Cryptocurrency Prices by Coinlib

Latin America crypto tax information: Brazil and Argentina

With not too long ago up to date steering, determining crypto tax in Latin America will be difficult. That’s why now we have partnered with Koinly to interrupt down the necessities of crypto taxation in these two main Latin American economies for 2025. Beneath is vital data offered by Koinly, one of many market’s main crypto tax options, in addition to particulars on how Koinly’s integration may help streamline tax reporting.

Vital: Nexo and Koinly don't supply tax recommendation. This text is for normal data functions and never supposed as monetary recommendation or a personalised advice. At all times seek the advice of a tax skilled for steering particular to your state of affairs.

How is crypto taxed, and what constitutes a taxable occasion?

In Brazil, cryptocurrency is taken into account an asset reasonably than a foreign money, which means transactions involving digital belongings are topic to taxation. The Receita Federal do Brasil (RFB) requires people to report crypto holdings and transactions, particularly in the event that they exceed BRL 5,000 a month.

A taxable occasion happens while you:

Promote crypto for fiat (e.g., BRL)

Trade one cryptocurrency for an additional

Use crypto to buy items or companies

Obtain crypto as earnings, together with mining rewards

Earnings from crypto transactions are topic to capital positive factors tax, however provided that month-to-month income exceed BRL 35,000. In case your positive factors keep under this threshold, chances are you'll be exempt.

How a lot tax will you pay?

Earnings tax in Brazil is between 7.5% to 27.5%:

Listed here are the present earnings tax and capital positive factors tax charges in Brazil:

The best way to calculate your crypto taxes

To calculate your capital achieve or loss from a cryptocurrency transaction, apply the next system:

Capital achieve/loss = Promoting worth – Buy worth

The promoting worth refers back to the honest market worth of your cryptocurrency on the time you half with it. Conversely, the acquisition worth represents the honest market worth of the crypto while you initially acquired it.

When you have earnings from crypto, you’ll want to find out the honest market worth of your holdings first.

Accounting strategies for crypto

For many buyers, you can be coping with a number of belongings of the identical sort and monitoring price foundation in these cases can turn out to be trickier, which is the place an accounting methodology is available in.

In Brazil, you possibly can select between FIFO (First-In, First-Out) or ACB (Common Price Foundation).

Are totally different digital belongings taxed otherwise?

The steering from the RFB is fairly restricted however doesn't distinguish between various kinds of digital belongings. As such, it’s doubtless that digital belongings are handled the identical from a tax perspective, so whether or not you’ve received cash, tokens, stablecoins, NFTs, or in any other case, it’ll all come right down to the precise transaction as to the way it’s taxed.

How are airdrops and forks taxed?

The restricted steering from RFB doesn't make clear how airdrops, together with these from a tough fork, are taxed. In some international locations, these are thought-about a form of further earnings and topic to Earnings Tax. After all, any later disposals of airdropped tokens that lead to a achieve (over BRL 35,000 month-to-month) could be taxable. It is best to communicate to an skilled accountant for recommendation on the tax implications of airdrops and different transactions the place steering is but to be issued.

The best way to report your crypto taxes?

In Brazil, the monetary yr is identical because the calendar yr and your tax return is due on the final enterprise day of April. You should report cryptocurrency income, capital positive factors, and different earnings earned all year long, together with employment earnings.

You'll be able to report your crypto taxes by means of the eCac on-line portal, the place chances are you'll have to submit the next varieties:

Private earnings tax return

This type is used to declare earnings from all sources throughout the tax yr, together with employment earnings. It have to be submitted by the final enterprise day of April. If you happen to maintain cryptocurrencies with an acquisition price exceeding BRL 5,000, they have to be reported as belongings in your annual earnings tax return. Nonetheless, in case your whole crypto holdings stay under this threshold, you aren't required to declare them.

Annual capital positive factors assertion

Capital positive factors from cryptocurrency transactions have to be reported in your annual capital positive factors assertion.

If you happen to made a revenue from crypto gross sales throughout the month, you need to report it, even when the full gross sales quantity was under BRL 35,000.

Nonetheless, you'll solely owe taxes in case your month-to-month revenue exceeds BRL 35,000.

If no revenue was made, submitting a capital positive factors assertion is just not required.

Month-to-month assertion of cryptocurrency operations

In case your whole crypto transaction quantity exterior Brazilian exchanges exceeds BRL 30,000 in a month, you need to submit a month-to-month assertion of cryptocurrency operations. This requirement doesn't apply to transactions made on Brazilian-based exchanges. The assertion have to be submitted by the final enterprise day of the next month.

How is crypto taxed, and what constitutes a taxable occasion?

