Cryptocurrency Prices by Coinlib

Dispatch #281: Bitcoin and macro: A ready recreation

On this patch of your weekly Dispatch:

- ETH’s hidden all-time excessive

- BTC’s stability

- The all-important FOMC

Market forged

BTC: Organising for a rebound?

On the weekly chart, Bitcoin is testing its 100-period easy shifting common, a key development indicator that has traditionally acted as dependable dynamic assist. Whereas the broader weekly construction stays mildly bearish, early indicators recommend draw back momentum could also be easing. Momentum and oscillator indicators are stabilizing: the Stochastic oscillator is close to oversold territory, the RSI stays impartial, and the MACD histogram, although nonetheless adverse, is step by step converging towards the zero line — pointing to fading promoting strain and the potential for a rebound to type.

The every day chart helps this cautiously stabilizing view. Value motion stays capped under most key shifting averages, preserving the short-term bias barely bearish to impartial, whereas momentum indicators recommend consolidation fairly than recent draw back acceleration. Stochastic readings stay oversold, RSI holds impartial floor, and the MACD histogram stays under zero with out renewed bearish growth.

From a ranges perspective, quick assist sits within the $87,000–$86,500 zone, with $85,000 under as the subsequent draw back reference, whereas the weekly 100-period SMA continues to behave as dynamic assist. On the upside, preliminary resistance is clustered round $90,000–$91,000, with $94,000 marking the subsequent significant hurdle ought to a rebound achieve traction.

The large thought

Bitcoin takes a (macro) break

This week’s Federal Reserve assembly is essentially the most carefully watched macro occasion on the calendar – not as a result of markets anticipate a dramatic coverage shift, however as a result of the Fed’s messaging can be carefully parsed. Whereas rates of interest are broadly anticipated to stay unchanged, consideration will centre on how policymakers assess inflation, progress, and the trail ahead.

After easing coverage late final 12 months, the Fed now seems content material to pause and reassess. With financial progress holding up and inflation nonetheless not totally again at goal, policymakers see little urgency to maneuver once more. In that sense, this FOMC assembly is much less about motion and extra about endurance.

Sturdy progress, tighter circumstances: Sturdy financial knowledge has pushed expectations for additional charge cuts additional out, with U.S. GDP increasing at a 4.4% annualised tempo within the third quarter and consumer spending continuing to carry the economy. The labour market is cooling however not breaking, giving the Fed room to attend. Markets have responded accordingly. Treasury yields have edged larger, gold has pushed to recent all-time highs, and Bitcoin has struggled to regain momentum, hovering under the $90,000–$91,000 vary at the same time as equities grind larger. Spot Bitcoin ETFs have seen greater than $1.5 billion circulate out in latest classes, underscoring how carefully institutional positioning stays tied to macro indicators.

Measured participation: Derivatives markets mirror a restrained tone. Funding charges are optimistic however subdued, leverage stays restricted, and choices exercise has leaned towards volatility methods fairly than sturdy directional conviction. Traders remain active — however selectively. Importantly, that warning hasn’t translated into significant promoting. Lengthy-term Bitcoin holders stay largely inactive, with little proof of broad-based distribution. Value discovery has more and more shifted towards spot markets, whereas leverage performs a smaller function than in earlier cycles. Volatility has adjusted on the brief finish, pointing to near-term uncertainty fairly than a reassessment of Bitcoin’s broader setup.

Why the longer-term case nonetheless holds: A Ate up pause doesn’t weaken Bitcoin’s longer-term case; it simply delays its next macro tailwind. Sturdy progress lowers recession threat, however coverage cycles nonetheless evolve as circumstances normalise. Over time, shifts in progress momentum, consumption patterns, and borrowing prices are likely to information financial coverage again towards a extra impartial stance. As coverage normalises, Bitcoin’s structural benefits come again into focus. Its provide is fastened and tightening by design, its portability exceeds that of conventional arduous belongings, and its market capitalisation stays solely round 10–12% of gold’s, underscoring significant catch-up potential because it matures.

Ready, with a calendar: For now, the Fed waits. Markets wait. And Bitcoin consolidates — not as a result of its thesis is damaged, however as a result of liquidity stays tight. Price cuts aren’t a prerequisite for Bitcoin’s function, however simpler monetary circumstances are likely to amplify momentum once they arrive. The subsequent actual checkpoint comes on March 28, when the Fed meets once more. Till then, ready isn’t uncertainty – it’s simply a part of the cycle.

Ethereum

ETH’s hidden all-time excessive

Ethereum noticed a pullback this week, with ETH easing round 7% as larger international yields and shifting charge expectations weighed on broader threat sentiment. Importantly, the adjustment was pushed by positioning fairly than fundamentals. On-chain knowledge present large holders adding, as whole worth locked throughout Ethereum additionally stays elevated, pointing to a rebalancing of publicity.

Beneath the floor, Ethereum’s fundamentals proceed to enhance. The community is processing more transactions than ever, whereas common charges stay close to latest lows – an indication that latest upgrades and layer-2 adoption are permitting Ethereum to scale extra easily. That progress continues to resonate with establishments, with Ethereum nonetheless internet hosting roughly two-thirds of all tokenised real-world belongings and serving as the first settlement layer for large-scale monetary experimentation.

Close to-term volatility might persist, however the broader picture remains intact: leverage has been diminished, adoption remains to be rising, and Ethereum’s function as core digital infrastructure continues to strengthen.

Macroeconomic roundup

The one and solely: Fed’s rate of interest determination

Markets head into the week centered on a handful of key macro indicators, with central financial institution steering, inflation knowledge, and labour market updates shaping expectations round progress, charges, and near-term threat urge for food.

U.S. Shopper Confidence (Jan) – Tue, Jan 27: A well timed snapshot of family sentiment as client spending continues to underpin U.S. progress.

