market sentiment for danger property. Hawkish commerce or tariff commentary would possible assist the greenback and stress crypto, whereas extra constructive alerts may enhance danger sentiment.

Preliminary Jobless Claims (Thursday): Claims are anticipated round 203,000. A stronger print may reinforce “higher-for-longer” charge expectations and cap danger urge for food, whereas softer knowledge would assist easing hopes and bolster Bitcoin by way of decrease yield stress.

Core PCE Inflation (Thursday): The Fed’s most popular inflation gauge is forecast at 0.2% MoM. Greater-than-expected inflation may delay charge cuts and weigh on danger property, whereas cooler readings would ease real-yield stress and assist danger sentiment.

Financial institution of Japan Curiosity Fee Resolution (Friday): Markets will look ahead to any change to the BoJ’s coverage stance, with the speed at 0.75% after a December hike to the best stage in many years. Continued stability would keep the exterior liquidity backdrop, whereas hints of additional tightening may tighten world monetary circumstances.

For a fuller breakdown of this week’s macro occasions and timings, see our full macro calendar on X.

Nexo

Nexo turns into official accomplice of Audi Revolut F1 Crew

After a yr marked by main sports activities partnerships and pivotal crypto market strikes, Nexo continues to make statements on the global stage. The corporate has entered a multi-year strategic partnership with the Audi Revolut F1 Crew, changing into the workforce’s inaugural official digital asset accomplice as Audi prepares for its landmark entry into Formulation 1 in 2026.

The alliance brings Nexo onto one of many world’s most elite sporting platforms, uniting two organisations outlined by precision, disciplined innovation, and efficiency on the highest stage. Reflecting on the partnership, Nexo co-founder Antoni Trenchev described it as a press release in regards to the future — “instantaneous, self-directed, and all the time on” — and about delivering significant utility and premium experiences to a world viewers.

The yr’s most fascinating knowledge story

Ethereum’s fundamentals strengthen

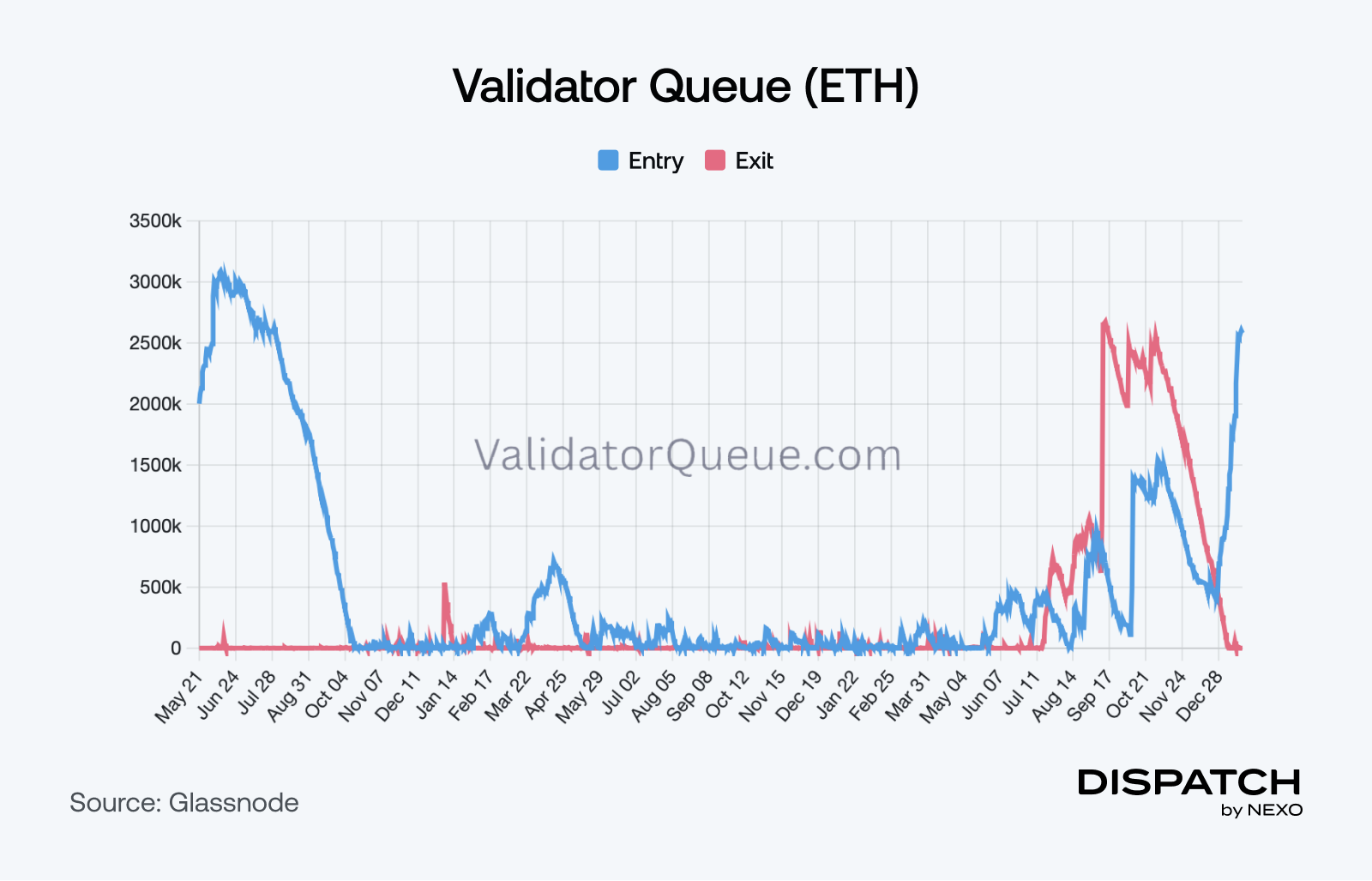

Ethereum’s staking flows are sending a transparent sign. The validator exit queue has fallen to close zero, down from roughly 2–2.5 million ETH in late 2025, pointing to a possible sharp decline in near-term promote stress. On the identical time, the entry queue is rebuilding, suggesting extra ETH is being locked away somewhat than positioned on the market.

This shift is displaying up in worth conduct. ETH has outperformed year-to-date, the share of provide in revenue has climbed to its highest stage since November, and community exercise continues to push towards file ranges, all whereas transaction charges stay compressed. Collectively, the info level to a tightening provide backdrop that helps extra resilient worth motion somewhat than reflexive volatility.

The numbers

The week’s most fascinating numbers

$66 billion – Bitcoin futures open curiosity hits an 8-week excessive, signalling a gradual return of danger urge for food after months of deleveraging.

$479 million – Spot Ether ETFs file their strongest weekly inflows since early October, signalling renewed institutional demand for ETH.

$2.17 billion – World crypto funding merchandise put up their strongest weekly inflows since October 2025, regardless of late-week macro headwinds.

36 million ETH – Ethereum staking reaches a brand new excessive, with almost 30% of provide locked and exit queues skinny, tightening liquid provide.

$4,675/oz – Gold hits a recent all-time excessive as coverage uncertainty and tariff headlines present assist.