In Argentina, cryptocurrency is classed as an intangible asset, which means transactions involving digital belongings are topic to taxation. The Administración Federal de Ingresos Públicos (AFIP) requires people to report their crypto holdings and transactions, notably after they generate taxable earnings.

A taxable occasion happens while you:

Promote crypto for fiat (e.g., ARS)

Commerce one cryptocurrency for an additional

Earn crypto as earnings, together with staking or mining rewards

Capital Features Tax applies while you promote or change cryptocurrency at a revenue, whereas Earnings Tax applies while you earn crypto, akin to mining or staking rewards.

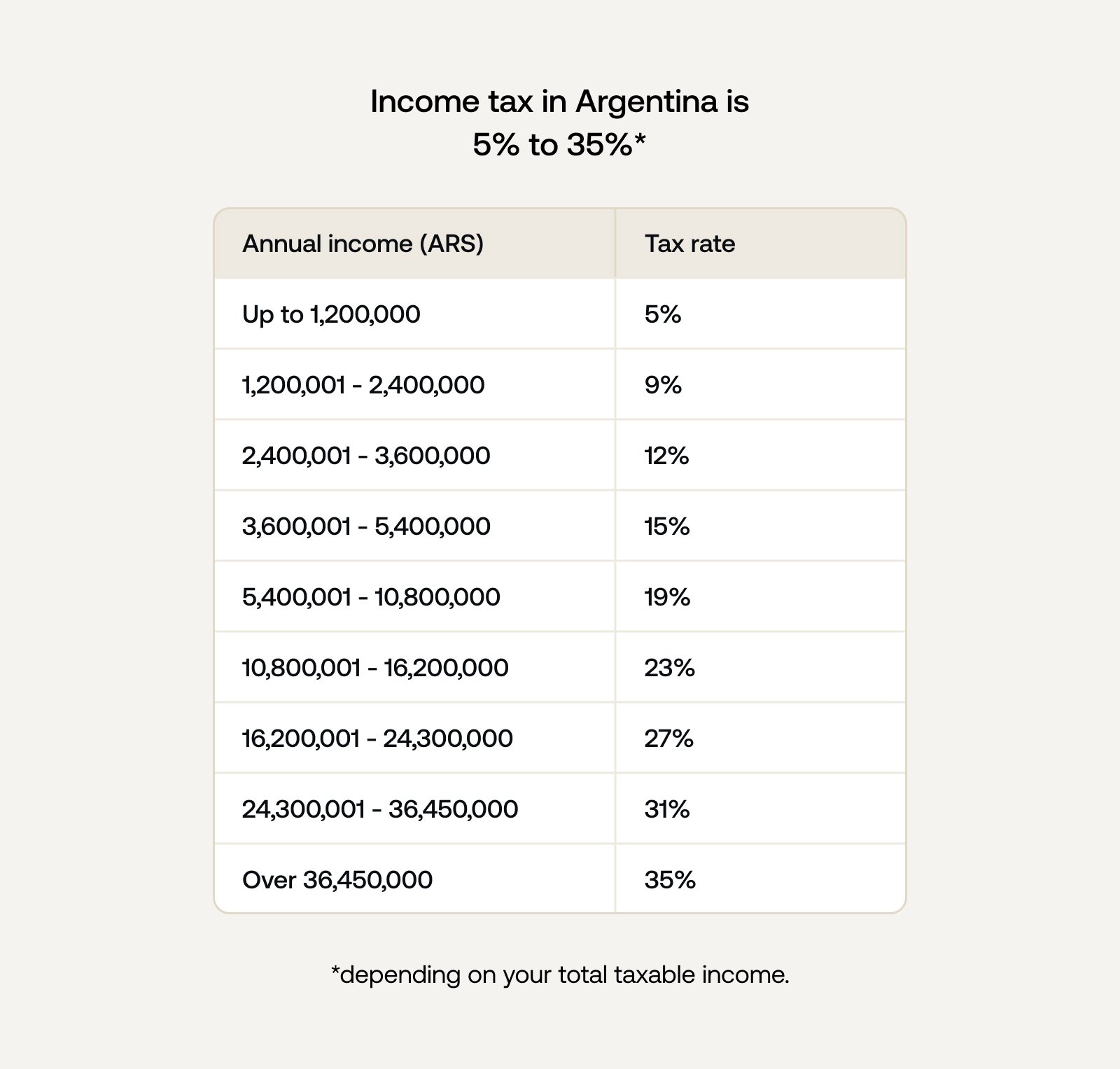

How a lot tax will you pay?

For capital positive factors, you’ll pay 5% or 15% relying on whether or not the transaction is made in pesos or a international foreign money. If the earnings is from a international supply, you’ll pay 15%.