Fed Curiosity Price Choice – Wed, Jan 28: Charges are broadly anticipated to stay unchanged. Consideration can be on the Fed’s steering and the way policymakers body the outlook for inflation and financial momentum.

U.S. Producer Value Index (Dec) – Fri, Jan 30: An essential replace on producer-level inflation, providing clues on whether or not worth pressures are easing additional.

Preliminary Jobless Claims – Thu, Jan 29: A high-frequency verify on labour market circumstances, with latest knowledge pointing to gradual cooling fairly than sharp deterioration.

Chicago PMI (Jan) – Fri, Jan 30: A regional learn on manufacturing exercise, usually used as an early indicator for broader industrial developments.

The week’s most fascinating knowledge story

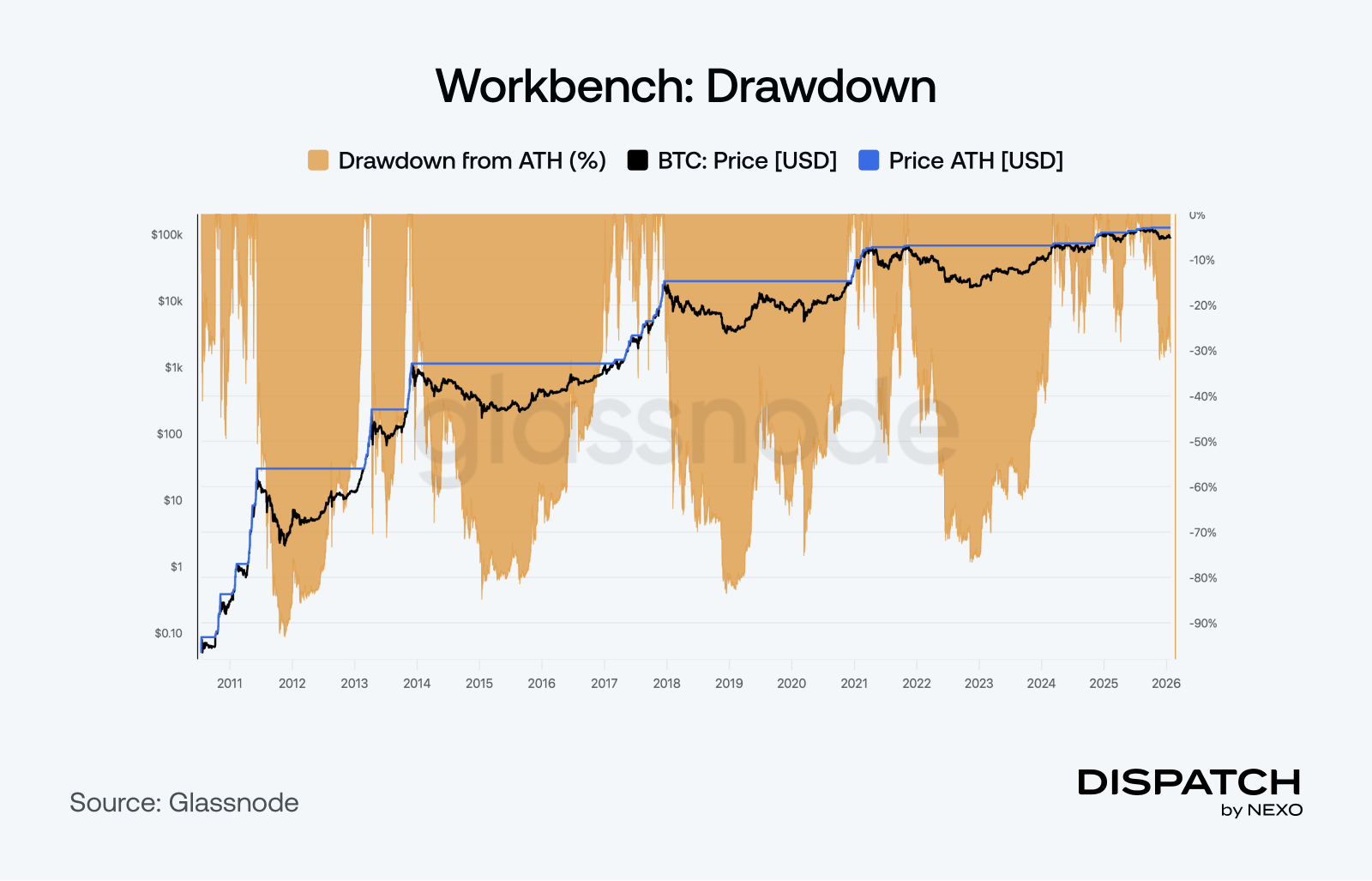

Bitcoin’s easing drawdowns

Bitcoin’s worth motion has been extra energetic in latest weeks. Seven-day annualised volatility rose from round 21% in early January to almost 39% by January 20, earlier than easing again towards the mid-20s – a reminder that short-term swings stay a part of the market’s character. Stepping again, nevertheless, places that motion into perspective. For the reason that ETF-led rally started in October 2023, Bitcoin has averted the deep drawdowns that outlined earlier cycles. The biggest pullback from prior all-time highs has been roughly 40%, a transparent enchancment from the near-70% decline seen in late 2022, and an indication that draw back threat has change into extra contained. That shift displays a market construction that has step by step strengthened. Lengthy-term holders proceed to anchor provide, whereas rising company balance-sheet demand has added a brand new layer of assist.

Scorching subject

Respect to our community – each and every NEXO-holder.

Here come the Bitcoin whales.

That’s bullish, right?

Dispatch is a weekly publication by Nexo, designed to help you navigate and take action in the evolving world of digital assets. To share your Dispatch suggestions and comments, email us at [email protected].