The best way to calculate your crypto taxes?

To find out your capital achieve or loss on a cryptocurrency transaction, use the next system:

Capital Acquire/Loss = Promoting Worth – Buy Worth

The promoting worth is the honest market worth of your cryptocurrency while you get rid of it, whereas the acquisition worth is the honest market worth of your cryptocurrency while you acquired it.

If you happen to obtain crypto as earnings (e.g., by means of mining, staking, or funds), you need to calculate its honest market worth on the time of receipt and report it as taxable earnings.

Accounting strategies for crypto.

If you happen to’ve bought a number of items of cryptocurrency of the identical sort (for instance, 3 ETH) at totally different worth factors, you’ll want an accounting methodology to find out your price foundation.

The AFIP is evident that when figuring out the associated fee to be allotted for a number of items, the oldest acquisition worth is used first. That is what’s referred to as the First In, First Out (FIFO) accounting methodology, the place the primary crypto acquired is taken into account the primary to be bought.

Are totally different digital belongings taxed otherwise?

The AFIP doesn't differentiate between varied digital belongings for tax functions. Consequently, all digital belongings—together with cryptocurrencies, stablecoins, tokens, and NFTs—are handled as monetary belongings and taxed based mostly on the precise transaction.

The important thing issue figuring out taxation is the kind of transaction reasonably than the character of the asset.

How are airdrops and forks taxed?

The AFIP has not issued particular steering on the taxation of airdrops or forks, however based mostly on normal tax rules, airdrops could also be thought-about a type of earnings and taxed upon receipt based mostly on honest market worth. If later bought, capital positive factors tax would apply.

Given the shortage of clear rules, consulting a tax skilled for steering on airdrops and forks is extremely advisable.

The best way to report your crypto taxes?

Argentina’s monetary yr runs from January 1 to December 31, and tax returns are due by June of the next yr. You'll be able to report your crypto by means of AFIP’s on-line tax portal.

Some notable modifications are coming to reporting your crypto in 2025, although. Again in 2024, the federal government enacted a legislation mandating that residents declare their cryptocurrency holdings to boost monetary transparency and fight tax evasion. The laws requires that digital belongings be held on exchanges registered with the Nationwide Securities Fee (CNV). Belongings declared earlier than March 31, 2025, will likely be taxed solely on capital positive factors, exempting the holdings themselves.

Simply calculate your crypto taxes and generate stories with Nexo’s integration with Koinly. Merely import your Nexo transaction historical past into Koinly, and it'll routinely decide your capital positive factors, losses, earnings, and extra. There are two strategies to do that, and we’ll information you thru each step-by-step.

Step 1: Create a free Koinly account and hyperlink it to your Nexo account

Nexo connects to Koinly by means of SSO or through CSV file add. To make use of single sign-on (SSO), navigate to the Wallets part in Koinly and seek for Nexo.

Step 2: Allow auto-sync and proceed to Nexo

You may be redirected to the Nexo web site to grant Koinly read-only API entry. As soon as approved, Koinly will routinely fetch your Nexo transaction historical past.

If you happen to favor handbook import, you possibly can obtain a CSV of your Nexo transaction historical past. Log into Nexo, go to the Transactions tab within the high menu, and choose a date vary that covers your full Nexo buying and selling historical past. Guarantee all transaction varieties and belongings are chosen, then click on export. After downloading your file, head to Koinly, seek for Nexo within the wallets part, and select import from file to add your CSV.

Keep in mind, it's essential repeat this course of for Nexo and all different exchanges, wallets, or blockchains you utilize so Koinly can precisely calculate your crypto taxes.

Step 3: Let Koinly compute your capital positive factors, losses, and earnings

As soon as your transaction knowledge is imported, Koinly will course of and calculate your tax liabilities.

Step 4: Obtain your crypto tax report

After reviewing your tax abstract and guaranteeing its accuracy, you possibly can obtain the required tax report when wanted—simply improve to a paid plan.

Hold information of all transactions, together with timestamps, values, and costs.

Seek the advice of a tax skilled for those who interact in advanced buying and selling or DeFi actions.

Use Koinly to automate calculations and guarantee compliance.

📌 Begin calculating your crypto taxes with Koinly immediately!

* In response to Koinly’s tax guides and normal weblog posts:

The knowledge on this article is for normal data solely. It shouldn't be taken as consulting skilled recommendation from both Nexo or Koinly. Neither Nexo nor Koinly is a monetary adviser. It is best to take into account looking for impartial authorized, monetary, taxation or different recommendation to test how the web site data pertains to your distinctive circumstances.